Outlook:

After a breakout, we almost always get reversion to the mean. Then we have to wait for the pullback to end before we can be sure the move in the breakout direction has momentum. Breakouts fizzle all the time. This one has the right smell for continuation.

The one vulnerability (and it’s not a big one) is the Fed policy meeting tomorrow and Wednesday, ending with the 2 pm statement (with new dots) and the press conference at half hour later. Some smarty-pants say the Fed should shock the market with the hike this time instead of April or June, nut that’s not how the Fed works. Like Martha Stewart using exaggerated pronunciation, the Fed likes to give advance warning and avoid any and all surprises. It gets enough criticism for other things and doesn’t need to add “failure to communicate” to the list.

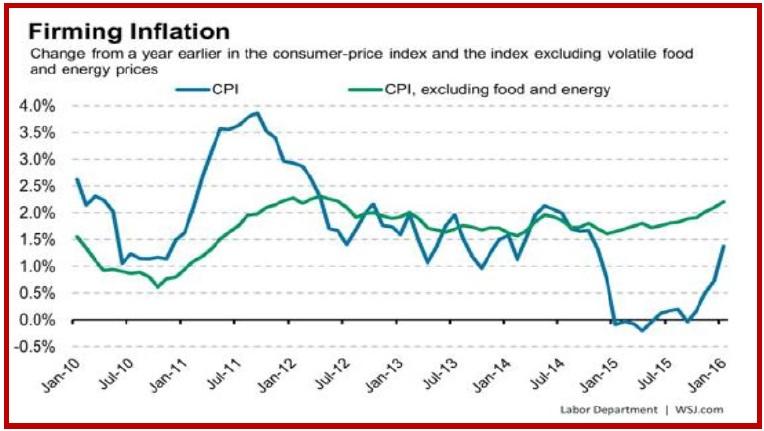

Today might be a yawn unless traders start positioning for tomorrow’s data, which includes retail sales, PPI, the Empire State Manufacturing survey, and business inventories. Even more interesting than retail sales will be Wednesday’s inflation data. Last time out, CPI was up 1.4% y/y, the highest reading since late 2014. See the chart from the Wall Street Journal. Better yet, show it to the bond market.

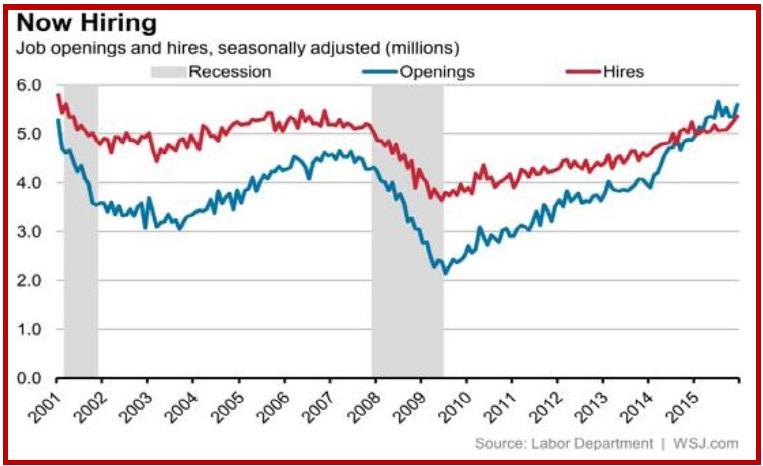

Closely related is the JOLTS report (Thursday) showing voluntary job-leaving and new hires. We can dismiss the Phillips Curve all we like, but you don’t get inflation without rising employment and rising wages. And the odds of the US going into recession are a tad lower (20% from 21%) but not zero.

According to the WSJ survey last week, the most pessimistic economist puts the odds at 50% (Standard Chartered). Allen Sinai (Decision Economics) says there is zero chance. “Jobs growth, income and consumption too solid and strong for a recession to occur.” The economy has “no real excesses” that could lead to a recession. Presumably Sinai is using “excesses” as a proxy for “crisis trigger.”

We expect the Fed to stay its hand this week and to be as annoyingly unclear as before of its intentions. That means analysts parsing every blessed word but more importantly, the new dots showing where members see rates out into the future. At a guess, the Dots will rule. We hate to admit it, but if oil continues to firm and $20 becomes only a dim possibility from the past, the dollar can resume its overall slide. See the dollar index chart on the first page of the Chart Package.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 113.68 | SHORT USD | WEAK | 02/04/16 | 117.57 | 3.31% |

| GBP/USD | 1.4348 | LONG GBP | WEAK | 03/11/16 | 1.4296 | 0.36% |

| EUR/USD | 1.1107 | LONG EURO | STRONG | 03/11/16 | 1.1094 | 0.12% |

| EUR/JPY | 126.27 | SHORT EURO | WEAK | 02/11/16 | 126.19 | -0.06% |

| EUR/GBP | 0.7742 | LONG EURO | WEAK | 03/11/16 | 0.7759 | -0.22% |

| USD/CHF | 0.9876 | SHORT USD | STRONG | 03/11/16 | 0.9877 | 0.01% |

| USD/CAD | 1.3250 | SHORT USD | STRONG | 02/01/16 | 1.4031 | 5.57% |

| NZD/USD | 0.6715 | LONG AUD | STRONG | 02/01/16 | 0.6478 | 3.66% |

| AUD/USD | 0.7544 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 8.08% |

| AUD/JPY | 85.76 | LONG AUD | STRONG | 03/03/16 | 83.57 | 2.62% |

| USD/MXN | 17.7258 | SHORT USD | WEAK | 02/23/16 | 18.1208 | 2.18% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.