Stronger USD exerts pressure on Gold, potential bearish breakout looms

Amidst the current market dynamics, Gold is facing downward pressure, largely driven by the stronger USD. While other commodities remain unaffected, Gold has been grappling with this challenge.

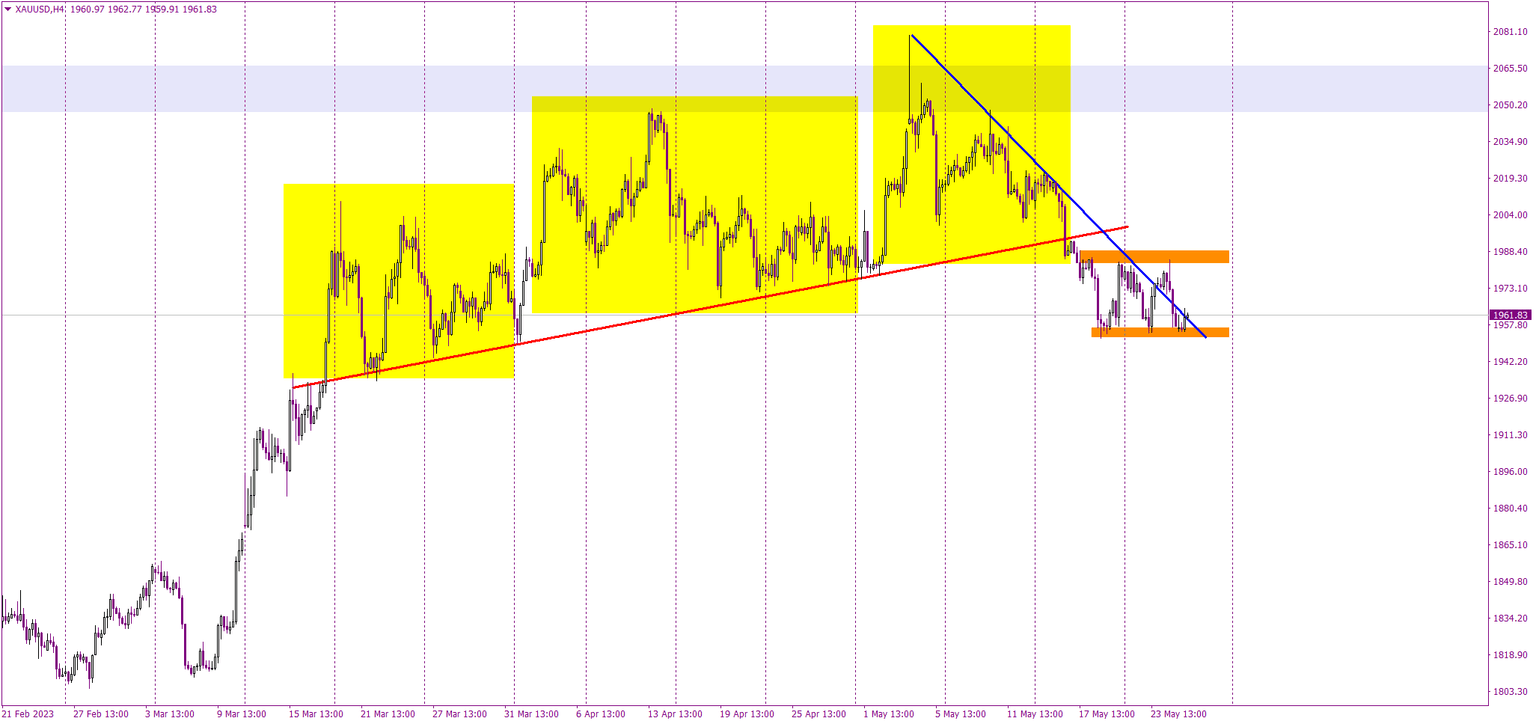

The chart reveals initial signs of weakness in early May, as the price failed to surpass the long-term resistance level around 2060 USD/oz (grey). This unsuccessful attempt marked the third peak of a triple top formation (yellow). On May 16th, the price breached the neckline of this pattern, triggering a sell signal.

Subsequently, Gold experienced a moderate decline, entering a sideways phase confined within a rectangle pattern (orange lines). The recent downward move has brought the price closer to the lower boundary of the rectangle, reigniting concerns of a potential breakout and continuation of the downtrend.

Regarding rectangle patterns, price action is relatively straightforward. A breakdown below the lower boundary would signal a selling opportunity, while an upward breach of the upper boundary would indicate a potential long position. Currently, the likelihood of the former scenario appears slightly more probable.

Author

Tomasz Wisniewski

Axiory Global Ltd.

Tomasz was born in Warsaw, Poland on 25th October, 1985.