Outlook:

The Fed said in July that conditions for a rate rise were “not yet" achieved. It’s important to note the Fed did not say it was worried about equity or commodity market prices, external events or the dollar. The US does not have inflation or expectations of inflation.

The Fed mandate says it needs to seek optimum levels of employment and to control inflation.

Employment is not optimum, to be sure, but inflation simply isn’t there. On the basis of the Fed’s mandate, the statement is entirely accurate—conditions do not warrant a rate hike. In fact, it’s possible the economy is so close to stall-speed that a hike could be positively dangerous, although the Fed is not in the habit of wild speculation like this.

It’s also not in the habit of taking an action experimentally, to see what will happen. We continue to think the Fed should raise rates in September, inflation be damned, because “normalization” will inspire more “normal” behavior by economic players.

Unfortunately for this viewpoint, the Fed is correct. We do not have upward price pressures that would justify a rate hike. Fed funds futures show a less than 50% probability of a September hike. Chances are nothing will have changed so much that we will have price pressures in December, either. The old argument that the Fed must act by December to retain credibility is now out the window. In fact, retaining credibility depends on following its own rules, and the rules say no hike.

Most of us wish they would just do it and get it over with, as the Market News fixed income reporter writes. A hike is not going to make much difference to anyone. One analyst thinks the Fed is cowardly and declining to take “bold” action because it fear unknown outcomes. Others concur that the Fed is doing exactly the right thing, given the data and the mandate, and it’s those FOMC members who want a hike who are out of step. In fact, those who want a hike without inflation are the one endangering the Fed’s credibility. The Fed would have to change its rules to justify a hike. We can add that an alternative would be to change its data.

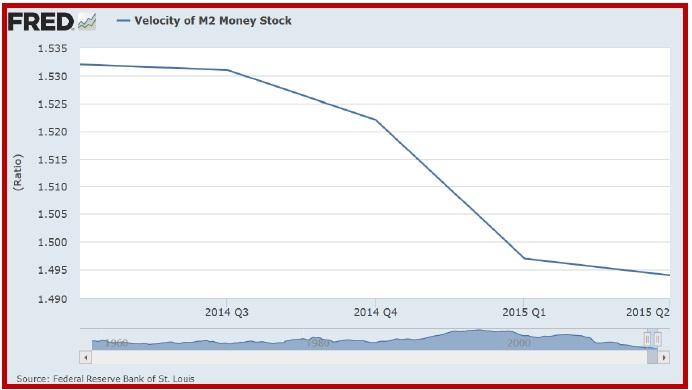

Let’s get wonky. Inflation comes from money supply growing vastly faster than GDP. According to the Fed, money supply is up 5-7%, depending on which measure you choose. See the table. And what about velocity? You need both to get inflationary conditions. Here the chart from FRED is a shocker (next page). Activity is falling, not rising.

And yet some at the Fed see conditions ripening. The sentence everyone is focusing on is “incoming information has not yet provided grounds for reasonable confidence that inflation would move back to 2% over the medium term..." But others feel conditions “as having been met or were confident they would be met shortly." So here’s the problem: does the Fed know what it’s doing? How can one group look at low data and see justification for delay, and another group look at the same data and see “conditions being met”?

It’s possible this boils down to that old bugaboo, communication. The Fed is speaking with forked tongue and saying both yes and no at the same time. Traders don’t appreciate this kind of uncertainty.

It’s okay for a central to withhold information but not okay for it to display what looks confusion. Confusion can give the appearance of mendacity—i.e., somebody at the Fed is lying (or delusional).

Bottom line, our old forecast from a few weeks ago is coming true—the euro is on a corrective upswing that could go quite far, driven by the euro’s Teflon quality of being able to overcome any and all obstacles that would fell a lesser currency. The dollar is not exactly toast, but it’s doomed to a downward correction due to the uncertainty at the Fed. In all likelihood, the Fed is not being wimpy about making a decision. It’s being wimpy about the data and about what the data means.

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.