A few ideas to play an oil bounce

Oil has wiped out sanctions and war premium – Bounce?

We can't help but think oil will hold support at $90 the first time down. If so, it could trigger a large rally. In the past we have shared a monthly chart that suggests that had the war not happened, oil wouldn't have breached trendline resistance near $90.00. That level was previously resistance and will now become support. We think it is worth a shot for a long play. However, never underestimate the commodity market's propensity to take the stairs up and the elevator down. So leaving plenty of room for error is key.

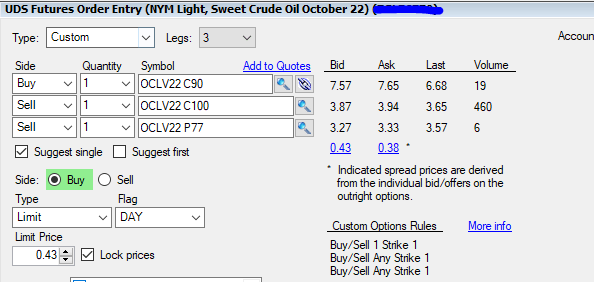

Aggressive traders could consider an October bull call spread with a naked put to pay for it; specifically, buying the October $90 call, selling the $100 call, and then selling the $77 put. This can be done for a net cost of about 40 cents or $400 but comes with unlimited risk below $77.

Alternative strategies

A limited-risk way to play the upside without as much stress of loss and margin requirement, but with a far less nimble strategy, would be a call butterfly. A trader can purchase an October $93 call, sell 2 $103 calls and then buy a $113 call for about $1.50 or $1500. This represents the maximum risk, with a maximum profit potential at expiration of about $8500 prior to transaction costs (4 commissions). That said, butterflies generally don't see much of a payout until close to expiration and if we are too right about the rally the market can move above the profit zone ($94.50 to $111.50.

A smaller and cleaner way to play is to go long a micro futures contract risking it to about $86.00.

Crude oil bull call spread with a naked put

BUY OCTOBER OIL $90 CALL.

SELL OCTOBER OIL $100 CALL.

SELL OCTOBER OIL $77 PUT.

Total Cost = About 40 cents or $400 plus transaction costs.

These options expire on September 15, 63 days to expiration.

Margin = $5500.

Risk = Unlimited below $77.

Maximum Profit = About $9600 before considering transaction costs if held to expiration, which isn't likely...$4,000 to $6,000 would be a reasonable goal.

Zaner360 symbols:

OCLV22 C90, OCLV22 C100, OCLV22 P77.

Author

Carley Garner

DeCarley Trading

Carley Garner is an experienced commodity broker with DeCarley Trading, a division of Zaner, in Las Vegas, Nevada. She is also the author of multiple books including, “Higher Probability Commodity Trading” and “A Trader's First Book on Commodities”.