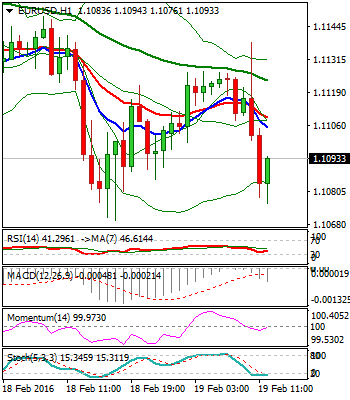

The Euro remains under pressure and returns close to yesterday’s low at 1.1070. Rising daily 20SMA, which contained yesterday’s weakness, still acts as support at 1.1176.

Bounce off 1.1170 was capped by the base of hourly Ichimoku cloud, spanned between 1.1136 and 1.1148, which marked initial resistance and was expected to limit upside attempts.

Near-term studies remain bearish and favor further weakness, with break below 20SMA, needed to expose more significant 1.1055/41 supports, 200SMA / weekly Ichimoku cloud top, break of which to confirm reversal.

The pair is on track for bearish weekly close, which will mark the first negative week after three-week rally and keep the downside pressured, together with yesterday’s close below 1.1120, Fibonacci 38.2% of 1.0709/1.1374 rally.

Alternative scenario requires return above hourly cloud to sideline immediate downside threats, while close above psychological 1.1200 barrier, reinforced by daily 10SMA, will revive bulls.

Res: 1.1138; 1.1148; 1.1185; 1.1200

Sup: 1.1070; 1.1055; 1.1041; 1.1010

GBPUSD

Cable is at the back foot, following yesterday’s upside rejection just under 1.44 barrier, capped by daily 20SMA / hourly Ichimoku cloud top and subsequent easing that closed below cracked daily 30SMA at 1.4370, which remains strong resistance.

Bearish daily studies keep focus at the downside, with upticks seen as selling opportunities and to be ideally capped under 30SMA.

The pair is also on track for strong weekly bearish close, which maintains downside pressure.

Extended near-term consolidation is expected to precede fresh bears, with attempts through initial supports at 1.4254/33, lows of past two days, to open way for full retracement of 1.4078/1.4665 recovery rally.

Only close above 1.4405, daily 10SMA would sideline near-term bears.

Res: 1.4370; 1.4391; 1.4405; 1.4449

Sup: 1.4254; 1.4233; 1.4200; 1.4147

USDJPY

The pair trades in narrow consolidation above fresh low at 112.70, posted today, on extension of three-day descend from 114.85, correction high of 16 Feb, where lower top is forming.

Descend from 114.85 remains capped by falling daily 10SMA, which currently lies at 113.85.

Overall structure remains firmly bearish and favors further retracement of corrective 110.97/114.85 upleg, with significant support at 112.45, Fibonacci 61.8% retracement and close below here to confirm bearish resumption.

Weekly candle is red, with long upper shadow, which confirms strong bearish pressure, built on past two weeks steep descend.

Upside breakpoint lies at 115 zone, Fibonacci 38.2% of 121.67/110.97 descend, where recovery attempts off 110.97 low were capped.

Res: 113.20; 113.52; 113.85; 114.35

Sup :112.45; 112.00; 111.64; 110.97

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 as US yields push lower

Gold price trades in positive territory above $2,310 in the American session on Monday. The benchmark 10-year US Treasury bond yield stays in the red below 4.5% after weaker-than-expected US employment data, helping XAU/USD hold its ground.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.