Outlook

Maybe it’s the effect of snow in April ruining the apply blossoms, but it seems like commentary today is particularly dumb. Nothing is dumber than “analysis” that oil will not continue its price rise in a straight line and there are plenty of roadblocks to the supply overhang getting whittled back in a neat and tidy manner so prices can go to $60. Golly.

We have no evidence the Saudis are not going to get a deal a the April 17 Doha conference. Why hold the conference at all? For all we know, the comment that the freeze deal is off unless Iran joins was a game ploy or a mistake by a prince. The latest on this saga is a statement reported by Reuters that Russian Energy Minister Novak says Iran has confirmed its participation in the Doha meeting but it will join the output freeze agreement only after its output rises to 4 million bpd. Or maybe the Saudis can just write a check for the difference between current output and 4 million—it should be all the same to Iran. This is actually quite funny—the two warring religious sects putting aside over a thousand years of history to be able to pay the phone bill.

To forecast the price of oil on a single princely comment is really, really dumb. The Doha conference is a Big Deal. Russia is behaving like a co-sponsor. Russia and Saudi Arabia together? Who would have thought it? Russia, Saudi Arabia and Iran together? The mind boggles.

As for the US economy, it may not be reaching escape velocity but it’s not bad--and better than most. The March ISM PMI rose to 51.8 from 49.5 in Feb, with New Orders up to 58.3 from 51.5. Prices Paid rose to 51.5 from 38.5. Production rose to 55.3 from 52.8. The final March Markit manufacturing PMI rose to 51.5 from 51.4 in the preliminary.

To put frosting on the cake, the Bloomberg/Michigan Sentiment survey rose to 91.0 in the final March reading from 90.0 in the flash, if down from the 91.7 final in February. Expectations rose to 81.5 in the March final from 80.0 in the preliminary, and Current Conditions were unchanged at 105.6 (if down from 106.8 in the final February).

The jobs report was good—215,000 new jobs created when a lesser number was forecast. This looks “steady,” as Yellen put it earlier in the week. The 3-month average is now 209,000, only a tad under the 12-month average of 223,000 before March. Wages rose 0.3% m/m or 2.3% y/y when the same 0.2% and 2.2% was forecast. Average hourly earnings of private-sector workers rose 7 cents to $25.43.

The unemployment rate ticked up to 5% but because the participation rate improved to 63, the 4th consecutive rise and the highest since March 2014. The participation rate bottomed out at 62.4% in Sept 2015, which was the lowest level since 1977. If anyone is looking, the “real” unemployment rate or U6 is at 9.8%, up a tad from 9.7% in Feb—but the Feb reading was the lowest since 2008.

All of this should have been dollar positive on the grounds that the data gives the Fed a more solid foundation for the next rate hike, when that day comes. But the market didn’t see it that way, choosing instead to keep uppermost in mind the Yellen statement that caution is warranted.

The bond market doesn’t accept it yet, but the Fed is poised to move closer toward more normalization at any time.

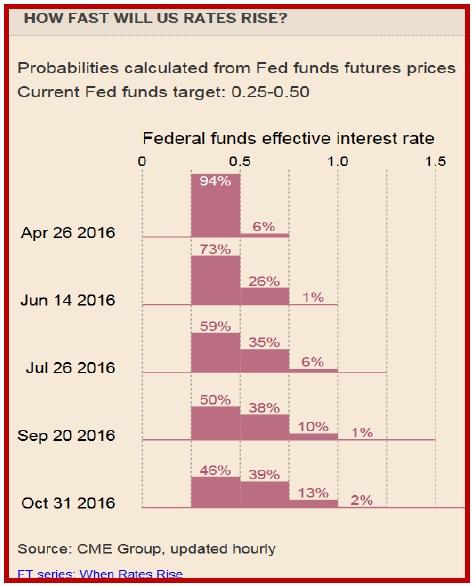

The Fed doesn’t like to surprise the little darlings and can be assumed to offer “guidance” well ahead of time, although it’s probably royally ticked off and a reprise of 1994 is not out of the question (a surprise rate move by Greenspan that literally no one saw coming and caused more than one fund to close its doors, including one of our clients). But we do not see the Fed backtracking, as was so thoroughly discussed earlier this year. The latest FT table of CME Fed funds futures shows a 45% probability of a 25 bp hike by October. Actually, the number for July is not that much less, 35%.

The important point is not the outright number, but the momentum. It’s not so long ago that the probability for October was single digits.

The dollar rebound today is not the real deal and will probably fade. But at some point soon, the dollar recovery will grow legs. Analysts are happily noting that emerging markets are recovering and looking forward to ongoing improvement. Don’t be fooled. If you are not already out, run for the exit.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 111.84 | SHORT USD | WEAK | 02/04/16 | 117.57 | 4.87% |

| GBP/USD | 1.4222 | LONG GBP | WEAK | 03/31/16 | 1.4371 | -1.04% |

| EUR/USD | 1.1360 | LONG EURO | STRONG | 03/11/16 | 1.1094 | 2.40% |

| EUR/JPY | 128.83 | LONG EURO | STRONG | 03/29/16 | 127.24 | 1.25% |

| EUR/GBP | 0.7987 | LONG EURO | WEAK | 03/11/16 | 0.7759 | 2.94% |

| USD/CHF | 0.9613 | SHORT USD | STRONG | 03/11/16 | 0.9877 | 2.67% |

| USD/CAD | 1.3080 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 6.78% |

| NZD/USD | 0.6847 | LONG NZD | STRONG | 02/01/16 | 0.6478 | 5.70% |

| AUD/USD | 0.7611 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 9.04% |

| AUD/JPY | 84.96 | LONG AUD | STRONG | 03/03/16 | 83.57 | 1.66% |

| USD/MXN | 17.3272 | SHORT USD | STRONG | 02/23/16 | 18.1208 | 4.38% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Asian trading hours on Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.