Outlook:

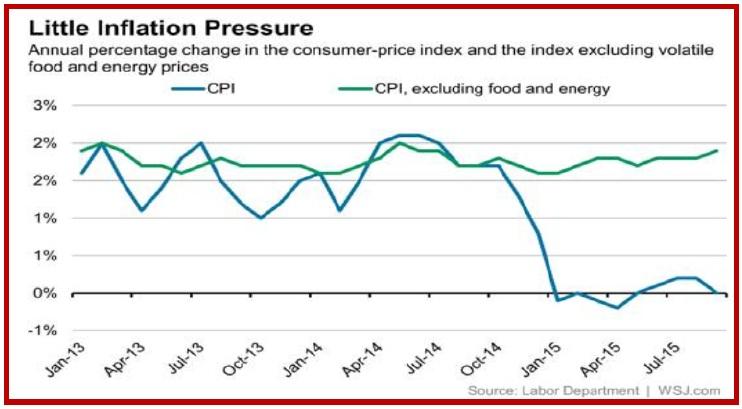

Today we get US CPI, supposedly of some interest. We already know the headline number will be low and the Fed is counting on various unnamed mystery factors to raise it sometime in the unspecified future. What might be interesting after the UK experience earlier today is core CPI, forecast to remain at 1.9% but only a tiny rise needed to push it to 2% for the first time since early 2013. See the WSJ chart. If the US were to get a 2% core CPI, we can expect the same experience as in the UK—the dollar “should” rise on even better odds of the Fed taking action at the Dec policy meeting.

Industrial production might be a bummer again, though. It includes “mining,” which include oil. We knew that sector has seen shrinkage, even if the rig count was up by two last time. But also, in part because of the strong dollar, manufacturing has been down in three of the last four months, with only July showing a gain.

Markets seem to be dismissing the longer-term effects of the terrorist attacks, not only in France (which will, of course, miss its budget targets again) but elsewhere, too, including the US. While hard to quantify, fighting terrorism is costly. Perhaps of equal importance is the drop in consumer confidence and spending, plus the ensuing drop in business investment. Some of these issues must be swirling around in investors’ minds and damaging the lure of eurozone assets. In the US, we have (perhaps) the opposite problem—a central bank ready, willing and able to raise rates, and even one regional Fed (Rosengren, Boston) telling the FT that bank lending to commercial real estate and large syndicated loans is possibly too much, too fast and could justify a faster pace of later rate hikes once the First Hike is done. This runs counter to what every Fed has been saying—“lower for longer.” It didn’t get much attention when it came out in the FT over the weekend, but it’s there. Rosengren said “We will continue monitoring the data and if the economy speeds up and some of the international offsets become diminished, then we would move a little bit faster [in lifting rates], and if it turns out the headwinds from the international side, from other areas, are more substantial, we can go more slowly.”

Not everyone buys into this view, of course—the probability of the first hike remains less than 70%, according to Fed funds futures calculations—but just wait. The policy divergence thesis, which has been waxing and waning for many months, is about to jump up and punch us in the face. The euro may fiddle-faddle around for a little longer, but now that the last intermediate low has been taken out, we need to consider a slide to the last big low, just under 1.0500 (1.0463) from March 13. Let’s not neglect the yen, either. The stampede to the yen as a safe haven was very short-lived. In a nutshell, the market is moving toward another move favoring the dollar, possibly a big one.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 123.26 | LONG USD | STRONG | 10/23/15 | 120.45 | 2.33% |

| GBP/USD | 1.5202 | SHORT GBP | STRONG | 11/06/15 | 1.5137 | -0.43% |

| EUR/USD | 1.0667 | SHORT EUR | STRONG | 10/23/15 | 1.1115 | 4.03% |

| EUR/JPY | 131.49 | SHORT EURO | STRONG | 10/23/15 | 133.88 | 1.79% |

| EUR/GBP | 0.7018 | SHORT EURO | STRONG | 10/23/15 | 0.7220 | 2.80% |

| USD/CHF | 1.0110 | LONG USD | WEAK | 10/23/15 | 0.9735 | 3.85% |

| USD/CAD | 1.3303 | LONG USD | STRONG | 10/28/15 | 1.3235 | 0.51% |

| NZD/USD | 0.6478 | SHORT NZD | WEAK | 10/05/15 | 0.6641 | 2.45% |

| AUD/USD | 0.7119 | SHORT AUD | STRONG | 10/29/15 | 0.7087 | -0.45% |

| AUD/JPY | 87.75 | LONG AUD | WEAK | 10/08/15 | 86.06 | 1.96% |

| USD/MXN | 16.7523 | LONG USD | WEAK | 11/06/15 | 16.6275 | 0.75% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.