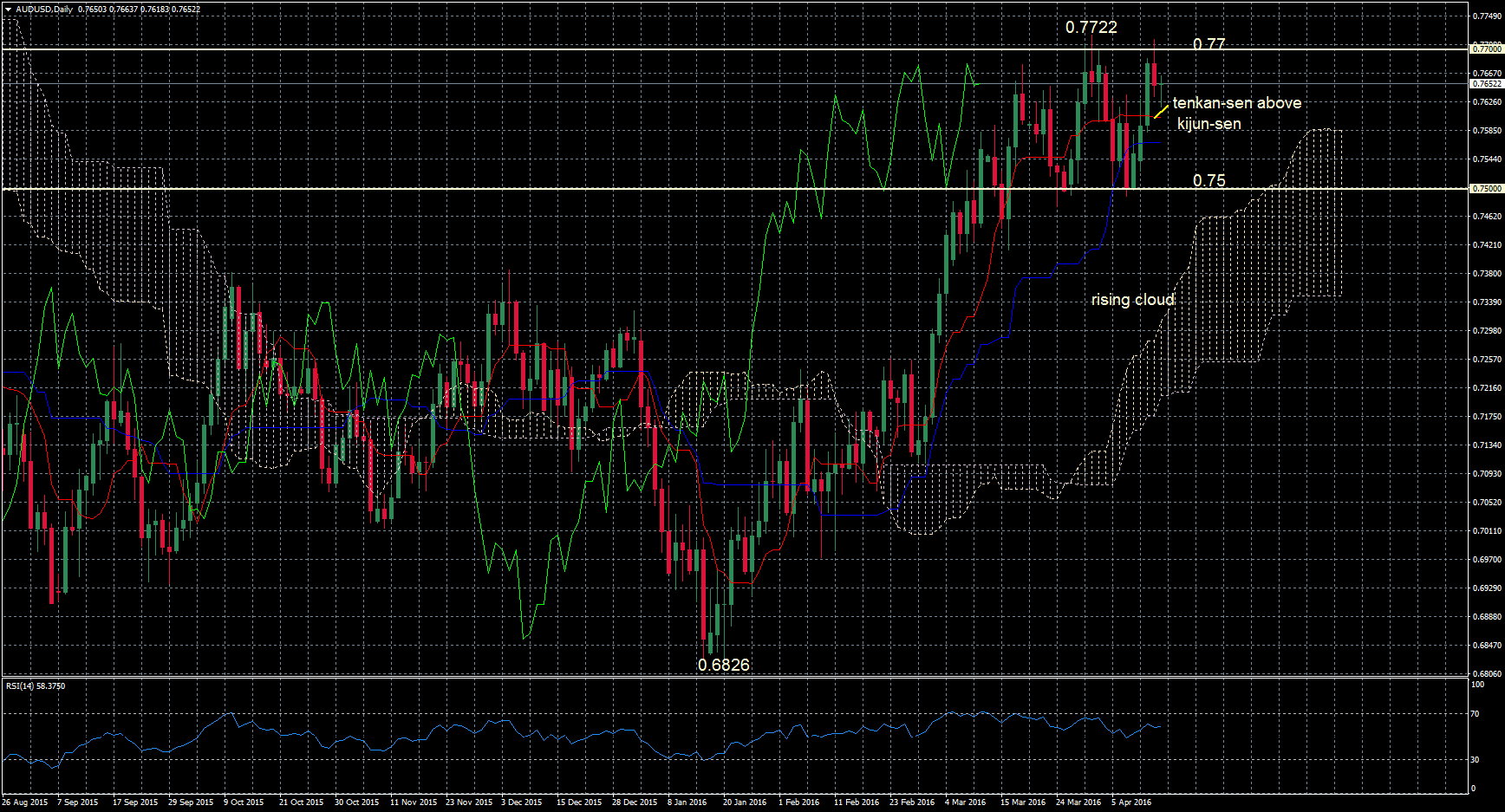

AUDUSD has had a short term neutral bias in the last couple of weeks. The pair has been trading in a broad range of 0.7500 – 0.7700 since early March. After a decent rally from 0.6826 to a 9-month high of 0.7722, the market approached overbought levels (RSI reached 70) and consequently there was consolidation after this move.

After several tests of the key 0.77 level, prices have failed to make a daily close above this level, which is acting as strong resistance. A high of 0.7715 was hit on Wednesday before prices fell back down. Short-term upside momentum has weakened. Support at 0.75 needs to hold otherwise a drop below this would see a shift in the recent bullish bias. But a clear break above the Mach 31 high of 0.7722 is needed in order to see a resumption of the uptrend that started from 0.6826.

Looking at the bigger picture, with the Ichimoku cloud rising and the market being above the cloud, this highlights the underlying bullish market structure. Also the tenkan-sen line is above the kijun-sen line and this is a bullish signal.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750 area as USD recovers

EUR/USD stays under modest bearish pressure and trades slightly below 1.0750 in the European session on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD drops below 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold stays near $2,310 as US yields edge higher

Following a quiet Asian session, Gold retreated slightly to the $2,310 area. Hawkish tone of Fed policymakers help the US Treasury bond yields edge higher and make it difficult for XAU/USD to gather bullish momentum.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.