A few days ago the Australian dollar made repeated attempts to move up strongly to the resistance level at 0.7850 however it was rejected every time and sent back easing lower. It has now eased back below the 0.78 level where it remains in the well established trading range between 0.77 and 0.7850. After finally springing to life in the middle of last week, the Australian dollar dropped sharply to close out the week and fall back down below 0.7800 again to more familiar territory below the resistance level at 0.7850. During last week the Australian dollar moved through the resistance at 0.7850 to reach a new four week high around 0.7900. For the last month the Australian dollar has steadied well and traded in a narrow range between support at 0.77 and 0.78, although a couple of weeks ago it rallied higher to a two week high near 0.7850. To start last week it slowly eased back a little from resistance at 0.7850 however it is finally made its way through there. It has enjoyed receiving solid support from the 0.77 level throughout this time and will be looking to receive further support in the coming days. A few weeks ago it rallied a little higher again back towards 0.78 however it then eased back to receive more support from 0.77. Several weeks ago the Australian dollar was on a roller-coaster ride dropping sharply to a new multi-year low below 0.7630 before rallying strongly and moving back up above the 0.77 level and more recently 0.78.

In the second half of January, the Australian dollar fell very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200. Back in mid-January it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650.

Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory. It seems a long way away now but the Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

A top Australian central banker on Thursday said low interest rates were proving less effective in spurring economic activity than in the past, in part because extraordinary easy policies globally were keeping the local dollar high. Philip Lowe, Deputy Governor of Australia’s Reserve Bank, emphasised that monetary policy was still playing an important role in supporting activity, which was why the bank cut rates to a record low of 2.25 percent in February. However, changing attitudes to debt and savings, a global trend to slower wages growth and the wave of easing by other major central banks was “complicating” the RBA’s task. “The scale of global monetary stimulus means that our exchange rate remains relatively high given the state of our overall economy,” Lowe told an economic conference organised by Goldman Sachs. “The end result here is that global developments have left us with a higher exchange rate and lower interest rates than would otherwise have been the case,” he added. “We may not like this configuration, but developments abroad give us little choice.” The RBA skipped on a chance at further easing at its March policy this week, but financial markets are still wagering it will cut again, likely in May.

(Daily chart / 4 hourly chart below)

AUD/USD March 5 at 23:20 GMT 0.7779 H: 0.7840 L: 0.7754

AUD/USD Technical

During the early hours of the Asian trading session on Friday, the AUD/USD is easing a little lower below 0.7800 after falling strongly down to near 0.7750 in the last 12 hours. Current range: trading right below 0.7800 around 0.7780.

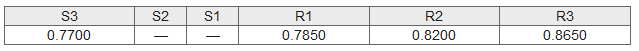

Further levels in both directions:

- Below: 0.7700.

- Above: 0.7850, 0.8200, and 0.8650.

Recommended Content

Editors’ Picks

AUD/USD tests lows near 0.6550 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is testing lows near 0.6550 after Australian Retail Sales dropped by 0.4% in March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data fails to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY rebounds to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.