Supply Shock and a Demand Shock Coming Up

Dual economic shocks are underway simultaneously. There are shortages of some things and lack of demand for others.

Rare Supply-Demand Shocks

Bloomberg has an excellent article on how the Global Economy Is Gripped by Rare Twin Supply-Demand Shock.

The coronavirus is delivering a one-two punch to the world economy, laying it low for months to come and forcing investors to reprice equities and bonds to account for lower company earnings.

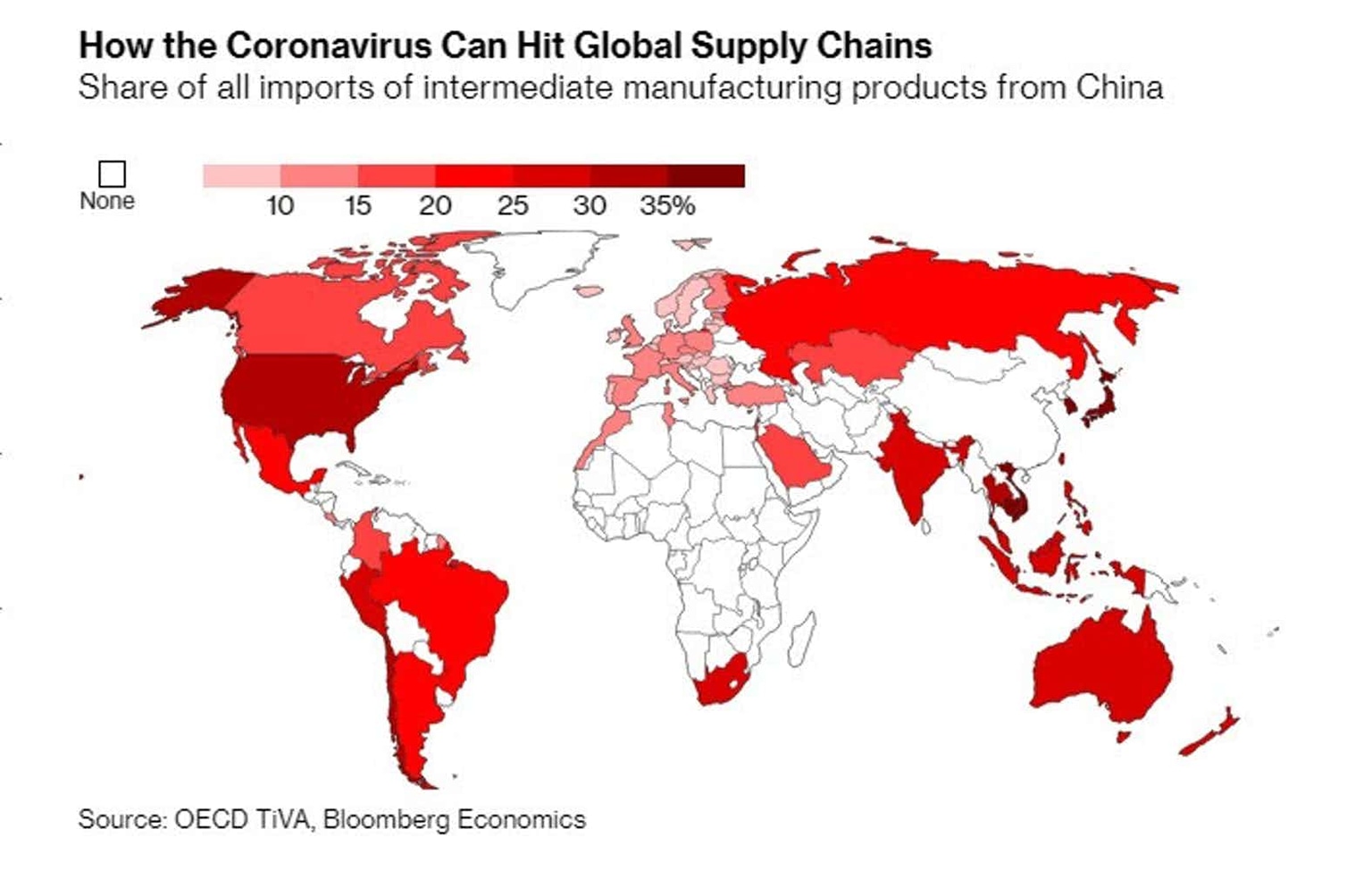

From one side, the epidemic is hammering the capacity to produce goods as swathes of Chinese factories remain shuttered and workers housebound. That’s stopping production of goods there and depriving companies elsewhere of the materials they need for their own businesses.

With the virus no longer contained to China, increasingly worried consumers everywhere are reluctant to shop, travel or eat out. As a result, companies are likely not only to send workers home, but to cease hiring or investing -- worsening the hit to spending.

How the two shocks will reverberate has sparked some debate among economists, with Harvard University Professor Kenneth Rogoff writing this week that a 1970s style supply-shortage-induced inflation jolt can’t be ruled out. Others contend another round of weakening inflation is pending.

Some economists argue that what’s happened is mostly a supply side shock, others have highlighted the wallop to demand as well, to the degree that the distinction matters.

Slowest Since the Financial Crisis

Inflationary or Deflationary?

In terms of prices it's a bit of both but mostly the latter.

There's a run on sanitizers, face masks, toilet paper ect. Prices on face masks, if you can find them, have gone up.

But that is dwarfed by the demand shock coming from lack of wages for not working, not traveling, not eating out etc.

The lost wages for 60 million people in China locked in will be a staggering hit alone.

That has also hit Italy. It will soon hit the US.

Next add in the fear from falling markets. People, especially boomers proud of their accounts (and buying cars like mad) will stop doing so It will be sudden.

Bad Timing

Stockpiling

Deflation Risk Rising

Another Reason to Avoid Stores - Deflationary

Hugely Deflationary - Weak Demand

This was the subject of a Twitter thread last week. I agreed with Robin Brooks' take and di so in advance but I cannot find the thread.

I did find this.

Deflation is not really about prices. It's about the value of debt on the books of banks that cannot be paid back by zombie corporations and individuals.

That is what the Fed fears. It takes lower and lower yields to prevent a debt crash. But it is entirely counterproductive and it does not help the consumer, only the asset holders. Fed (global central bank) policy is to blame.

These are the important point all the inflationistas miss.

Mike "Mish" Shedlock

Author

Mike “Mish” Shedlock's

Sitka Pacific Capital Management,Llc