In the last 24 hours the Australian dollar has dropped sharply back through the support level at 0.8650 and is now threatening to remain below this level. Prior to the strong fall, over the last week or so the Australian dollar has been able to rally higher and bounce off multi year lows around 0.8550 and in doing so has moved back within the previously well established trading range between 0.8650 and 0.88. A few days ago the Australian dollar ran into the resistance level at 0.88 again which stood tall and sent prices lower again. A couple of weeks ago it fell sharply from above the resistance level at 0.88 back down to the support level of 0.8650 before crashing further to a new multi-year high near 0.8550. During the last couple of months the Australian dollar has done well to stop the bleeding and trade within this range after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650 and a then eight month low in the process. The resistance level at 0.88 remains a factor and is continuing to place downwards pressure on price, however more recently all eyes have turned on to the support level at 0.8650 to see if the Australian dollar can hold on and stay within reach again.

Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory. The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year.

The good news is the Australian economy looks like it’ll be taking a turn for the better next year. The not-so-good news, for borrowers at least, is that the upturn should pave the way for rising interest rates. The latest Westpac/Melbourne Institute Leading Index, which indicates the likely pace of economic activity three to nine months into the future, suggests economic growth will remain below trend into the first half of 2015. But while the index remains in negative territory, it did pick up in October, suggesting the economy could be headed for greener pastures during the June quarter, Westpac chief economist Bill Evans said. Mr Evans said the improved growth outlook suggested by the index was consistent with Westpac’s view of where the economy was headed, driven by expectations of a pickup in consumer spending and non-mining investment in 2015. That would lend support to the labour market, pushing the unemployment rate down through the second-half of 2015 to 5.9 per cent by the end of the year, he said. The pickup would then allow the Reserve Bank to begin hiking interest rates as early as August 2015, he said. “Overall, we expect Australia’s growth rate in 2015 to reach an above trend 3.2 per cent despite a larger drag from mining investment,” Mr Evans said.

(Daily chart / 4 hourly chart below)

AUD/USD November 19 at 21:45 GMT 0.8619 H: 0.8721 L: 0.8601

AUD/USD Technical

During the early hours of the Asian trading session on Thursday, the AUD/USD is trying to rally higher after dropping sharply back through the support level at 0.8650. Current range: trading right around 0.8620.

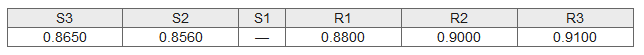

Further levels in both directions:

- Below: 0.8650 and 0.8560.

- Above: 0.8800, 0.9000, and 0.9100.

Recommended Content

Editors’ Picks

AUD/USD stays defensive below 0.6500 ahead of Fed

AUD/USD is on the back foot below 0.6500, consolidating the previous decline early Wednesday. China's holiday-led thin conditions and pre-Fed policy decision caution trading leave Aussie traders on the edge.

USD/JPY holds higher ground near 158.00, Fed in focus

USD/JPY holds the rebound near 158.00 in Asian trading on Wednesday. The US Dollar remains on the bid amid a risk-off market environment, underpinning the major. The interest rate differential between Japan and the US is likely to maintain a bullish pressure on the pair ahead of the Fed decision.

Gold pullbacks on rising US yields, buoyant US Dollar as inflation heats up

Gold prices drop below the $2,300 threshold on Tuesday as data from the United States show that employment costs are rising, thus putting upward pressure on inflation. XAU/USD trades at $2,296 amid rising US Treasury bond yields and a stronger US Dollar.

Bitcoin price dips into $60K range as spot traders flock to Coinbase Lightning Network

Bitcoin price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area. It comes as markets continue to digest the performance of Hong exchange-traded funds after their first day of issuance.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.