The Euro maintains overall negative tone and posts new low at 1.3420, Fibonacci 138.2% expansion of the third wave from 1.3699, 01 July. Near-term narrow range consolidative action is under way and so far being capped by descending hourly 55 SMA. Negatively aligned hourly studies see current action limited at the upside, as 4-hour technicals are bearish and favor further downside, with break below 1.3420/00 supports expected to open next significant level at 1.3247, Fibonacci 38.2% retracement of one year rally from 1.2042 to 1.3992. However, overextended daily studies require caution of possible stronger rally, which requires lift above initial 1.3483 lower top and break above lower platform at 1.3547, to confirm recovery.

Res: 1.3442; 1.3474; 1.3483; 1.3500

Sup: 1.3420; 1.3400; 1.3380; 1.3350

GBPUSD

Cable remains under pressure, as acceleration of pullback from 1.7189 peak, broke below psychological 1.7000 support, with losses finding temporary support at 1.6959. Consolidative action is under way and was was so far capped at 1.7000 level, now reverted to resistance, with near-term directionless phase, expected to precede fresh leg lower, as near-term studies remain negative and daily indicators are attempting below the midlines. Immediate targets below 1.6959 lay at 1.6934, 50% retracement of 1.6697/1.7189 rally and daily Ichimoku cloud top, below which comes 1.6900, round-figure support and 1.6885, Fibonacci 61.8% retracement. Conversely, sustained break above 1.7000 barrier, would signal near-term base and open way for stronger recovery towards 1.7051, 24 July lower top.

Res: 1.7000; 1.7025; 1.7050; 1.7093

Sup: 1.6959; 1.6934; 1.6900; 1.6885

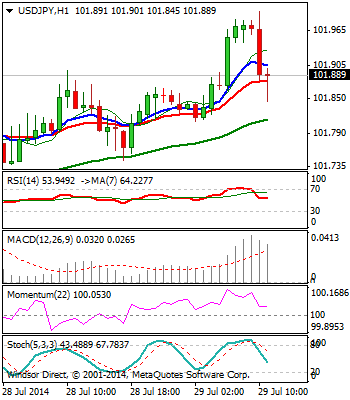

USDJPY

The pair maintains positive near-term tone and tests psychological 102 barrier, after acceleration above near-term 101.30/60 consolidative phase, also broke 101.78/85 lower tops, also 20/200 and 55/200 death crosses. Sustained break above 102 barrier, reinforced by 200SMA, is required to confirm bullish resumption and expose next pivotal barrier at 102.25, 03 July lower top. Positive near-term studies support the notion, however, still weak daily conditions require caution while the price holds below 102 barrier.

Res: 102.00; 102.25; 102.35; 102.78

Sup: 101.71; 101.60; 101.30; 101.05

AUDUSD

The pair’s near-term price action is at the back foot, after recovery attempt off 0.9334 higher low stalled at 0.9468, failing to open way for final attack at key 0.9503, 01 July low. Instead, downside acceleration, which probed below psychological 0.94 handle, retraced 61.8% of 0.9334/0.9468 upleg, weakening near-term structure and signaling prolonged 0.9503/0.9320 range trading. However, daily indicators at their midlines could increase downside pressure and risk return to very strong 0.9320 base, loss of which is expected to accelerate lower and expose another strong support and short-term higher base at 0.92 zone.

Res: 0.9405; 0.9422; 0.9447; 0.9468

Sup: 0.9382; 0.9358; 0.9327; 0.9320

Recommended Content

Editors’ Picks

EUR/USD stays weak near 1.0700 after German GDP data

EUR/USD is keeping the red near 1.0700 as investors await inflation and growth data for the Eurozone. The data from Germany showed that the GDP contracted at an annual rate of 0.2% in Q1 as expected, not allowing the Euro to attract investors.

GBP/USD remains pressured toward 1.2500 on US Dollar rebound

GBP/USD is extending losses toward 1.2500 in European trading on Tuesday. A cautious risk tone and a decent US Dollar comeback weigh negatively on the pair. The focus now shifts to mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

Data fuels China optimism

China's factory activity has expanded for a second consecutive month, marking the best streak in over a year and fueling optimism for the sustainability of the world's second-largest economy's recovery.