Hence, when the SNB decides to intervene in currency markets, it has a lot to consider. The Swiss economy is significantly reliant on the global export market. Germany is the main Swiss export market at 15.21% of total. Including Germany, the Eurozone market accounts for well over 35% of total. The US accounts for 10.12%; the UK 4.43%; Hong Kong 7.77%; China, 5.92%; India, 6.79%. Hence nearly 70% of total Swiss exports are destined for countries with major currencies.

In general, Switzerland’s major exports involve Gold or other precious metals and minerals, especially through consumer discretionary applications. The second largest export involves pharmaceuticals, medical products and medical instruments. The imports are similarly structured with gold, precious metals and minerals leading the list. Consumer discretionary, particularly jewelry, automobiles and electronics follow. Specifically, bilateral trade with the United Kingdom involves the same type of trade goods and in similar proportion.

What it all amounts to is that the Swiss economy is sensitive to exchange rates and then particularly in markets for consumer discretionary products in a global economy. A market which is expected to gradually decline for some time to come.

The most recent SNB policy assessment was released on 10 December; the next meeting is scheduled for March. However, board members do give interviews and speeches, which often indicate the consensus thinking of the governing board. For instance Vice Chairperson Fritz Zurbrügg on 13 January: “...price stability and sound public finances make it easier for companies to plan, especially as regards investment. So, by fullfilling its mandate and ensuring price stability, the SNB makes an indirect contribution to the competitiveness of the Swiss economy... ...exchange rates play an important role in the SNB’s monetary policymaking... ...exchange rate movements can have far reaching consequences for economic and price developments... ”

Hence, the SNB makes it clear that its currency intervention policy is integral to the Swiss economy.

From his introductory remarks from the 10 December governing board assessment meeting, Chairperson Thomas Jordan noted: “...Despite depreciating somewhat in recent months, the Swiss franc is still significantly overvalued... ...The interest rate differential with other currencies, even following the European Central Bank’s (ECB) mild interest rate cut, is thus still markedly higher than at the beginning of the year...” This might indicate that the SNB is satisfied that the rate differential with other central bank base rates is sufficient enough, at present -0.75%, to discourage further capital inflows.

However, Chairperson Jordan was also careful to note that “...The SNB also remains active in the foreign exchange market in order to influence the exchange rate situation, as necessary. The negative interest rate and our willingness to intervene in the foreign exchange market are intended to ease pressure on the Swiss franc. Our monetary policy thus helps to stabilise price developments and support economic activity...”

It’s important to note the timing. The 10 December meeting had taken place when markets were just beginning to unravel. Vice Chair Zurbrügg made his remarks after global markets had unraveled significantly more. Further, since that 13 January speech, markets have not improved, to say the very least.

The question now becomes that of what may be expected of the Bank of England and how will that affect the Pound Sterling? The next BOE monetary policy committee meeting is scheduled on 4 February. However, BOE Governor Mark Carney may have given an indication of the MPC’s consensus leaning through his 19 January Peston lecture at Queen Mary University of London: “...The beginning of 2016 in the UK is significant in that it marks a turning of a page... ...in financial conditions. At the same time, in the MPC’s judgment, it did not yet herald a turn in the stance of monetary policy...”

A bit further on in the lecture, Governor Carney was very specific: “...The obvious question is, if the turn of the year heralded the normalisation of bank regulation and macroprudential policy, why not the start of normalisation of monetary policy? There were some media suggestions that Governor Carney was being critical of the Fed’s recent policy action, but he carefully detailed the differences between the US and UK economies. Specifically, he noted: “...pass-through of weak global inflation, compounded by exchange rate appreciation, is likely to exert a greater and more persistent drag on UK inflation... ...now is not yet the time to raise interest rates...”

Hence, with the BOE signaling it’s satisfaction with domestic growth, comfortable with its oversight of inflation and its concerns over global markets, it’s reasonable to conclude that the BOE plans to maintain its policy going forward. This indicates a stable or possibly strengthening Pound. On the other hand, the SNB has clearly signaled its obligation to weaken the Franc.

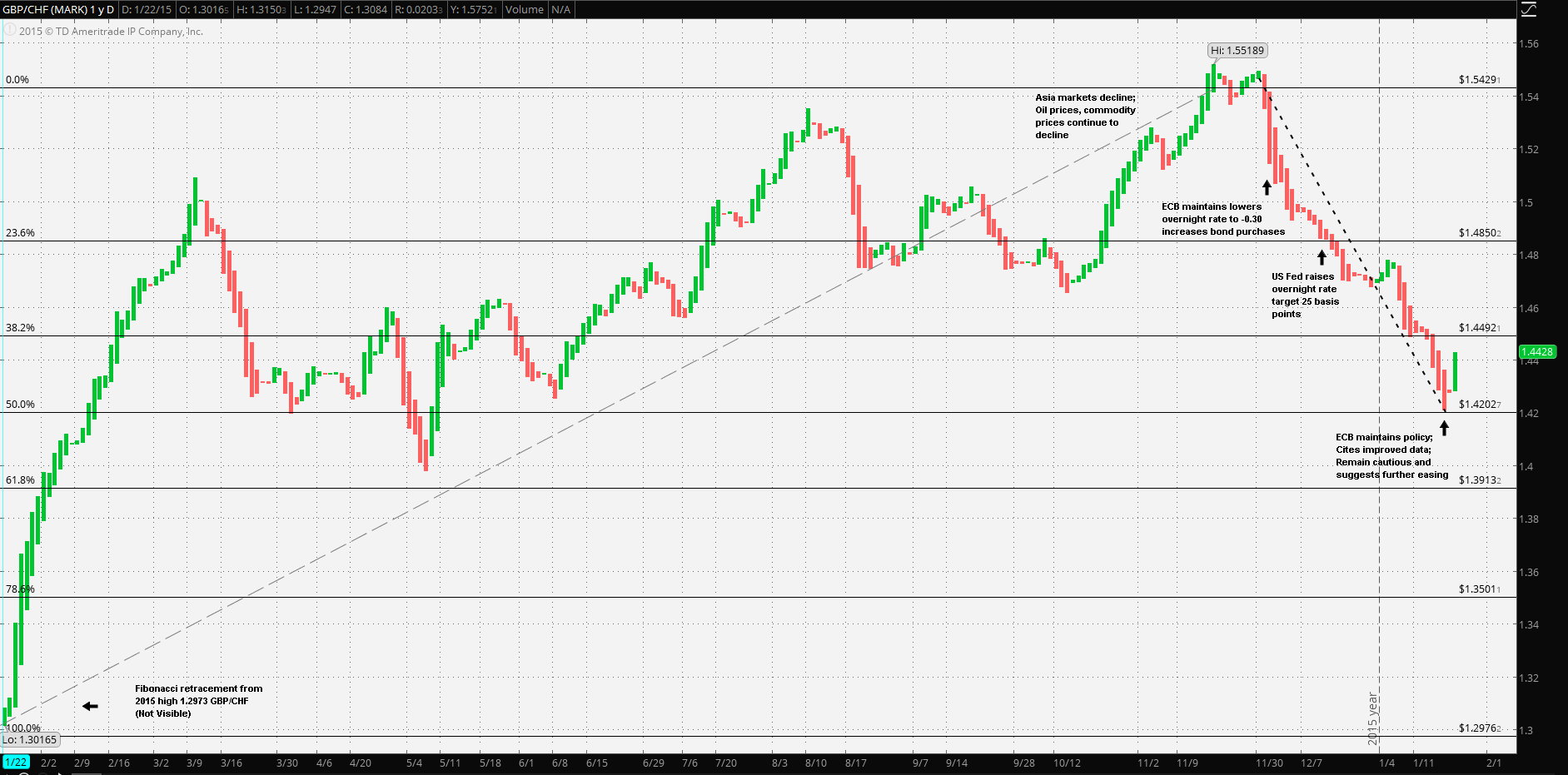

The chart indicates an 8.3891% gain of the Franc vs the Pound since 19 November of 2015. In light of the global situation this is likely a safe-haven trade. Hence, it’s reasonable to conclude that the SNB will act and in the process reverse the current strengthening trend vs Sterling.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.