Strategy Idea: Bullish 10-year note spreads

Seasonal Tail Wind and Head and Shoulders in the ZN

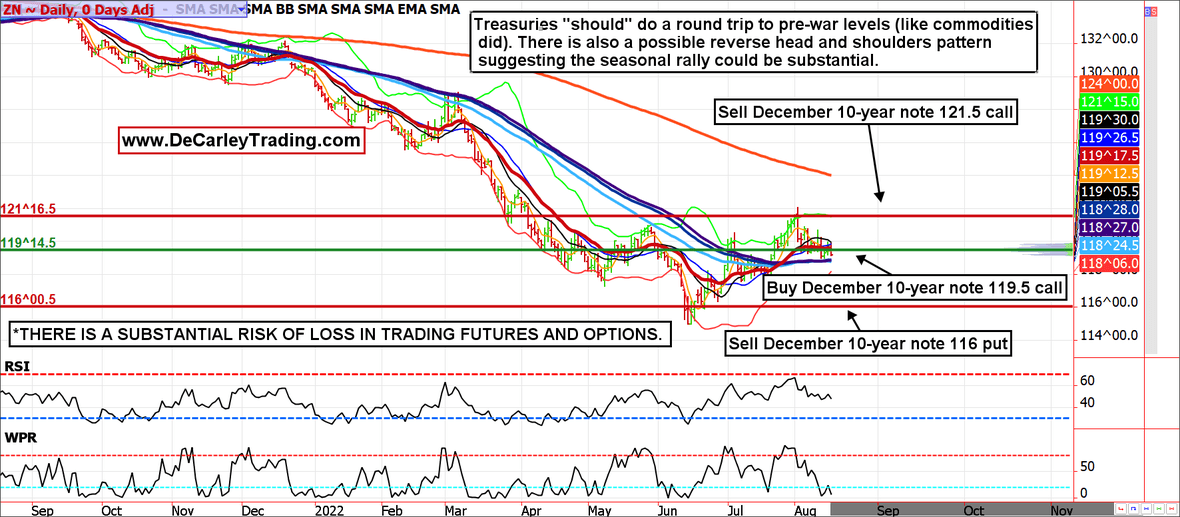

The Treasury market has had one of the worst years on record. The recent recovery was a good start, but most of the selling in early 2022 occurred on the heels of the "inflation trade" in which traders/hedgers sold Treasuries and bought commodities in an attempt to reduce exposure to upward price pressure. The commodity markets have completed a round trip back to pre-war lows and we suspect Treasuries (and eventually the US dollar) will follow. Further, the 10-year note chart seems to be forming a reverse head and shoulders pattern (this pullback could be the final shoulder); if so, the fall rally could be substantial (seasonally, Treasuries do well this time of year). It should also be noted that softer data on the economy and under-allocation to Treasuries should offer support going forward.

We've been burnt by the Treasury bear once this year, so we like the idea of speculating "small" and leaving room for error. Using the December 10-year note futures options seems to fit the bill. It is possible to buy the December ZN 119.5 call, sell the 121.5 call and the 116 put for a total cost of about 10 to 11 ticks or $156.25 to $171.90 plus transaction costs. The risk is unlimited below 116, so there might be a need to hedge or adjust if things fall apart.

Alternative Strategies

If you prefer limited risk, you could consider buying the 119.5/121.5 call spread for about 53 ticks or $828 plus transaction costs. Or, you could buy the 121.50 call outright for about 57 ticks or $890.62. In either of these versions, the risk is limited to the cost of entry.

DECEMBER BULL CALL SPREAD WITH A NAKED PUT

BUY DECEMBER 10-YEAR NOTE 119.5 CALL

SELL DECEMBER 10-YEAR NOTE 121.5 CALL

SELL DECEMBER 10-YEAR NOTE 116 PUT

Total Cost = About 11 ticks or $171.87 plus transaction costs

These options expire on November 25, 101 days to expiration

Margin = $1640

Risk = Unlimited below 116.0

Maximum Profit = $1828 if held to expiration, which isn't likely. A profit of $800 to $1200 is a worthy target.

Zaner360 symbols: OZNZ22 C119.5, OZNZ22 C121.5, and OZNZ22 P116

*There is a substantial risk of loss in trading futures and options. There are no guarantees in speculation; most people lose money trading commodities. Past performance is not indicative of future results.

Due to time constraints and our fiduciary duty to put clients first, the charts provided in this newsletter may not reflect the current session data.

Seasonality is already factored into current prices, any references to such does not indicate future market action.

**There is substantial risk of loss in trading futures and options.

** These recommendations are a solicitation for entering into derivatives transactions. All known news and events have already been factored into the price of the underlying derivatives discussed. From time to time persons affiliated with Zaner, or its associated companies, may have positions in recommended and other derivatives. Past performance is not indicative of future results. The information and data in this report were obtained from sources considered reliable. Their accuracy or completeness is not guaranteed. Any decision to purchase or sell as a result of the opinions expressed in this report will be the full responsibility of the person authorizing such transaction. Seasonal tendencies are a composite of some of the more consistent commodity futures seasonals that have occurred over the past 15 or more years. There are usually underlying, fundamental circumstances that occur annually that tend to cause the futures markets to react in similar directional manner during a certain calendar year. While seasonal trends may potentially impact supply and demand in certain commodities, seasonal aspects of supply and demand have been factored into futures & options market pricing. Even if a seasonal tendency occurs in the future, it may not result in a profitable transaction as fees and the timing of the entry and liquidation may impact on the results. No representation is being made that any account has in the past, or will in the future, achieve profits using these recommendations. No representation is being made that price patterns will recur in the future.

Author

Carley Garner

DeCarley Trading

Carley Garner is an experienced commodity broker with DeCarley Trading, a division of Zaner, in Las Vegas, Nevada. She is also the author of multiple books including, “Higher Probability Commodity Trading” and “A Trader's First Book on Commodities”.