EURUSD

Fresh strength probes again above pivotal 1.0992/1.1001 resistances, daily cloud base/falling daily 20SMA, after past two days trading was capped here. Daily indicators are turning up, however, setup of daily MA’s is mixed and 20d Bollingers are contracting and signal limited action. Daily close above 20SMA, would be initial signal of fresh recovery leg that needs lift above 1.1108, daily Kijun-sen, to be confirmed and expose breakpoint at 1.1215, 10 July high and daily cloud top. Otherwise, downside risk would increase, in case of repeated failure to clear break 1.10 pivotal zone. Session low at 1.0967, offers initial support, guarding 1.0924 higher base and mid-point of the rally from 1.0807, 20 July low.

Res: 1.1039; 1.1059; 1.1108; 1.1215

Sup: 1.0967; 1.0924; 1.0900; 1.0868

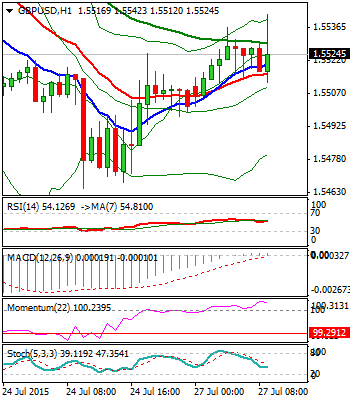

GBPUSD

Cable remains within daily cloud, following last week’s sharp reversal that left triple-top at 1.5670 zone. Dips were so far contained at 1.5464, Friday’s low / near Fibonacci 61.8% of 1.5327/1.5673 upleg, with today’s action, bouncing higher, in corrective attempts. Structure of daily studies is turning bearish that sees limited upside attempts, before fresh leg lower. Initial barrier, daily 20SMA, lies at 1.5552, ahead of daily cloud top, reinforced by daily Tenkan-sen at 1.5570, below which, extended rallies should be ideally capped. Only daily close above here, would sideline downside risk and signal higher low formation.

Res: 1.5552; 1.5570; 1.5617; 1.5670

Sup: 1.5501; 1.5464; 1.5449; 1.5409

USDJPY

The pair came under pressure and eventually broke below near-term congestion, signaled by triple-Doji. Today’s fresh acceleration lower, weakens near-term technicals and signals possible test of strong 123.15/122.90 support zone. Immediate supports at 123.16/03, daily 20SMA / daily cloud top, are coming in focus, along with 122.90, higher low of 14 July, also Fibonacci 38.2% of 120.39/124.46 rally . Violation of this strong support zone, would be seen as a signal of stronger correction of 120.39/124.46 upleg and formation of lower platform at 124.45 zone. Conversely, while 123.15/122.90 support zone holds, overall bulls are expected to commence fresh leg higher for renewed attack at strong 124.36/72 resistance zone.

Res: 123.55; 123.82; 124.17; 124.46

Sup: 123.16; 123.03; 122.90; 122.43

AUDUSD

Aussie remains under strong pressure as last Friday’s fresh acceleration lower, eventually took out psychological 0.7300 support, to post fresh 6-yeal low at 0.7258 and leave daily/weekly bearish candles that signal further weakness. Bearish tone prevails on all timeframes, however, corrective attempts could be anticipated in the near-term, as daily studies are entering oversold territory. Initial resistance lies at 0.7300, former support and session high, ahead of falling daily 10SMA at 0.7366 and 0.7441, lower top and daily 20SMA, below which, extended rallies should be limited. The pair continues to look for near-term target at 0.7204, Fibonacci 76.4% of 0.6007/1.1079, 2008/2011 rally, loss of which is expected to open psychological 0.7000 support in the short-term.

Res: 0.7300; 0.7366; 0.7415; 0.7447

Sup: 0.7258; 0.7204; 0.7150; 0.7100

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.