Technical analysis – WTI futures bounce at 75 mark, broader bullish bias holds

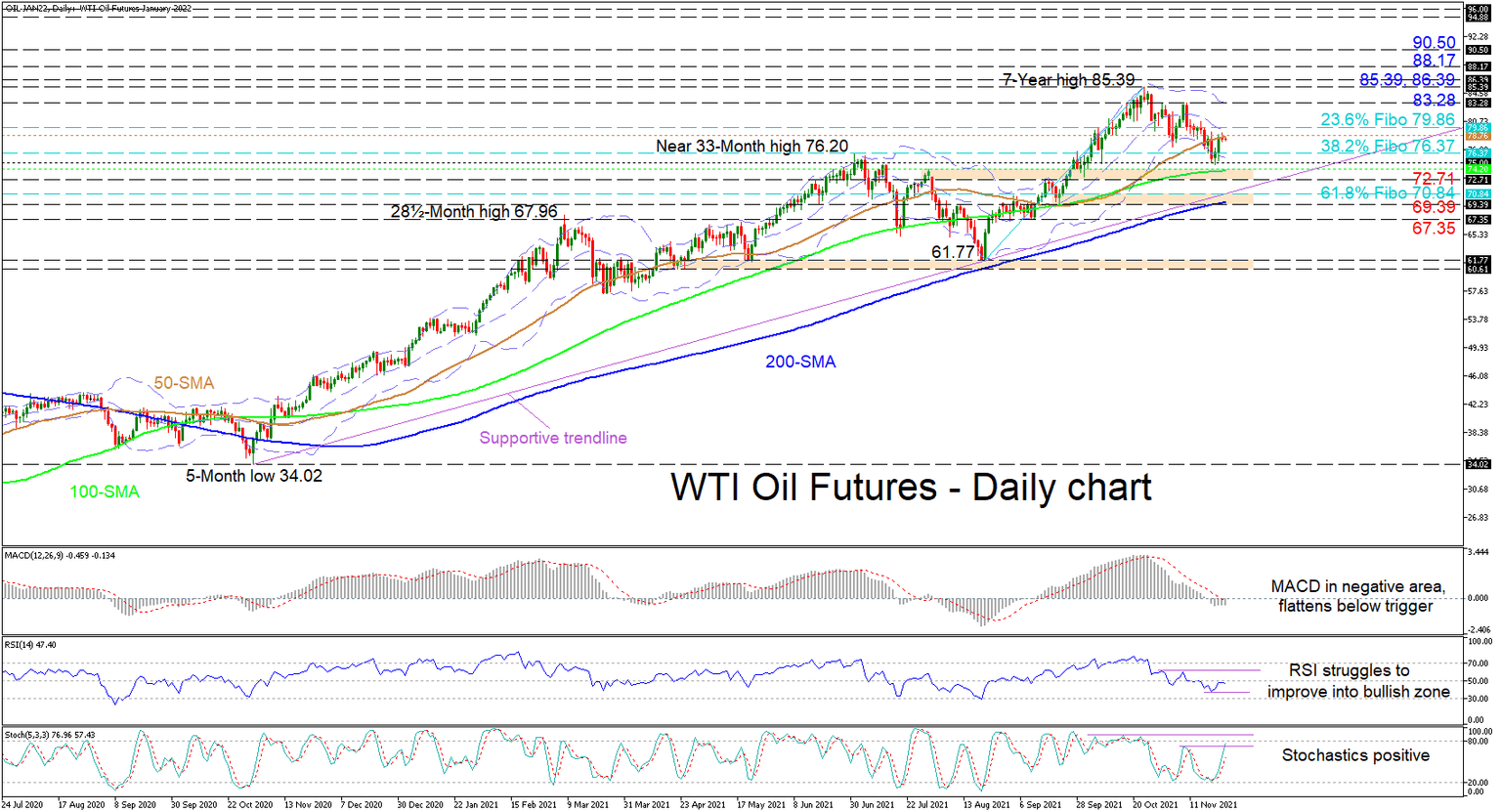

WTI oil futures are striving to overstep the curbing 50-day simple moving average (SMA) after the pullback from the 7-year high rebounded at the 75.00 handle. The 200-day SMA is defending the bigger bullish structure, while the 50 and 100-day SMAs are endorsing the short-term uptrend in the pair.

The short-term oscillators are suggesting that the negative momentum may be running out of steam. The MACD is slightly in the negative region but is flattening below its red trigger line, indicating that negative forces are somewhat subsiding. That said, the RSI is signaling that upside forces are lacking a convincing upwards drive, while the positively charged stochastic oscillator is promoting gains in the pair.

In the positive scenario - reinforced by the lower Bollinger band - buyers could face an immediate zone of resistance between the 50-day SMA at 78.76 and the 79.86 level, which is the 23.6% Fibonacci retracement of the up leg from 61.77 until 85.39. Overstepping this, the price may push higher to test the upper Bollinger band at 83.28. If buying interest intensifies, the bulls could then challenge the seven-year high of 85.39 and the nearby 86.39 barriers, achieved in October 2014. Resuming the climb, the price may then target the 88.17 inside swing low from the early part of October 2014 and the 90.50 border.

If price gains remain capped by the 50-day SMA at 78.76, sellers could encounter preliminary downside limitations from the nearby 38.2% Fibo of 76.37, the lower Bollinger band and the 75.00 hurdles. Dipping past the 75.00 mark, an upside defence formed between the 100-day SMA at 74.20 and the 72.71 obstacle could prove to be a tough boundary for sellers to conquer. If bearish pressures persist, a possible supportive trend line, pulled from the 34.02 trough could deter a deeper decline from challenging the 69.39-70.84 buffer zone, where the 200-day SMA also resides. Slightly lower, the 67.35 barrier could be a critical defense to cement a return of the bearish bias in the bigger picture.

Summarizing, WTI oil futures are sustaining a bullish bearing above the 75.00 psychological number and the 72.71-74.20 support band. Negative concerns could grow with a dive past the 69.39-70.84 boundary.

Author

Anthony Charalambous joined XM in 2019 and specializes in preparing daily technical analysis, using his years of trading experience to provide detailed forecasting for all major asset classes such as forex, indices, commodities and equities.