Outlook:

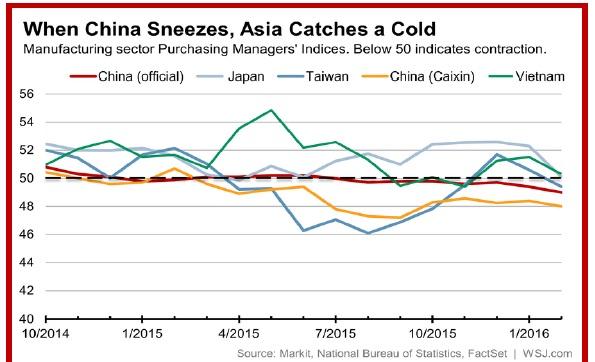

After bad data from China and Europe on manufacturing, today’s ISM report will become critical. Reuters reports the ISM national manufacturing index is expected to rise to 48.5 in Feb from 48.2 in Jan, but after the Chicago bombshell, nerves could be frayed to the point of seeing a lesser move as a disaster. We also get Feb car and truck sales, probably another blockbuster number. And construction spending is forecast up 0.4% in Jan from 0.1% in Dec.

Unless data surprises, attention will remain on incendiary comments by NY Fed chief Dudley, speaking in China, who captured the top story in the FT today. Escalating global worries, they get persist, will trigger another downgrade in his outlook. He is most worried about falling inflation expectations becoming a self-fulfilling prophecy. “At this moment, I judge that the balance of risks to my growth and inflation outlooks may be starting to tilt slightly to the downside.”

The FT Notes that both the NY Fed’s own survey and the University of Michigan report yesterday show the lowest readings on record. Consider Japan, Dudley said. Once expectations fall meaningfully below the central bank objective, it’s very hard to push them back up. Okay, so now we have define the meaning of “meaningfully.”

To change to a less gloomy topic, it’s possible the most important news today is the settlement deal Argentina made with the four hedge fund holdouts whose court cases have prevented Argentina from accessing the markets for 12 years. The holdouts will be paid $4.65 billion, “which represents 75 percent of the full judgments for the four hedge funds and includes principal, interest and a payment to settle the claims outside of the court, as well as ‘certain legal fees and expenses incurred,’” according to the NY Times.

The NYT also notes an academic has calculated that one fund invested $48 million for some bonds in 2008 and will get back $620 million, or an annual return of about 38%. The NYT seemingly disapproves of such a big return. But that’s precisely the point—a return has to be Very Big to induce investors to take the risk of debt of parties with a history of default. Argentina has a bad track record. The funds went through legal hell to get any return at all, let alone a return commensurate with the risk, which did materialize. Some of the final payment goes to reward the investor for the years of uncertainty as well as the opportunity cost. We don’t actually know whether 38% is too high, but it’s certainly not ridiculously high. It’s also the price Argentina pays for thumbing its nose at international law (along with the ship taken off the coast of Africa).

We say new Argentina Pres Macri has done the right thing by promoting the settlement. Argentina can now return to the global market and will pay less in the near future now that it seems chastened and willing to obey the rules of the road. Later on, of course, Argentina will do it again—default—if history is a guide. All those Argentines strolling up Fifth Avenue and the streets of Greenwich will soon be back in BA.

But never mind. We have a new precedent and investors will be less gun-shy. In fact, the settlement is good for all emerging market issuers and their investors by clarifying that contracts are sacred and will be enforced. Many EM’s never really got that point, including some in the Middle East. To be fair, some in the US are willing to let fuzziness persist, too (do Freddie and Fannie paper have a US federal guarantee or not?). Anytime the rule of law wins, we all win. Wouldn’t it be nice if the Poobahs at the IMF and IFF could see this basic point. They are always and forever trying to figure out a way for debtors, especially EM debtors, to escape responsibility when conditions move against them. Well, they should do some adverse-condition risk analysis before they borrow, not afterwards.

To return to FX, we expect the dollar to weather the current effort at a pullback in fine fettle. Other economies are in worse shape. The ECB is expected to be aggressive in easing at the March 10 policy meeting, while Japan just issued its first negative-rate 10-year note. The BoE can’t return to a normalization path until Brexit is over and that’s not until June 23. If the vote were to go in favor of Brexit, sterling is a dead duck. And talk of negative rates everywhere, even the US, is very frightening.

Off on the side but coming more into focus is the disaster of Trump possibly becoming unstoppable in winning the Republican nomination after today’s primaries. People are starting to panic, not least the Republican establishment. One possible happy outcome—Texas may reject Cruz, who deeply deserves to be rejected. If Trump is unqualified, Cruz is more unqualified. The one thing we are getting out of all this is the serious disapproval of the voting public over the conduct of its politicians. To a certain extent, this is behind Brexit, too. The worry is that we are all becoming Greece.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 113.23 | SHORT USD | WEAK | 02/04/16 | 117.57 | 3.69% |

| GBP/USD | 1.3993 | SHORT GBP | STRONG | 02/17/16 | 1.4349 | 2.48% |

| EUR/USD | 1.0870 | SHORT EURO | STRONG | 02/23/16 | 1.1011 | 1.28% |

| EUR/JPY | 123.08 | SHORT EURO | WEAK | 02/11/16 | 126.19 | 2.46% |

| EUR/GBP | 0.7768 | LONG EURO | STRONG | 10/23/15 | 0.7194 | 7.98% |

| USD/CHF | 1.0002 | LONG USD | NEW*WEAK | 03/01/16 | 1.0002 | 0.00% |

| USD/CAD | 1.3514 | SHORT USD | WEAK | 02/01/16 | 1.4031 | 3.68% |

| AUD/USD | 0.6807 | LONG AUD | WEAK | 01/25/16 | 0.6980 | -2.48% |

| AUD/JPY | 80.99 | SHORT AUD | WEAK | 02/11/16 | 78.47 | -3.21% |

| USD/MXN | 17.9747 | SHORT USD | WEAK | 02/23/16 | 16.1208 | 0.81% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700 as USD struggles ahead of data

EUR/USD is posting small gains above 1.0700 in the European session on Thursday. The pair remains underpinned by a sustained US Dollar weakness, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD stays firm above 1.2500 amid US Dollar weakness

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair's uptick is supported by a broadly weakness US Dollar on dovish Fed signals. A mixed market mood could cap the GBP/USD upside ahead of mid-tier US data.

Gold price trades with modest losses amid positive risk tone, downside seems limited

Gold price edges lower amid an uptick in the US bond yields, though the downside seems cushioned. A positive risk tone is seen as another factor undermining demand for the safe-haven precious metal.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.