Swiss Franc holds steady ahead of SNB rate decision

The New Zealand dollar eased slightly against the USD in overnight trading after the statistics office released the GDP data. The numbers showed that the economy contracted by 1.6% in the first quarter, which was lower than the analysts forecast of 1.0%. It contracted by 0.2% on a year-over-year basis. The GDP annual average was 1.5% while expenditure declined by 1.3%. This contraction was the worst ever recorded in more than a decade. Still, analysts believe that the economy will bounce back since the country has already reopened. Meanwhile, in Australia, the unemployment rate rose from the previous 6.2% to 7.1%.

The Swiss franc was calm during the Asian session as analysts waited for the SNB rates decision. Analysts polled by Reuters expect that the bank will leave rates unchanged at -0.75%. The meeting comes at a time when the Swiss franc is relatively strong and when the Swiss economy is going through its worst recession in years. This means that the SNB could surprise the market by extending the negative rates and by even launching additional programs like quantitative easing and yield curve control.

The British pound was also little changed during the American and Asian sessions as traders waited for the BOE interest rate decision. Analysts expect the bank to leave interest rates unchanged at about 0.10%. They also expect it to follow in the ECB’s and Fed’s footsteps and add more money into the current quantitative easing program. The amount of new addition ranges from £100 billion to $200 billion. Also, like the Bank of Japan, the bank may announce a new yield curve control program.

Other things we will be watching today are US initial jobless claims data, Philadelphia Fed manufacturing index, housing starts from Canada, and the interest rate decision by Norges Bank.

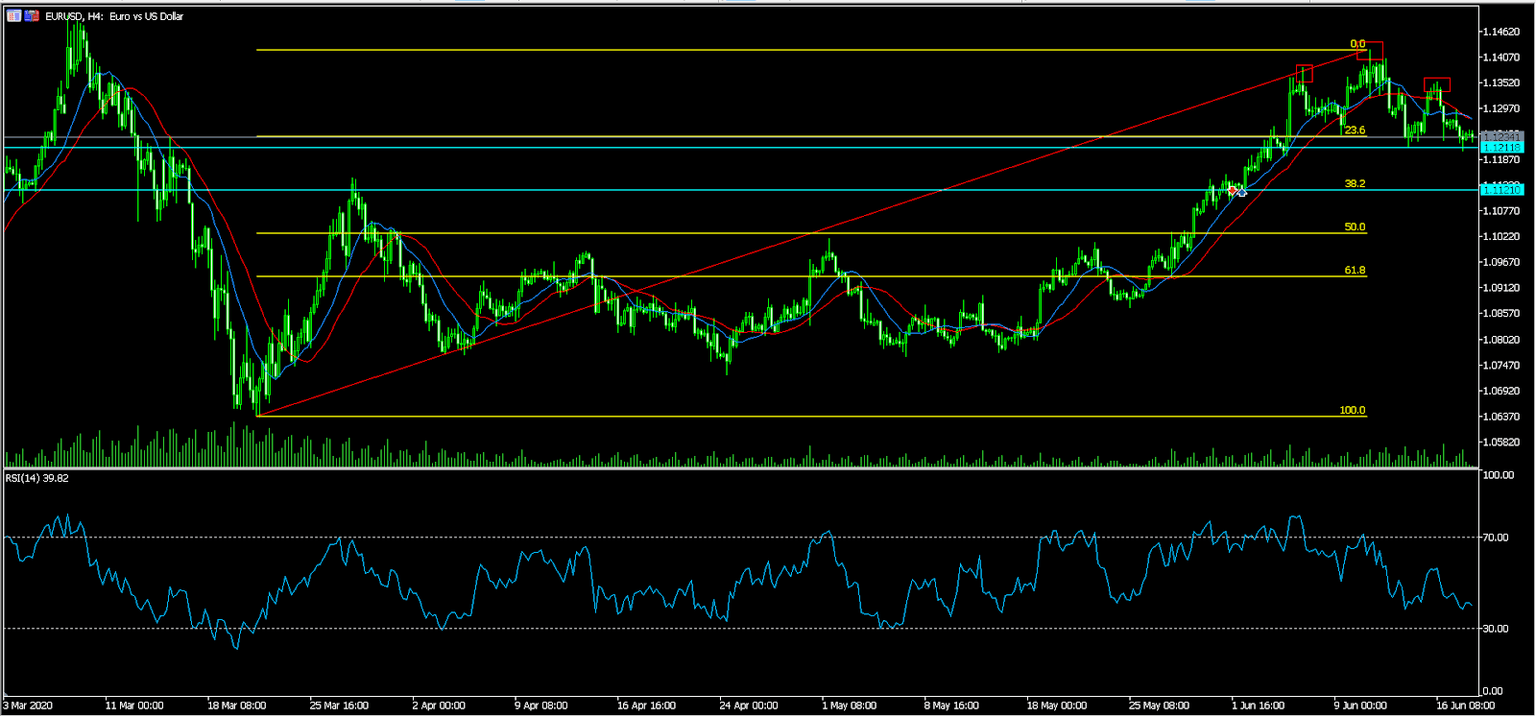

EUR/USD

The EUR/USD is trading at 1.1232, which is significantly lower than Friday’s high of 1.1420. On the four-hour chart, the pair has formed a head and shoulders pattern, with the neckline at 1.1211. Also, the 28-day and 14-day exponential moving averages have made a bearish crossover while the RSI has been in a downward trend. The pair may continue falling as bears target the 38.2% retracement at 1.1121.

USD/CHF

The USD/CHF pair is trading at 0.9494, which is slightly above last week’s low of 0.9375. On the daily chart, the price is below the 50-day and 100-day exponential moving averages and is slightly above the 23.6% Fibonacci retracement level. Also, the RSI is moving in a downward trend. Therefore, the downward movement will likely continue so long as the price remains below the descending white trendline.

GBP/USD

The GBP/USD pair is trading at 1.2530, which is slightly below last week’s high of 1.2812. On the daily chart, the price is along the 100-day EMA and slightly above the 50-day EMA. It is also above the 50% Fibonacci retracement level while the Average True Range (ATR), which is used to measure volatility, is at the lowest level in months. The pair will likely continue falling ahead and after the BOE interest rate decision.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.