After easing back over the last few days, the Australian dollar has fallen sharply in recent hours down through the key 0.82 level and down to a one week low below 0.81. Over the last week or so the Australian dollar made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing last week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. For most of the last month over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. It was only a week ago that the Australian dollar drifted lower to another new multi-year low near 0.8030. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently.

For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650. Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory.

The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

The RBA should slash interest rates to a fresh record low next month, Westpac’s top economist says, as new figures show consumers remain pessimistic. Bill Evans says delaying a rate cut until March, as markets are predicting, would be “awkward” for the RBA. He argues a February cut, following what are expected to be weak December quarter inflation figures, is the better option. The RBA is due to release its next major economic report card – the quarterly Statement on Monetary Policy – just three days after its February 3 board meeting, giving the central bank a good opportunity to explain its decision and update its inflation forecasts, Mr Evans said. “The prospect of moving in February should be attractive to the bank,” Mr Evans said on Wednesday. “Delaying the move to March, which seems to be favoured by markets, makes the Statement much more awkward, particularly if, as we expect, the bank’s inflation forecasts will be lowered significantly.” Westpac expects the RBA to cut rates twice this year, in February and March, to a new record low of two per cent.

(Daily chart / 4 hourly chart below)

AUD/USD January 21 at 21:55 GMT 0.8092 H: 0.8234 L: 0.8078

AUD/USD Technical

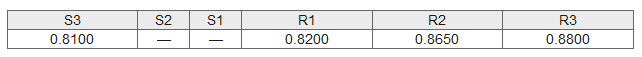

During the early hours of the Asian trading session on Thursday, the AUD/USD is trading in a narrow range around 0.8090 after dropping sharply from back above the key 0.82 level. Current range: trading right below 0.8100 around 0.8090.

Further levels in both directions:

- Below: 0.8100.

- Above: 0.8200, 0.8650, and 0.8800.

Recommended Content

Editors’ Picks

EUR/USD manages to hold above 200-hour SMA ahead of Eurozone CPI, FOMC

EUR/USD meets with some supply during the Asian session on Tuesday and erodes a part of the previous day's gains amid the emergence of fresh US Dollar buying. Spot prices, however, remain in a familiar range held over the past week or so and currently trade around the 1.0700 round-figure mark.

GBP/USD consolidates its gains above 1.2550, investors await Fed rate decision

GBP/USD consolidates its gains near 1.2560 after flirting with the key 200-day SMA and three-week highs in the 1.2550-1.2560 zone during the early Tuesday. Investors reduce their bets on BoE rate cuts, which support the Cable.

Gold struggle with $2,330 extends, as focus shifts to Fed decision

Gold price is looking to build on to the previous downside early Tuesday, as traders continue to take profits off the table in the lead-up to the US Federal Reserve (Fed) interest rate decision due on Wednesday.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

Data fuels China optimism

China's factory activity has expanded for a second consecutive month, marking the best streak in over a year and fueling optimism for the sustainability of the world's second-largest economy's recovery.