The Euro averts immediate downside risk, on a bounce from 1.2360 lows, where double-bottom is under formation and offering solid support for now. Yesterday’s positive close signals possible stronger recovery attempts, however, bounce stays for now capped under initial barrier and first breakpoint at 1.2450, broken bull-channel support / Fibonacci 38.2% of 1.2597/1.2360. Break here to open 1.2480, 50% retracement / daily Tenkan-sen line and psychological / Fibonacci 61.8% barrier at 1.2500, above which to confirm recovery. Hourly indicators are struggling above the midlines, while negative tone prevails on a larger timeframes and sees limited upside action for now. Unless the price returns above 1.25 barrier, which would expose pivotal 1.26 barrier in the near-term, prolonged consolidative phase is expected to precede fresh attempts lower. Break below 1.2360 base to resume broader downtrend and look for key targets at 1.2100, trendline support and 1.2042, low of 24 July 2012.

Res: 1.2450; 1.2480; 1.2500; 1.2541

Sup: 1.2414; 1.2395; 1.2372; 1.2360

GBPUSD

Cable remains in extended consolidation above fresh lows at 1.5590, with current range tops being reinforced by descending 4-hour 55EMA. Yesterday’s Outside Day, along with crack of initial dynamic barriers of the daily chart, 10SMA and Tenkan-sen line, would mark near-term base and signal stronger recovery. Today’s close above congestion tops at 1.5735, is seen as minimum requirement to spark corrective action. Regain of the next significant barrier at 1.58, Fibonacci 61.8% of 1.5939/1.5588 downleg, to confirm and open pivotal 1.5939, lower top. However, caution is required as near-term studies show improvement but larger picture remains bearish. Repeated failure at range ceiling, to signal prolonged consolidation, with downside risk in play.

Res: 1.5712; 1.5735; 1.5765; 1.5805

Sup: 1.5646; 1.5624; 1.5590; 1.5550

USDJPY

Near-term structure weakened, as recovery attempts off 117.33 low, where the pair attempts higher base, failed to sustain gains above 118.35 lower tops and subsequent weakness increases risk of fresh attack at 117.33. The price probes below hourly cloud base at 117.75, the last significant support ahead of 117.33, below which to complete hourly failure swing for stronger pullback, as daily studies are overbought. Sustained break below 117.33 to open 117.10/00, daily Tenkan-sen line / psychological support, with 116.51, Fibonacci 38.2% of 112.56/118.96 ascend, in extension. Alternative scenario requires break above 118.56, overnight’s recovery rejection, to re-focus pivotal 118.96 top.

Res: 118.20; 118.56; 118.71; 118.96

Sup: 117.68; 117.33; 117.10; 117.00

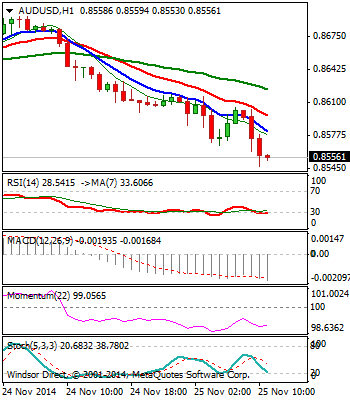

AUDUSD

Near-term structure turned bearish after the pair completed 5-day corrective rally from 0.8564 to 0.8720. Return to 0.8564 low, also cracked near-term bull-trendline, connecting 0.8539/0.8564 lows, exposing pivotal 0.8539 support, 07 Nov low. Yesterday’s close in red confirms negative stance for eventual completion of 0.8539/0.8794 correction. Break lower to signal an end of near-term consolidative phase and resumption of larger downtrend, towards next targets at psychological 0.8500 level and 0.8460, bear-trendline, connecting 2008 peak at 0.9848 and Jan 2014 low at 0.8658.

Res: 0.8568; 0.8600; 0.8618; 0.8660

Sup: 0.8500; 0.8460; 0.8441; 0.8400

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.