As it is now, in the worst case scenario, the regional hostilities surrounding Turkey might ‘spill-over’ within Turkey’s borders. On the other hand, now finding itself a central player for NATO, which includes a significant portion of EU member states, might provide the leverage for Turkey to finally take its place among EU member states and potentially a Eurozone member.

The United Kingdom, also an EU member, has quite a different perspective in its relation to the EU. There has been a growing ‘grass roots’ movement calling for the UK to exercise its ‘Opt-Out’ option. Although initially considered a non-issue, the movement has gained enough momentum to catch the attention of the BOEiii. Second, the UK economy seems to be bogged down by stubbornly low inflation, well below the BOE’s annualized 2% target, in spite of reasonably good GDP growth.

At the BOE’s 8 October Monetary Policy Committee meeting, it was decided to maintain current policy of a 0.5% bank rate and its £375 billion asset purchase target. The committee noted, “...Twelve-month CPI inflation was zero in August, well below the 2% target rate... ...Core inflation remains subdued at around 1%, influenced both by restrained labour cost growth and by muted import cost growth, itself partly reflecting the continuing dampening influence of sterling’s appreciation since mid-2013... ...With inflation below the target, and the likelihood that at least some spare capacity remains in the economy, the MPC intends to set monetary policy so as to ensure that growth is sufficient to absorb any remaining underutilised resources...” The committee specifically made note of the long term strengthening of the Pound Sterling. A third variable reflects back to the Euro, in particular, the ECB continuing efforts to inflate consumer prices. The ‘lowflation’ currently being experienced by the UK, most likely, has at its roots low import prices competing with the domestic UK economy. This may be partly evidenced by the UK’s current account deficitiv. The contraction in the Asia-Pacific region will also make it more difficult for both the UK and ECB to stabilize consumer prices.

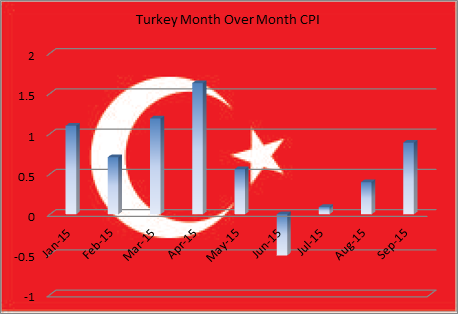

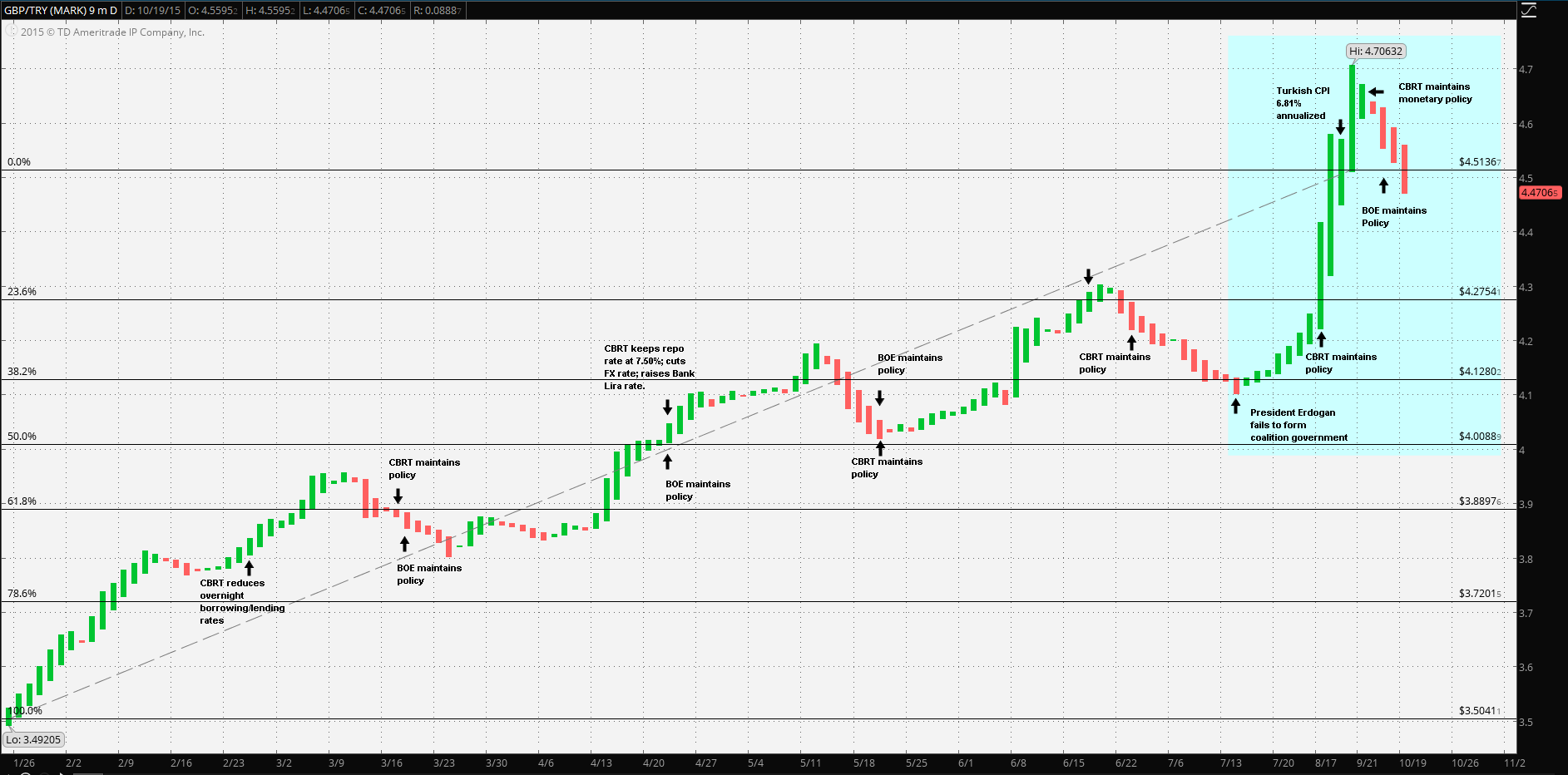

The chart indicates the steady weakening of the Lira vs the Pound Sterling over the previous nine months. From a low of ₤3.5056 to the Pound Sterling, 23 January, 2015 to its high of ₤4.70632, 14 September the Lira has lost a stunning 34% against Pound Sterling. Again, the reason may be the simultaneous strengthening of Sterling against most majors and a weakening of the Lira. There is one particular point of note: the sharp loss from 14 July, moving up to the 14 September high and recovering to ₤4.4706 to the Pound. From point to point is almost a 9% decline. This particular decline coincides with President Erdogan’s AK party, failing to form a coalition majorityv.

However, a good conclusion may be drawn from this: the CBRT is indeed an independent agency of the Turkish government. CBRT Governor Basci withstood months of political pressure by the conservative majority ruling party to cut rates, but still managed to stick to the policy. Now with the ruling party weakened in the last election, the CBRT has that much more leverage to pursue inflation containment as it sees fit. The refugee crisis has opened many venues of communication with the European Union. As a member, the UK may have a say, but the economic relationship between Turkey and the UK is far weaker that the relationship between Turkey and continental Europe.

On the other hand the UK seems to be keeping a polite economic distance from the Eurozone club members. After the 22 October press conference, Mr. Draghi strongly indicated the likelihood of expanding the current QE. The current refugee crisis has raised many long standing issues between Turkey and the European Union, for example Cyprus, the Kurdish minority and EU membership. For the present it seems that the Euro and Lira are on parallel, if not slightly convergent paths. The Pound Sterling, on the other hand, is on strengthening path vs the Euro, with or without a BOE Bank Rate increase. Hence, it’s not unreasonable to expect the CBRT to be well able to maintain Turkish economic policy on a track leading to closer ties with the continental EU economy, and by doing so, weaken against the Pound Sterling.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0700 after US data

EUR/USD lost its traction and turned negative on the day near 1.0700 in the American session on Tuesday. The data from the US showed that Employment Cost Index rose more than expected in Q1 and provided a boost to the USD.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar gathers strength following the strong wage inflation data, forcing the pair to stay on the back foot.

Gold extends daily slide toward $2,310 ahead of US data

Gold stays under bearish pressure and declines toward $2,310 on Tuesday. The benchmark 10-year US Treasury bond yield holds steady at around 4.6% ahead of US data, making it difficult for XAU/USD to stage a rebound.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.