Outlook:

This is going to be an awful week. In addition to data, mostly on housing but also advance Q1 GDP (Thursday), we have two major central bank meetings, the Fed and the BoJ. The RBNZ also meets.

The Fed pretty much has to remind everyone that hikes are still on the table, just not yet. China may be looking less scary of late, but Brexit surely qualifies as a source of global uncertainty. Besides, GDP is likely to be low, something we seem to be getting in Q1 in recent years. The Atlanta Fed GDP Now measure is 0.3% as of last Tuesday, the same as the week before. We get the new version tomorrow. The new NY Fed GDP estimate is a bit higher at 0.8%. If everyone expects GDP to be low, the release may not have much effect on anything, so it will be the PCE deflator everyone will care about. We also get inflation forecasts from the eurozone and Japan.

In Japan, the BoJ is likely to cut the inflation forecast as a justification for some additional stimulus. We have lost count of many times analysts say more stimulus is on the way. The latest story is that the BoJ will pay banks to make loans, i.e., a negative rate on loans to banks, akin to the ECB’s TLTRO initiative. It can also make the deposit rate more negative and re-mix the composition of assets purchased to include whole classes of equities (ETF’s), according to a Bloomberg survey. With speculators still very heavily long the yen, it’s not clear the BoJ can make a splash. After all, Japan has the equivalent of full employment. If households won’t spend and businesses won’t invest under these circumstances, what will?

Here’s a strange forecast—18 of 41 economists in the Bloomberg survey expect the BoJ to take no action. In other words, the negative deposit rate is so new, Kuroda will want to wait to see the effects. The FT reports “On the other hand, BoJ officials are alarmed by the yen’s rise from about ¥120 to ¥111 against the dollar this year… Inaction could lead to a further rise in the currency.

“They are also watching daily inflation data produced by a start-up called Nowcast. Mr Kuroda often cites Nowcast as a sign of underlying inflationary pressure but since the start of Japan’s new fiscal year in April, its index has plunged from year-on-year rises of 1.3 per cent to just 0.7 per cent. Mr Kuroda may not make up his own mind until he wakes on Thursday and learns what the US Federal Reserve did overnight. If the Fed hints at a June rate rise, it could weaken the yen and give the BoJ some breathing space.” Well, it can hardly be that close a call. For one thing, the BoJ and the Fed are surely talking on the phone. For another, the BoJ has its own statisticians and it would be insulting for Kuroda to rely entirely on a subscription service like Nowcast rather than his own staff.

The Japan problem haunts us all. Analysts are making much of last week’s jobless claims hitting the lowest since 1973. This is not really that good, given U6 so high (either 9.9% as the BLS says for 14.4% as Gallup said in early April). But in at least some corners of the macro world, the US economy is recovering enough to justify higher yields. The WSJ reports TD Securities sees $5 billion in futures bets on falling yields converted into a net $2.4 billion on rising yields as of last week (April 19). This is a vast turnaround from net negatives at $11.7 billion in the week ending April 5, which was the highest since November.

In addition, “Investors broadly pulled $279.7 million out of U.S. bond mutual and exchange-traded funds targeting U.S. government bonds for the week ended April 20, according to data from fund tracker Lipper. That was the eighth consecutive weekly outflow, following 11 weeks of net inflow.”

Some analysts think this means the tide is turning. Central bank policy is working, if at a glacial pace. “Inflation expectations have risen modestly, reflecting in part the more-upbeat market sentiment and a steady rise in oil prices. The 10-year break-even rate, reflecting the yield spread between the 10-year Treasury inflation-protected bond and the 10-year Treasury note, reached 1.65 percentage points Friday, the highest level since August.” But this is still the minority viewpoint. Most analysts slow growth, implying zero or only tiny wage gains, and thus inflation still far off on the horizon. We could easily see another effort to reach 2% fail again.

Fixed income analysts are a little befuddled. Maybe some analysts see inflation coming but it’s not the primary focus of the big players. And if the big players are not buying into the inflation story, then the rise in yields has to be a flash in the pan. Market News writes “The 10-year topped Thursday's high yield of 1.886% by rising to 1.897% on Friday. It seems like small potatoes, but the yield has been steadily moving higher since a low of 1.72% on April 11. And in this highly range-bound market, a little bit goes a long way. Market sources also made note the yield on the mighty long bond touched 2.71% on Friday. It was trading at 2.56% on April 11. The little five-year note, always the whipping boy on the curve, reached a high yield of 1.367% Friday. On April 11 it settled at 1.157%.”

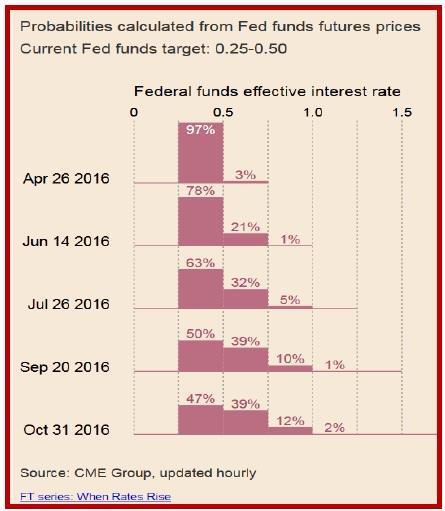

Normally you would expect moves like this to be anchored in some hard data or serious expectations of central bank statements, if not action. But aside from the jobless claims hitting the 1973 level, we have none of that. The CME estimates of bets on the next hike are little changed. See the FT’s table. We don’t even get a press conference after the FOMC on Wednesday, just a statement that may change a word or two. The only driver out there is supply expected from some European countries and the UK this week, plus a US schedule organized around the FOMC. Oh, yes, Portugal may get a downgrade from the last agency of four, making it ineligible for the ECB asset purchase plan.

Bottom line, yields don’t always rule (as theory says they should) but to the extent the fairly firm dollar is based on rising yields, don’t count on it continuing. We could get another drop in oil prices that takes equity indices down and yields with them on safe-haven concerns. China’s debt problem could become more visible. Japan could do nothing and intervention become the next step, promises to G20 notwithstanding. It may not seems that way, but these are highly uncertain times.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | NEW*WEAK | Date | Rate | Gain/Loss |

| USD/JPY | 111.22 | LONG USD | WEAK | 04/22/16 | 110.52 | 0.63% |

| GBP/USD | 1.4432 | LONG GBP | WEAK | 04/12/16 | 1.4309 | 0.86% |

| EUR/USD | 1.1252 | LONG EURO | WEAK | 03/11/16 | 1.1094 | 1.42% |

| EUR/JPY | 125.15 | LONG EURO | WEAK | 03/29/16 | 127.24 | -1.64% |

| EUR/GBP | 0.7797 | LONG EURO | WEAK | 03/11/16 | 0.7759 | 0.49% |

| USD/CHF | 0.9752 | LONG USD | NEW*STRONG | 04/25/16 | 0.9752 | 0.00% |

| USD/CAD | 1.2691 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 9.55% |

| NZD/USD | 0.6869 | LONG NZD | STRONG | 02/01/16 | 0.6478 | 6.04% |

| AUD/USD | 0.7709 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 10.44% |

| AUD/JPY | 85.74 | LONG AUD | WEAK | 03/03/16 | 83.57 | 2.60% |

| USD/MXN | 17.5386 | SHORT USD | STRONG | 02/23/16 | 18.1208 | 3.21% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.