Outlook:

Macro developments are starting to get a little scary. Not a new recession, but stagnation. Re-consider what the Markit economist said of the eurozone PMI’s this morning: growth is anemic. "The survey data therefore so far show no signs of European Central Bank stimulus or the weaker euro helping to revive the manufacturing sector, at least for the eu-ro area as a whole." We get the US ISM version later today, forecast to dip to 51.4 from 51.8. The jobs report on Friday, and the ADP private sector estimate on Wednesday, are powerful indicators, but ISM is (arguably) a more important indicator.

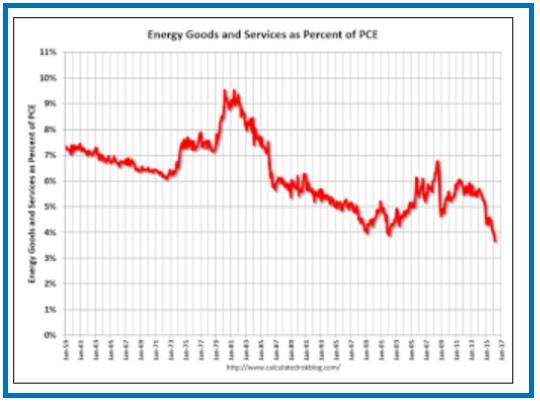

And this follows the personal income and expenditure on Friday. For some reason this data has already vanished from the radar screen, but it should not be dismissed. The latest PCE price index is a lousy 0.82% y/y, down from 0.96% (revised) the month before. The core PCE index came in at 1.56%, down from 1.72% (revised) the month before. And it’s interesting that that energy expenditure as a proportion of PCE is falling and has reached a record low of under 3.7%. Because of the recent price rises, this is will rise, too. See the chart. There is nothing in here to inspire the Fed to hike rates.

We have Feds speaking all over the place this week, stating with NY Fed Dudley but also Mester, Lock-hart, Lockhart and Williams, with Draghi and Abe also on the speaking circuit. And let’s not neglect publicity-hound Roubini, who asserts the SNB might seek authority to prevent banks from converting money from negative-yielding accounts to cash. This might come ahead of the Brexit referendum on June 23 so that the SNB can avoid spending money on intervention.

As for NY Fed chief Dudley, on Friday he said let’s go slow on hiking because “divergent signals” cloud the outlook for the US economy. Inflation expectations are still a “cause for concern” and “As past experience shows, it is difficult to push inflation back up to the central bank’s objective if inflation ex-pectations fall meaningfully below that objective,” he warned, citing Japan’s years-long struggle to stoke inflation.” According to the FT, “Mr Dudley added that he still expects inflation to rise to a 2 per cent annual pace in the medium run, but cautioned that ‘it is still possible that the return of inflation to our objective could take longer than I anticipate.’”

Then today, to make matters worse, Dudley said there are gaps in the Fed’s ability to provide emergency funding. He wants to offer the discount window to all comers. This might be a semi-political position, since Congress is on the hunt for something to criticize the Fed for. “Mr Dudley said regulators were currently examining holes in lender-of-last-resort provision on an international basis, with one key area of focus being gaps in backstops for globally systemic groups that operate in multiple jurisdictions.” This is exactly what Congress wants to avoid. Nobody noticed that last time the Fed lent almost $1 trillion to foreign banks—they got it all back, of course. It’s not impossible that Congress can shoot the US in the foot.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | WEAK | Date | Rate | Gain/Loss |

| USD/JPY | 106.46 | SHORT USD | STRONG | 04/29/16 | 107.07 | 0.57% |

| GBP/USD | 1.4610 | LONG GBP | STRONG | 04/12/16 | 1.4309 | 2.10% |

| EUR/USD | 1.1489 | LONG EURO | STRONG | 03/11/16 | 1.1094 | 3.56% |

| EUR/JPY | 122.33 | SHORT EURO | NEW*STRONG | 05/02/16 | 122.33 | 0.00% |

| EUR/GBP | 0.7864 | SHORT EURO | NEW*STRONG | 05/02/16 | 0.7864 | 0.00% |

| USD/CHF | 0.9575 | SHORT USD | WEAK | 04/29/16 | 0.9632 | 0.59% |

| USD/CAD | 1.2547 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 10.58% |

| NZD/USD | 0.7006 | LONG NZD | STRONG | 02/01/16 | 0.6478 | 8.15% |

| AUD/USD | 0.7626 | LONG AUD | WEAK | 01/25/16 | 0.6980 | 9.26% |

| AUD/JPY | 81.17 | SHORT AUD | NEW*STRONG | 04/02/16 | 81.17 | 0.00% |

| USD/MXN | 17.1705 | SHORT USD | STRONG | 02/23/16 | 18.1208 | 5.24% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.