Outlook:

We were right that payrolls would solidify the December-hike sentiment, even if we thought it would do it from behind (low number). Getting a high number and also a bigger-than-expected gain in earnings was a bonus. Now we have a shortage of news to trade on until Thursday (eurozone GDP) and Friday (US retail sales).

The absence of news gives rein to mischief, including fruitcake ideas about what the hike will mean. We suspect that it has been expected for so long that nothing much will happen, but you never know what third-rate idea might catch hold. One might be the effect on the US debt or mortgages, both about to get more expensive. (The US has a large issuance calendar this week.) Another might be that higher funding costs plus the need for banks to improve their Total Loss Absorbing Capacity will drive banks back into nasty tricks to widen spreads. And of course we have the usual horde of nay-sayers in the equity space saying P/E’s are already too high, sell the rally.

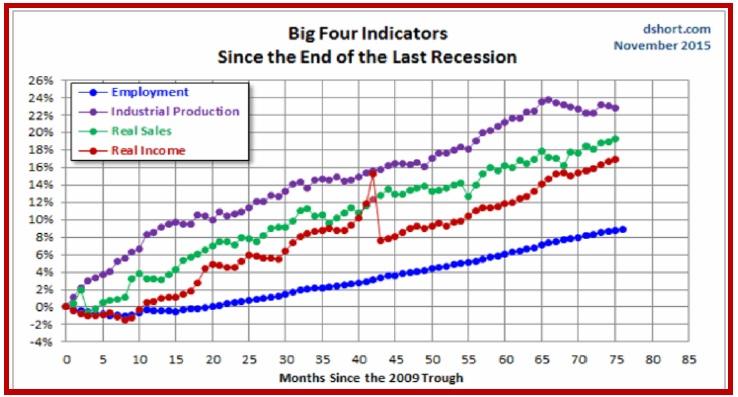

Surfing around seekingalpha.com though, we found the chart below. We say it shows the US economy has improved sufficiently in key areas to justify the hike. These improvements might also justify the gains the dollar has already made plus a little more to come. Over long periods of time, currency levels are correlated with economic growth. The warning lies in “long periods.”

And many analysts think the dollar has already reaped the benefits of divergence long before divergence became even remotely real—and to be fair, it still isn’t real until the Dec FOMC. Perhaps the pullback will be severe, on profit-taking and second thoughts alike. Once the jitters get shaken out, though, the trajectory should toward old-low targets like 1.0660 from April and 1.0548 from March 16. The only thing we know for sure is that it will not be a straight line from here to there.

What can upset this apple cart? Aside from the unknown unknowns (war, terrorism, natural disasters), we have a one-word answer—China. This doesn’t mean China will actually be at fault if turmoil reemerges, just that the financial world is ready to lay the blame there. The OECD world outlook for 2015 issued today raised the forecast for China to 6.8% from 6.7% this year and kept the 2016 forecast at 6.5%--but cuts it to 6.2% in 2017. And since trade is the linchpin, we will have to watch Chinese data every month to see how close or far away the growth goal might be.

The OECD says global trade will be up only 2% this year, a rare low number and one that coincides with downturns in 1975, 1982-83, 2001 and 2009. The OECD chief economist declares the drop “deeply concerning." The solution is output growth, expected up 3.3% next year (from 3.6% previously forecast) and a lot depending on stimulus measures in China.

The OECD approves of the rate hike (normalization) and blames the Fed’s delay for global market turmoil. Funny, the Fed blamed global market turmoil for one of the delays. US growth will be 2.4% this year and 2.5% next year. Some wage growth would be nice. For the eurozone, growth will be 1.5% this year and 1.8% next year, lower than earlier forecasts but not terrible (for Europe).

The OCED is not the last word on economic health, but the overall take-away is that the world is still quite fragile. Tell it to the Marines.

On the political front, tomorrow we get another Republican candidate debate. Front-runner Carson is being outed as a liar (all military academy appointments are “free scholarships” and he didn’t get one). A new book about Trump discloses some lies, too (the family was from Germany, not Sweden, with the original name Drumpf). Bush cannot succeed with George’s foreign affairs legacy dragging him down; we know those advisors lied. Carly lies about HP, although it looks like Marco did not lie about his credit cards. The point is that politicians lie. The American voting public is slow to catch on to this age-old truth, which is why it takes us over a year to pick a candidate. Are they smarter in the UK and Canada, where electioneering is only a few weeks? Yes, probably.

Note that Wednesday is a holiday in the US—Veterans Day. The bond market is closed, although the stock market stays open, and FX is mixed. The futures market is open but banks are closed, so spot FX should be skimpy at best. We will publish reports as usual.

Be careful. Big moves almost always bring consolidations.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 123.51 | LONG USD | STRONG | 10/23/15 | 120.45 | 2.54% |

| GBP/USD | 1.5079 | SHORT GBP | STRONG | 11/06/15 | 1.5137 | 0.38% |

| EUR/USD | 1.0768 | SHORT EUR | STRONG | 10/23/15 | 1.1115 | 3.12% |

| EUR/JPY | 133.00 | SHORT EURO | STRONG | 10/23/15 | 133.88 | 0.66% |

| EUR/GBP | 0.7141 | SHORT EURO | STRONG | 10/23/15 | 0.7220 | 1.09% |

| USD/CHF | 1.0036 | LONG USD | WEAK | 10/23/15 | 0.9735 | 3.09% |

| USD/CAD | 1.3283 | LONG USD | STRONG | 10/28/15 | 1.3235 | 0.36% |

| NZD/USD | 0.6539 | SHORT NZD | WEAK | 10/05/15 | 0.6641 | 1.54% |

| AUD/USD | 0.7058 | SHORT AUD | STRONG | 10/29/15 | 0.7087 | 0.41% |

| AUD/JPY | 87.17 | LONG AUD | WEAK | 10/08/15 | 86.06 | 1.29% |

| USD/MXN | 16.8043 | LONG USD | WEAK | 11/06/15 | 16.6275 | 1.06% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.