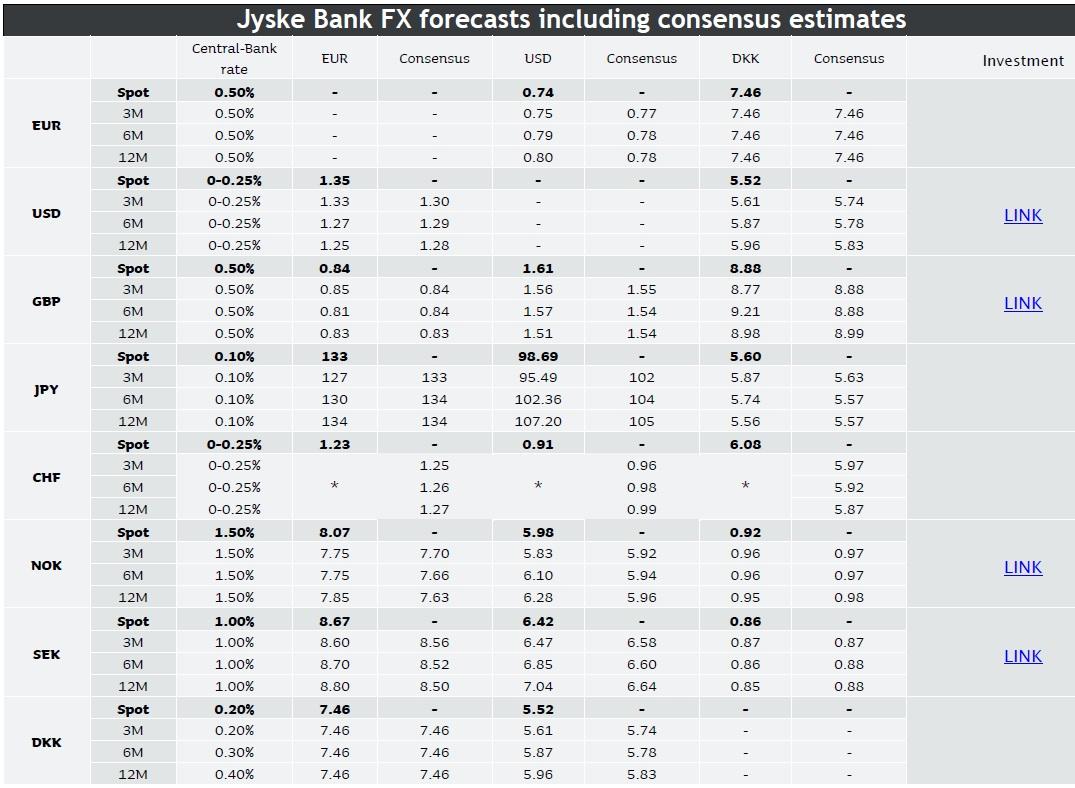

FX forecasts

FX overview

US dollar - USD

The Fed’s delay of QE tapering was an unforeseen obstacle for our view on USD - monetary-policy divergence between Europe and the US is a very important element in our expectation of future USD strengthening. Yet, the prospect of a stronger USD is still intact - although postponed. Moreover, the prospects for USD involve a higher degree of uncertainty.

QE tapering has not been cancelled but delayed - unfortunately, the uncertainty related to QE tapering is higher than previously. This is due to the Fed's major focus on forward-looking economic data. Housing and job market data will be decisive.

We expect improved data from the US - in 2014 growth is expected to be about 2% higher in the US than in Europe. However, for the short term the uncertainty related to economic data is high - the current fiscal-policy negotiations only add to the uncertainty.

Our short-term target has been sharply revised. The long-term targets were only marginally adjusted despite higher uncertainty.

Fundamental valuation

Monetary policy: The Fed’s purchase activity is unchanged. The Fed buys government and mortgage bonds in the amount of USD 85bn a month.

We have moved the expectation of QE tapering to December (January at the latest). The timing is more uncertain than previously due to a high degree of data dependence.

A new long-term LTRO from the ECB is increasingly likely, but not until past mid-October.

Fiscal policy: Negotiations about fiscal austerity measures have begun. We see the largest risk of USD weakening if the negotiations reach a deadlock.

Economic growth: The US: (2.7% for 2014). Europe: (1.1% for 2014).

Purchasing-power parity: EUR/USD 1.22.

USD-positive price triggers

The US: Better US indicators (especially job data) will force up interest rates and increase the likelihood of an early expiry/tapering of QE3. The dollar will appreciate on rising interest rates.

Europe: The debt crisis and structural problems in the euro zone continue. (Not a current issue.)

The negative credit spiral deteriorates and hampers growth and credits in Europe. The ECB announces a new relaxed LTRO to the banks (very topical).

The ECB announces a negative deposit rate for banks.

Global markets: Global growth (especially China, USA or Europe) slows down again. USD is being purchased due to search for safe haven.

Investment case

The narrow trading range between 128 and 134 in the past 12 months is expected to have come to an end. We expect that EUR/USD will breach to the downside in step with the Fed's QE tapering and rising interest rates.

0-3M: Highly uncertain. The delay of QE tapering and messy fiscalpolicy negotiations are bad news for USD, but a potential LTRO from the ECB may turn around the picture.

Moreover, the next quarter brings challenges for, e.g., Portugal and Greece.

3-12M: QE tapering is expected to be initiated. This will strengthen the dollar. However, the exact timing for the tapering has become more uncertain due to a higher degree of data dependence.

Significant growth divergence and improved external balances will strengthen USD. The Fed raises interest rates earlier than the ECB.

USD-negative price triggers

The US: A slowdown in the autumn with weak economic indicators will delay the Fed's tightening plans.

The fiscal-policy negotiations reach a deadlock. The Fed delays QE tapering due to the risk of slower growth. The US' credit rating is downgraded.

Europe: The crisis-hit PIIGS countries finally gain control of their budgets.

Global markets: Japan's monetary-policy stimuli spread and support risky assets (safe-haven currencies come under pressure).

Chinese growth maintains positive momentum.

Pound sterling - GBP

We still have a positive long-term view of GBP, but the 'easiest part' of the appreciation has taken place. A European LTRO will be welcomed. At its latest monetary-policy meeting the Bank of England did what it could to support sterling:

The BoE did not voice concern about higher interest rates (10-yr gov. bond yields increased from 1.7% in the spring to 2.7%).

None of the committee members wanted new monetary-policy easing measures.

For the short term, sterling is exposed to disappointments from several factors. Economic indicators have surprised to the upside (Economic Surprise Index is high) and increase the risk of future disappointments. Moreover, the money market discounts interest-rate hikes at the end of 2014 against the BoE's own expectations of Q3 2016 at the earliest. This is in our opinion far too aggressive.

Fundamental valuation

Monetary policy: The BoE's interest rate is 0.50%. We do not anticipate any change in the interest rate or an expansion of the BoE's purchase programme in the coming 12 months.

The monetary-policy committee has so far surprised by being 'tougher' than expected, causing sterling to strengthen.

Fiscal policy: There are prospects that the public tightening will continue in 2014 which will hamper growth.

Growth: We anticipate slowly improving economic indicators. Improved exports are supporting the currency.

Purchasing-power parity: Approx. 0.745 EUR/GBP.

GBP-positive triggers

The UK: The improvement of economic indicators continues. Unemployment declines faster than expected down towards 7%.

The monetary-policy committee maintains a rhetoric where increasing interest rates do not constitute a concern.

Europe: Increasing financial turmoil in the euro zone will cause sterling to strengthen against the euro.

A new LTRO from the ECB will cause the euro to weaken against sterling.

Global markets: A downgrade of global economic growth will support sterling due to the search for safe haven.

Investment case

Our latest expectation of a sterling appreciation has unfolded rather quickly. 'The easy part' is over. An LTRO from the ECB (like we expect) will pave the way for our 6M target.

0-3M: Sterling has become slightly vulnerable - fortunately the FX market has not fully discounted the aggressive behaviour of the money market. If so we should be trading at 0.82 EUR/GBP.

3-12M: Investors are concerned about Carney effect. We do not think it will materialise. If we are right, sterling will appreciate.

The monetary-policy divergence will be more obvious. The BoE is again reluctant while the ECB announces a new LTRO.

Europe's slow growth is here to stay.

GBP-negative triggers

The UK: The Bank of England will keep interest rates low until unemployment reaches 7% (its own forecast points to Q3 2016). The markets do not believe in the BoE. If the BoE is right, sterling will depreciate.

Economic growth remains slow and inflation relatively high. The central bank resumes its quantitative easing.

A downgrade of the credit rating by Standard & Poor's or general distrust in the government's fiscal recovery plan.

Europe: The debt crisis escalates and the UK financial sector collapses.

The Swiss franc – CHF

According to consensus expectations, the Swiss franc should weaken. Consensus is that in 12 months the franc will trade at 1.27 (EUR/CHF) against the current 1.25. We are not quite in line with consensus since we maintain the expectation that EUR/CHF will stay in the range 1.20-1.25. However, we see a slowly increasing pressure to the upside - in our view, the franc is not going anywhere over the next three months due to:

the ECB airing the possibility of a new LTRO. Banks' liquidity surplus is close to the critical level of EUR 200bn (after this consensus is that short-term interest rates will be forced up = the ECB will react).

the current budget negotiations and coming debt-ceiling negotiations disturbing the scenario for US growth. The Swiss franc is by now the only real safe haven left in the FX market.

Fundamental valuation

Monetary policy: Interest rates are historically low, inflation is marginally increasing, the currency is strong. We do not expect changes from the SNB as the economy is doing relatively well.

The SNB has determined a minimum price for EUR/CHF of 120. The market has confidence in the SNB and so do we.

CHF is still a ”safe-haven currency”. If the SNB fails to maintain its minimum rate, CHF will strengthen considerably in a short period of time. 100-110 for EUR/CHF is not unlikely.

Growth: The economy is strong relative to the euro zone. Unemployment is very low (approx. 3%), the development of housing prices is positive, and the current-account surplus is wide.

Purchasing-power parity: 132.20 EUR/CHF

CHF-positive triggers

Switzerland: The economic trend in Switzerland is of minor importance to the franc. The current-account surplus supports a strengthening of the franc if the SNB stays away from the market.

Europe: Renewed debt crisis turmoil will strengthen the franc. After Japan’s new monetary-policy strategy, the franc is one of the world’s most attractive safe havens.

If growth scare and debt crisis turmoil flare up again, EURCHF will fall to 120.

Global markets: The US budget and debt-ceiling negotiations may be very messy. During the 2011 negotiations, US equities fell by 17% - the franc will strengthen.

Investment case

- 0-3M: The fiscal chaos in the US may contribute to franc appreciation.

0-12M: We expect that the franc will remain in the range of 120-125 EUR/CHF.

A few deviations are expected to be short-lived. Deviations will be to the downside at CHF/DKK – we do not expect to see a stop of the SNB’s intervention level at 120 EUR/CHF.

Read our recent CHF research report (read here).

Only an extremely strong negative wave in the financial markets will be able to make the SNB remove its intervention level.

CHF-negative triggers

Switzerland: Given the SNB’s announced minimum rate, it will be difficult for EUR/CHF to breach below 120.

Investors are still heavily invested in the franc. If they want to abandon the franc, the downward movement for the franc may be extreme.

Europe: Renewed calm about the situation in Europe in combination with a positive development in Japan, for instance due to falling value of the yen may cause speculators to sell the franc both speculatively and to raise new loans in francs, which may send the franc up towards 129-130.

Global markets: The global economy regains positive momentum to an extent that surprises more than we have seen so far.

The Japanese yen - JPY

1 October will be a decisive day for the yen. The Tankan report will be released and in the wake of the report Prime Minister Shinzo Abe will announce whether VAT hikes will be introduced. If VAT hikes are implemented, the Bank of Japan will most certainly ease the monetary policy to counter the negative growth and inflation effect from the higher VAT. The reason for the VAT hikes is Japan's very high budget deficit. Japanese debt keeps growing (more than 230% of GDP) and if Japan should have any possibility of repaying it or just stabilising it, the country needs targeted initiatives. For the long term, fiscal tightening is negative for the yen since the BoJ will try to dampen the negative spill-over effect on growth and inflation. But the yen will still receive safe-haven flows - fiscal turmoil in the US may contribute to yen appreciation for the short term (0- 3M).

Fundamental valuation

Monetary policy: The interest rate of the Bank of Japan is 0%- 0.10%. It will stay at this level.

The BoJ’s purchase programme involves negative pressure on JPY. The programme risks an increase if VAT is hiked.

Fiscal policy: Japan is a champion in government debt with approx. 230% of GDP. The budget deficit is about 10% of GDP. Government debt is mainly owned by the Japanese themselves.

Growth: Economic indicators are improving, but real growth is not expected to rise higher than to 1.5% in 2014 and just below 1% in 2015. The current account will improve over time.

Purchasing-power parity: EUR/JPY 1.025.

JPY-positive triggers

Japan: Speculative investors are strongly positioned for further yen weakening. A sharp increase in risk aversion will strengthen the yen. Investors will be caught fully off-guard.

A too solid depreciation of the yen will hit Japanese growth due to high energy costs. Japan is a large importer of energy. No interest in the yen weakening too fast.

Europe: The debt crisis escalates. The yen has for many years been a safer haven than the dollar. We expect this to happen again in the event of a crisis.

Global markets: The difficult fiscal negotiations in the US may end up being very messy. US equities fell by 17% in 2011 during similar negotiations. The yen will strengthen.

Investment case

The short-term scenario is more balanced than last month - but the fiscal-policy negotiations in the US may contribute to yen appreciation. The same is the case if the ECB launches a new LTRO.

0-3M: Greatest likelihood of yen appreciation. Investors will be caught off-guard.

3-6M: The Bank of Japan continues to relax its monetary policy - the central bank will show a strong reaction when/if a VAT increase is implemented.

6-12M: Further weakening of the yen.

Risk factors

Japan: The central bank expands its purchasing programme to include foreign bonds.

The Bank of Japan squeezes Japanese pension funds, etc. out of Japanese government bonds and into foreign paper. The initiative has been introduced but still needs to be implemented.

Europe: Europe gains momentum and economic indicators continue their positive trend.

Global markets: A solid improvement of US and European indicators will weaken the yen relative to the euro and the US dollar.

The Fed scales down its purchasing programme. Higher interest rates in the US and Europe weaken the yen against the US dollar and euro.

The Norwegian krone - NOK

Since the August edition of Spot On, NOK regained positive momentum as expected. We expect further NOK appreciation although the latest monetary-policy meeting at Norges Bank was a disappointment to investors (the market had positioned itself much too aggressively). Norway still has attractive characteristics in the form of a wide current-account surplus, an AAA-rating, relatively high growth and a central bank expected to hike interest rates before most other developed economies. But we see increasing signs of weakness for NOK for the long term – a structural shift may be in the making. An important element here is flagging demand for safe haven combined with an increasingly vulnerable housing market. Moreover, oil prices look set to decline, which will impact both oil revenue and oil investment - the housing market and oil investment are important catalysts for Norwegian growth.

Fundamental valuation

Monetary policy: The latest monetary-policy meeting resulted in a higher interest rate path. A hike is expected in early 2014. But t he central bank is concerned about the housing market.

Fiscal policy: Norway has sound public finances and a very attractive AAA rating.

Growth: Recent GDP figures disappointed on the surface but below the surface they were actually decent. This bodes well for the future.

Liquidity: NOK is one of the more illiquid currencies. It will soon get cramped when so many want out at the same time.

Purchasing-power parity: 7.29 EUR/NOK.

Price triggers

Norway: Norges Bank becomes concerned about the trend in lending as well as the high level of housing prices and sharpens its rhetoric about impending interest-rate increases (currently it is rather to the opposite).

Europe: Lower ECB rate or new 3-year LTRO allotments will strengthen the krone.

Global markets: The recent period of improved global growth indicators will in the long term cause the krone to appreciate. The Norwegian krone is a relatively cyclical currency.

Syria? Higher oil prices are positive for the krone. On the other hand, investors will abandon illiquid assets. Due to the present investor sentiment, the risk is offhand highest to the downside.

Investment case

We successfully closed the short-term BUY recommendation for NOK. The long-term BUY recommendation is maintained - there are good opportunities again for the short term.

0-3M: Despite a fair counter reaction in NOK following a period with significant NOK weakening, investors are upset. Good news is required to restore confidence.

3-6M: NOK is expected to appreciate. Stronger growth, prospects of higher interest rates and a generally underestimated krone will be supportive.

6-12M: We assess that there is a structural shift underway for NOK, and in the period ahead (+12M) we must accept a slightly weaker NOK.

Risk factors

Norway: Low liquidity is the greatest threat to the krone.

The housing market collapses – banks as well as economic growth are affected.

Global markets: Syria? Higher oil prices are positive for the krone. On the other hand, investors will abandon illiquid assets. Due to the present investor sentiment, the risk is offhand highest to the downside.

Rising interest rates in the UK and the US are negative for the krone since a narrower interest-rate spread will reduce the incentive to stay invested in the krone.

The Swedish krona – SEK

In the short term, the krona is more or less trading at the expected level. In the long term, we still see a small positive potential of 1-2% in the krona.

Since last month not much has happened. As expected, the krona has appreciated slightly, and the previous divergences to the money market and the equity market are closed. In the short term (0-1M) the risk is, in our view, greatest for a small weakening of the krona. Going forward, the picture for the krona is very balanced. On the one hand, the economy's cyclical dependence has a positive impact on the currency, but, on the other hand, it is expected that the outflow of safe-haven positions will continue at a moderate pace.

One thing that was worth noting in the previous month was that Finansinspektionen was given the responsibility for financial stability. When/if Finansinspektionen initiates instruments against the very hot housing market, this will to a higher degree liberate Riksbanken.

Fundamental valuation

Monetary policy: The Riksbanken has left its key rate unchanged at 1.00% since 2012. We anticipate an interest-rate increase at the end of 2014.

”The scaling down” in the US and global monetary-policy rebalancing will be a slightly negative factor for the krona.

Finansinspektionen has been given the responsibility for the financial imbalances – the Riksbanken can hence to a higher degree focus on inflation.

Fiscal policy: Sweden has an AAA rating and sound public finances which reduce the risk involved in SEK investments.

Growth: 2013 is expected to be a year of slow growth. In return, the Riksbanken and the government are positive about 2013.

Positive price triggers for the krona

Sweden: Rising inflationary pressure combined with a strong housing market. The Riksbanken advances the time of an interest- rate hike.

Europe: The debt crisis is cancelled. The krona will lose its safe-haven flow but strengthen via its cyclical dependence.

The ECB once again reduces its interest rates or makes other easing initiatives (for instance a new LTRO).

Global markets: Increasing global growth is positive for the krona.

Investment case

820-880 EURSEK is our expected 12-month trading range - deviations from the range are expected to be temporary. Recommendation: Buy at the bottom and sell at the top

3M: No clear direction from the current level. Greatest risk that economic indicators will disappoint slightly. Currently no signs of major political adjustments from Riksbanken.

3-6M: The krona stabilises at the expected trading range. The time of an interest-rate hike from Riksbanken has moved closer.

6-12M: Relatively large uncertainty. The krona may be a victim of repositioning (as we have seen it with the Swedish krone), but higher global economic growth will support the cyclical element of the krona.

Negative price triggers for the krona

Sweden: Weaker economic indicators will open the door for interest- rate cuts from Riksbanken - particularly if Finansinspektionen makes initiatives against the very hot housing market.

Europe: European money-market rates increase even further (short-term risk – in the long term it will kill European economic growth).

Global markets: Dramatic slowdown in global economic growth. Sweden's open economy will be hit hard.

Scaling down of QE in the US. This will result in rising global interest rates and remove part of the incentive to keep the krona.

War in Syria will result in sale of illiquid currencies.

The Polish zloty – PLN

In the medium term (3-6M) we expect a trading range of 415-435 (1.72-1.80). In the long term (+12M) the zloty will emerge slightly stronger - particularly if the European banks manage once again to ease the lending requirements.

Over the next six months, the pressure will still be on the upside, meaning that the weakening of the zloty is to be hedged. The coming three to four months will to a higher degree than usual be affected by the economic development in the US, as the trend in economic indicators will affect FOMC to either continue with the easing (positive for the zloty) or start reducing the easing (negative for the zloty).

We expect the central bank to leave interest rates unchanged in the coming year. The relatively low interest rate will contribute to maintaining the negative pressure that has been on the zloty over the past six months.

As long as the euro zone is still in a low-growth scenario, Poland must by itself generate growth through its domestic demand. PMI's and consumer confidence start showing budding signs of increasing economic improvement, which is positive in the long term.

Fundamental valuation

Monetary policy: Central-bank rates are record-low at 2.5%. We do not anticipate any changes over the next twelve months.

Fiscal policy: The budget deficit has shrunk considerably.

Growth: We expect that the central bank will keep its interest rates at a very low level to support economic growth.

The current account has shown a surplus. PMIs show steep increases. There is a trend of economic improvement.

REER: The zloty is approx. 3% below the 5-year moving average.

Positive triggers:

Poland: Lower budget deficit and higher current-account surplus.

Retail sales and inflation begin to point upward due to a successful cycle of interest-rate cuts.

Europe: Stronger growth in Europe is positive for the zloty. Europe is the most important trading partner. A faster upswing will appreciate the zloty.

Global markets: A new 3-year LTRO with a fixed interest rate from the ECB will give increased liquidity and support the Polish market.

Investment case

The zloty is strong relative to the other EM currencies. The interestrate cycle has bottomed out and the economy has started showing budding signs of improvement. Hence, the zloty will a good case in the long term.

0-3M: Rising interest rates in the US, the euro zone and the UK and discussions about the debt ceiling in the US increase the pressure on the emerging markets and the risk of further closure of EM positions.

3-6M: The zloty is expected to be stable to marginally stronger.

6-12M: Stabilisation of Europe and improved Polish balances (budget and current account) will strengthen the zloty a shade.

Negative triggers:

Poland: If the financial crisis in the euro zone flares up again, the zloty will depreciate since European banks and investors are relatively heavily positioned in Polish bonds.

Europe: Germany is the largest trading partner. Slower economic growth in Germany will affect the current account and Polish growth.

Global markets: Rising interest rates in the US have so far resulted in the close-down of EM positions on a large scale. If interest rates increase further and if this continues to spill over into European interest rates, it will once again affect the zloty.

The analysis is based on information which Jyske Bank finds reliable, but Jyske Bank does not assume any responsibility for the correctness of the material nor for transactions made on the basis of the information or the estimates of the analysis. The estimates and recommendations of the analysis may be changed without notice. The analysis is for the personal use of Jyske Bank's customers and may not be copied.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY recovers 156.00 after testing 155.50 on likely Japanese intervention

USD/JPY has recovered some ground above 156.00 after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.