The last few days has seen the GBP/USD slowly edge back towards the key 1.68 level after moving to a multi-year high near 1.6850 within the last week. The last month has seen a steady climb higher from a one month low below 1.65. About a month ago the resistance level at 1.6750 became important as the pound was struggling to make any break above it. This level eventually led the pound to fall to its one month low before the recent resurgence. The 1.6650 level also became important as it provided reasonable support during that period. Throughout the last couple of months the GBP/USD has received solid support from the key 1.66 level after it retraced strongly from the resistance level at 1.68.

In early February, the pound enjoyed a very healthy time moving well from the support level at 1.6250 through 1.6450 before pushing on to the then multi-year high above 1.680. In late January the pound fell sharply and experienced its worst one week fall this year which resulted in it moving to the six week low near the support level at 1.6250. Over the last few months the pound has established and traded within a trading range roughly around the key level of 1.6450, whilst moving down to support at 1.6250 and up to 1.66 and beyond.

The 1.66 level has become quite significant and has loomed large throughout this year providing some resistance to higher prices. This level has resurfaced again as one of significance and it is now providing solid support. In late November it did well to break through the long term resistance level at 1.6250 which had established itself as a level of significance over the last few months. This level continues to play a role in providing support. In early November, the pound bounced strongly off the support level at 1.59 to return back to above 1.6250.

The Bank of England minutes will be released this week. They will give more insight into Governor Carney's decision to hold rates as the how the members voted on different topics. There was no surprise at the BOE announcement given that the central bank had originally mentioned that rates would remain low even as their previous unemployment target was close to being met. The target was actually hit the week after the rate decision was published.

(Daily chart / 4 hourly chart below)

GBP/USD April 22 at 02:50 GMT 1.6792 H: 1.6819 L: 1.6786

GBP/USD Technical

During the early hours of the Asian trading session on Tuesday, the GBP/USD is trying to rally back to the 1.68 level after recently moving down below it. Current range: Trading just below 1.6800 around 1.6795.

Further levels in both directions:

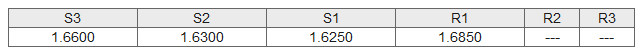

- Below: 1.6600, 1.6300, and 1.6250

- Above: 1.6850.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.