There was one out-of-the-ordinary concern. It has been an issue with several Central and Eastern European (CEE) emerging market nations for several years already: foreign currency denominated loans; mostly mortgages but also auto and other loans. Fellow EU member Hungary seems to have resolved the same problem, but it wasn’t cheap nor easy. It took combined parliamentary and Hungarian central bank measures culminating just recently in legislation designed to share the cost of converting 1.43 billion Francs (£710 million) to its legacy currency, Forints and then subsidizing 30.837 billion Forints (£73 million) for consumers who exchange Franc loans for Forint loans.

A similar plan is currently making its way through Poland’s bicameral legislative process. However, NBP Governor Belka warned that the bill would undermine the Zloty creating painful private banking sector capital shortages: “...A sudden conversion would mean a risk of a significant weakening of the zloty, and hence a rise in the costs of foreign exchange-denominated loans.... ...so, we would be shooting ourselves ... in the foot...”

From 2007 through 2008, more than 500,000 Poles applied for Swiss Franc denominated mortgages , taking advantage of lower rates. The Franc has since appreciated greatly against the Zloty causing payments to balloon. The proposed legislation will divide the conversion costs equally between banks and credit holders. The final legislation has not yet been decided on.

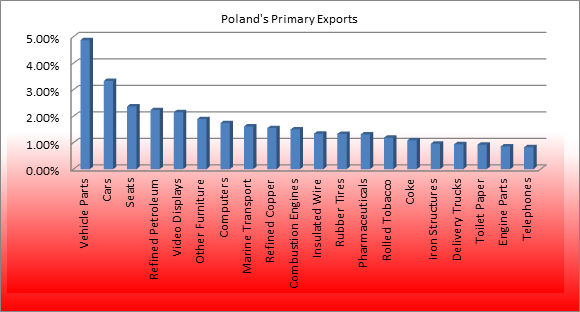

Poland has an industrial economy, manufacturing mostly automobiles and auto parts. Poland does have mineral resources, primarily coal. It is Europe’s second largest coal producer; however, coal is not among its top exports. Other than coal, Poland has small amounts of crude oil and gas as well as sulfur, copper, natural gas, silver lead, salt and amber. Poland trades mainly within the EU and greater Europe.

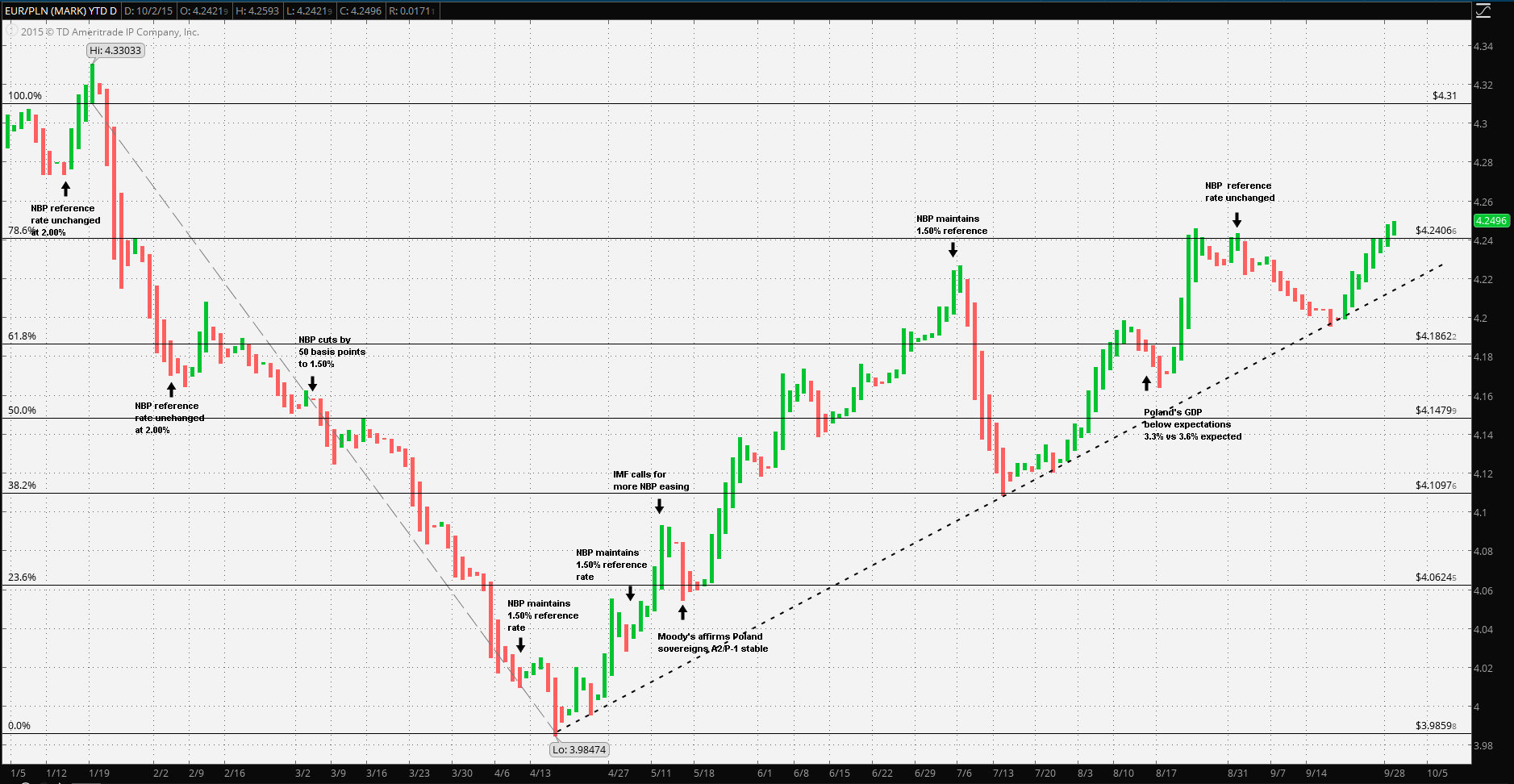

At the January meeting the NBP left its reference rate unchanged at 2.00%. Year over Year GDP was 3.4%, double the 2013 rate of growth, however, prices continued to deflate. Note that this meeting took place before the ECB implemented its expanded QE and one day before the Swiss decoupling from the Euro. At the February meeting the NBP again maintained the reference rate, with CPI at -1.00%, however, while Governor Belka strongly suggested a March rate cut. Indeed, the NBP policy council cut rates more than expected at the March meeting; 50 basis points to 1.5%. Concerns over accelerating deflation seemed to be the motivation; CPI dropped 1.3% in January of 2015. The Zloty’s best against the Euro in 2015 occurred on 21 April a week after the NBP decided against further rate cuts. The Zloty had gained 8.812% from the 29 December nine month high of 4.36985 per Euro.

In spite of IMF calls for the NBP to take more aggressive action against deflation, Governor Belka seemed comfortable with a strengthening Zloty stating, “...We have a free-floating currency, so its rise and fall are natural...” calling further cuts “unnatural and not serious”. The NBP may have been comfortable with its deflation, but not the IMF, calling for greater easing; nor was the market, driving Hungarian short term yields below the same Polish maturities in spite of Poland’s better ratings.

The Zloty finally began to weaken vs the Euro from the 20 April low until the 8 July meeting which coincided with a critical juncture of the Greek-EU impasse and China equity market sell-offs. At that point the Zloty had declined by 6.1% vs the Euro. The Zloty rallied to trend from 9 July through 17 July, then resumed its steady weakening trend. The NBP, once again stood fast at the July meeting, Governor Belka stating: “...The expected stable economic growth, amid recovery in the euro area and a good situation in the domestic labor market, reduce the risk of inflation remaining below the target in the medium term...” If the NBP’s goal was to weaken the Zloty, the chart clearly backs up the NBP’s decisions to that point. Further Poland’s economy was among the best performing in the CEE region.

One other factor which may have contributed to the EUR/PLN trend was a growing chorus in both houses of the Polish government for a Hungarian styled, government supported, foreign currency loan conversioniv, a plan strongly opposed by the government and the NBP.

However, the global economic contraction which had begun in China some months before was beginning to indirectly affect the Polish economy, mainly through its heavily weight trade with Germany. Poland’s July GDP measure was below expectations at 3.3% a 30 basis point decline month over month.

It’s difficult to argue with success. The Narodowy Bank Polski has done a reasonably good job of managing the economy as well as working down the Zloty vs the Euro. Since last March, presently and for the foreseeable future, the ECB will press forward with its asset purchase program. There are ‘hawks’ on the bank’s NBP, but outside of their future inflation concerns, have otherwise gone along with policy. The only fly in the soup is that of the global economic contraction and its effect on Germany and the German auto export industry.

In total, there seems to be little risk of a rate increase. From the steady handed history in 2015, the NBP will more likely maintain rates unless the slowing in GDP accelerates. Past actions prove that when the NBP reacts, it does so strongly.

Risk warning: Spreadbetting, CFD trading and Forex are leveraged. This means they can result in losses exceeding your original deposit. Ensure you understand the risks, seek independent financial advice if necessary. The value of shares and the income from them may go down as well as up. Nothing on this website constitutes a solicitation or recommendation to enter into any security or investment.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.