Underlying dollar weakness hasn’t gone

Yesterday, the dollar traded volatile making several turns during the day. Eventually, the greenback never went far away from opening levels. Trading flows were thin, as usual on Monday, while eco data were scarce and of second‐tier importance. Comments of ECB’s Praet, dovish as usual, couldn’t attract the attention of markets. We won’t draw many conclusions from these volatile intraday moves, but it suggests that dollar sentiment remains shaky and key dollar support levels aren’t safeguarded. EUR/USD closed at 1.1392, up from 1.1388 Friday’s close. USD/JPY ended at 111.34, down from the 111.80 previous close.

Overnight, Asian equities are under downward pressure with the exception of China which was closed yesterday, as oil prices broke below key support levels (to $37.53 currently). It is pushing the safe‐haven yen to stronger levels across the board. USD/JPY dropped to 110.80, a whisker away of the sell‐off low at 110.67 and the upper side of a key support area that extend to 110/109.90.

Japan’s services sentiment fell to 50. Speculation rises the BOJ will downgrade its inflation outlook. Meanwhile BOJ Kuroda said he keeps monitoring FX markets and might ease policy further. Officials from BOJ, MOF and FSA are said to meet on markets, but it isn’t clear what the authorities can do to stop the yen from strengthening. Of course, FX interventions are a possibility, but a risk‐off environment isn’t the right one for interventions. Heightened alert over the yen!!. The Reserve Bank of Australia kept rates unchanged, but added that an appreciating Aussie could complicate the adjustment under way. The Aussie strengthened lightly. The trade‐weighted dollar is little changed at its5 month low. US Treasuries are higher overnight and commodities in general stabilize following yesterday’s steep losses. EUR/USD made a shy attempt to take out the 1.14 handle, but is now little changed around 1.1385.

Today, the eco calendar is well filled with the US non‐manufacturing ISM the key release. It is expected to pick up from 53.4 to 54.2 following four consecutive monthly declines. The up‐move of EUR/USD, which started early February and got a final push by Yellen’s comments last week, took out a first key resistance. In past days however it stalled ahead of another key resistance (1.1495). However, the dollar showed no signs of rebound on Friday despite constructive eco data, suggesting that Yellen’s comments were not completely absorbed. In this context a test of the next resistance remains possible. If a riskoff context would be confirmed, it should be dollar negative. A strong nonmanufacturing ISM should trigger a return action of the dollar. If that doesn’t happen, a test of the resistance is inevitable.

After the March dovish ECB and FOMC meetings, the dollar was sold and subsequently also the 1.1376 resistance was broken after soft comments from Yellen. The EUR/USD rally extended to an intra‐day high of 1.1438 on Friday. The 1.1495 resistance is the key line in the sand medium term. The soft Fed approach and now risk‐off sentiment pushed USD/JPY below the 110.99/114.87 range (confirmation needed). Unless risk sentiment turns outright negative we believe the range bottom may stay intact. However, a test is no longer excluded and a drop below 110 may trigger a wave of USD selling (see higher).

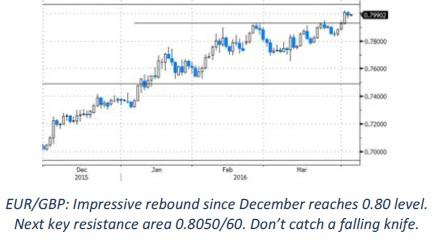

EUR/GBP: Sterling regains some ground

Yesterday, sterling was initially again in the defensive, despite the huge losses on Friday. However, EUR/GBP approached the 0.8020 level several times, but there was no conviction to break it. Two polls put the Brexit “leave” proponents with a 4% lead on the “remain” side. The fact sterling could hold onto Friday’s lows, suggested the sterling selling is a bit exhausted for now. So, sterling started to climb higher versus the euro with EUR/GBP dropping steadily from 0.8017 to about 0.7960, where a counter reaction occurred. Later on, sterling lost about half of its intraday gains to close at 0.7985 from 0.8008 on Friday eve.

A similar pattern of Cable that moved from 1.4220 to an intra‐day high of 1.4322, before sliding to a 1.4263 close, up 37 pips. Trading conditions were very thin and fundamental triggers unavailable.

Today, the UK services PMI will be published. An increase of the headline index to 53.5 from 52.7 is expected. In EMU, German orders for February were unexpectedly weak, while later on the EMU services PMI may be revised higher. We think that the UK services PMI is key. Recently, stronger UK data seldom could give sterling positive momentum as its was overshadowed by other issues as Brexit, a huge growing current account deficit and the absence of rate hike hopes. In this context, we believe that the UK services PMI should be iron‐strong to keep sterling away from key sterling support levels. The recent sterling decline has been fast, which heightens on the other hand the chances for a pause in the sterling selloff. The technical picture of EUR/GBP improved further as the pair broke above the 0.7929/31 resistance. EUR/GBP marched higher since December (0.70) without significant corrections. It closes in on the 0.8050/60 resistance area (H2 2014 highs) and erased the steep early 2015 losses. We never try to catch a falling knife and remain cautious on sterling.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to marginal gains above 1.0750

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD edges higher toward 1.2600 on improving risk mood

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold rebounds above $2,310 as US yields push lower

Gold price trades in positive territory above $2,310 in the American session on Monday. The benchmark 10-year US Treasury bond yield stays in the red below 4.5% after weaker-than-expected US employment data, helping XAU/USD hold its ground.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.