However, the most interesting top export from New Zealand to Australia is high grade crude petroleum. New Zealand’s Ministry of Foreign Affairs and Trade notes that: “...Crude oil is our largest export commodity to Australia, comprising 18% of total exports by value. Most of NZ’s crude oil is exported to Australia for refining. NZ’s high quality oil is more suited to the Australian refineries than to NZ’s only major refinery at Marsden Point – which is configured to process lower-quality oil. Once it has been refined, crude oil is primarily consumed in Australia. In 2012, our export of crude oil to Australia declined by NZ$456 (£189) million (or 21%) and this was the key driver of the overall decline in merchandise exports. For the 2012 year, our total crude oil exports to the world were down (an annual decrease of NZ$383 (£158.9) million or 17%) ...”

Further, oil production generates about £164.93 million in revenue for the government. According to OECD’s most recent data New Zealand’s (2012) petroleum exports to Australia were approximately £871.25 million. According to NZ Petroleum & Mineral data, 2014 crude petroleum exports totaled 14.71 million barrels at roughly £372.25 million; a 70% decline in revenue from 2012. This most likely reflects the collapse in oil prices beginning in 2014. Lastly, New Zealand exports over 96% of its high quality crude to Australia. (All figures adjusted for recent price per barrel and currency valuations).

The point of the matter being both nations are major trade partners with China and both nations are major crude petroleum trade partners with each other. The last important piece of information is noted above: New Zealand’s high quality crude exported to Australia is consumed in Australia. Thus a decline in consumption translates to a decline in demand.

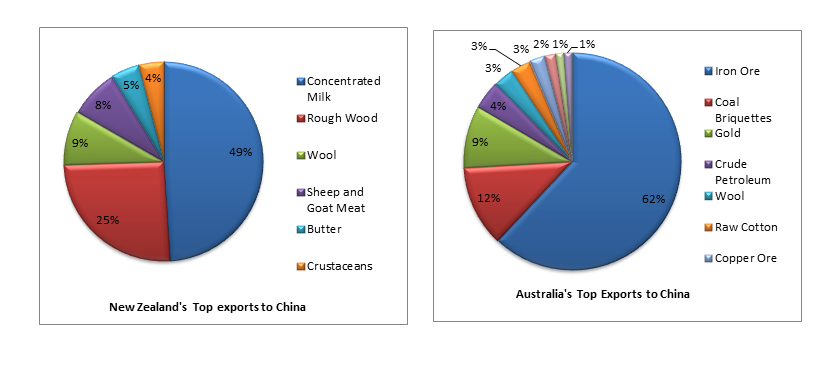

Hence, the continued and accelerating economic contraction in China will adversely affect economic growth in Australia, particularly in the mining and refining industry, leading to less need for energy, thus adversely affecting New Zealand’s economic growth.

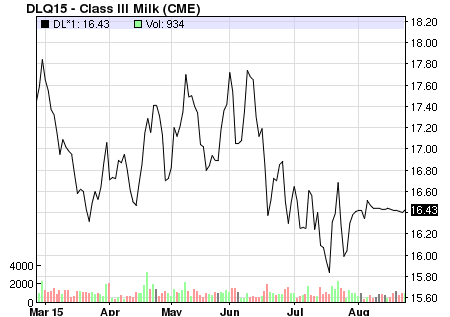

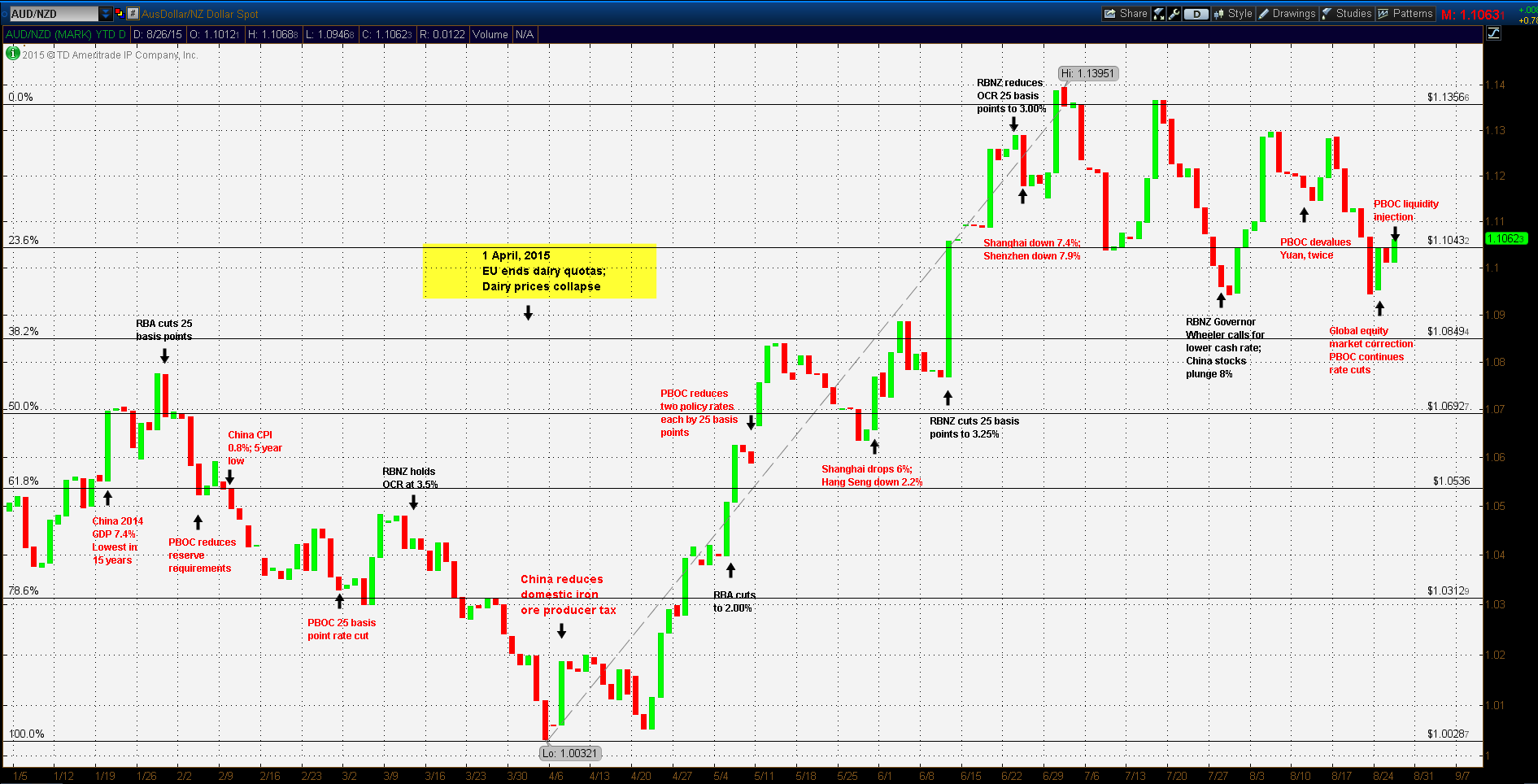

Ordinarily a shortfall in one export product, even if a major product, still may be offset by other exports. Unfortunately, New Zealand’s top global export commodities, milk and dairy products, had suffered a major setback earlier in the year by a change of EU regulations restricting dairy production. The lifting of quotas began 1 April, 2015 causing an immediate and sharp decline in dairy prices , globally. Within a month, dairy producers around the world were increasing volumes or cost cutting or cutting prices . By June, dairy prices declined to such an extent, the asset ratings firm Fitch warned on quality ratings of New Zealand’s banks .

Hence, the pressures on both the New Zealand and Australian commodity export economies were created within the China trade triangle and also from outside of the triangle by a sudden surge in dairy production due the expiration of production controls literally half way around the world.

In light of circumstances beyond their control did both the RBNZ and RBA miss the economic warning signs emanating from China? Very early in the year reports indicated China’s global trade target missed for the third consecutive year; measuring at 3.4% growth, short of the expected 7.5% growth . There were other significant long term data declines, for example, 2015 GDP expectations were for 7.4% well below the actual 10.4% growth in 2010. In 2014 housing prices had declined 4.5% and an estimated 60 million units remained unsold; (real estate accounts for about 25% of China’s GDP). Manufacturing was operating at 70% of capacity, and domestic consumption accounted for a mere 54% of GDP, compared with US domestic consumption which accounts for 75% of GDP .

In February, however, the PBOC took action cutting bank reserve ratio requirements. January CPI data indicated falling consumer prices; the weakest in five years . The PBOC then began a sequence of actions, reducing the savings rate, loan rates, reserve ratio, bank repurchase rate, all in the wake of continuing poor economic data . As of 25 August, the PBOC has supported markets with at least £311 billion and cut its benchmark rates for the 5th time since January.

The whole point of the matter is that all the warning signs were there, not just for New Zealand and Australia, but for every global economy. Yet, markets pressed on, with record margin leverage, continued building of oil supplies, and a strange faith that China, now an emerged mostly free market economy, would resume its 10% growth rate, more or less. As recently as 23 August, as global markets around the world were collapsing, a top US Federal Reserve official was predicting an increase in the benchmark overnight rate as soon as September. Advanced economies seemed to be in denial.

As it stands now The RBNZ overnight cash rate is at 3.00% while the RBA overnight cash rate is at 2.00%. The next meetings will be held 10 September and 1 September respectively. In light of the global equity market correction, continuing industrial and agricultural commodity price declines, a growing realization that China is not immune from capital market cycles and the fact that in the Asia-Pacific region, both the RBNZ and RBA currently have the best combination of high quality, high yield government bonds, it’s not unreasonable to expect further rate cuts at each of the respective upcoming meetings.

There are some risks to be addressed. In particular, would the RBNZ or RBA or both cut rates before the meeting? That is entirely possible, however, that may be viewed by other advanced economies in the region, most notably Japan, Korea, Singapore and China as a ‘protectionist’, possibly leading to an accelerated cycle of currency devaluations. On the other hand, a likely possibility would be that the RBNZ and the RBA will coordinate rate cuts, or having some official indication that the RBNZ will follow the RBA in order to keep markets stable and not appear to be acting defensively.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD edges higher toward 1.2600

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.