Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is neutral, and our short-term outlook is neutral. Our medium-term outlook remains bearish, as the S&P 500 index extends its lower highs, lower lows sequence:

Intraday outlook (next 24 hours): neutral

Short-term outlook (next 1-2 weeks): neutral

Medium-term outlook (next 1-3 months): bearish

Long-term outlook (next year): neutral

The U.S. stock market indexes lost between 0.3% and 0.5% on Friday, extending their short-term downtrend, as investors reacted to economic data, quarterly earnings releases. The S&P 500 index broke below its recent consolidation. Then it got close to support level of 2,050. However, the index has managed to bounce off that support level and close its trading session at around 2,065. On the other hand, resistance level is at 2,070-2,075, marked by the recent consolidation. The next level of resistance remains at 2,100-2,115, marked by last year's medium-term local highs. Is this the end of two-month long uptrend? Or is this just a correction before another leg up reaching last year's all-time high? We still can some see technical overbought conditions:

Expectations before the opening of today's trading session are virtually flat. The European stock market indexes have gained 0.4-0.8% so far. Investors will now wait for some economic data announcements: ISM Index, Construction Spending at 10:00 a.m. The S&P 500 futures contract trades within an intraday consolidation, following its Friday's volatility. The nearest important level of support is at 2,045-2,050, marked by Friday's local low. On the other hand, resistance level is at 2,070, marked by recent fluctuations. The market broke below its slightly descending short-term trading channel, as we can see on the 15-minute chart:

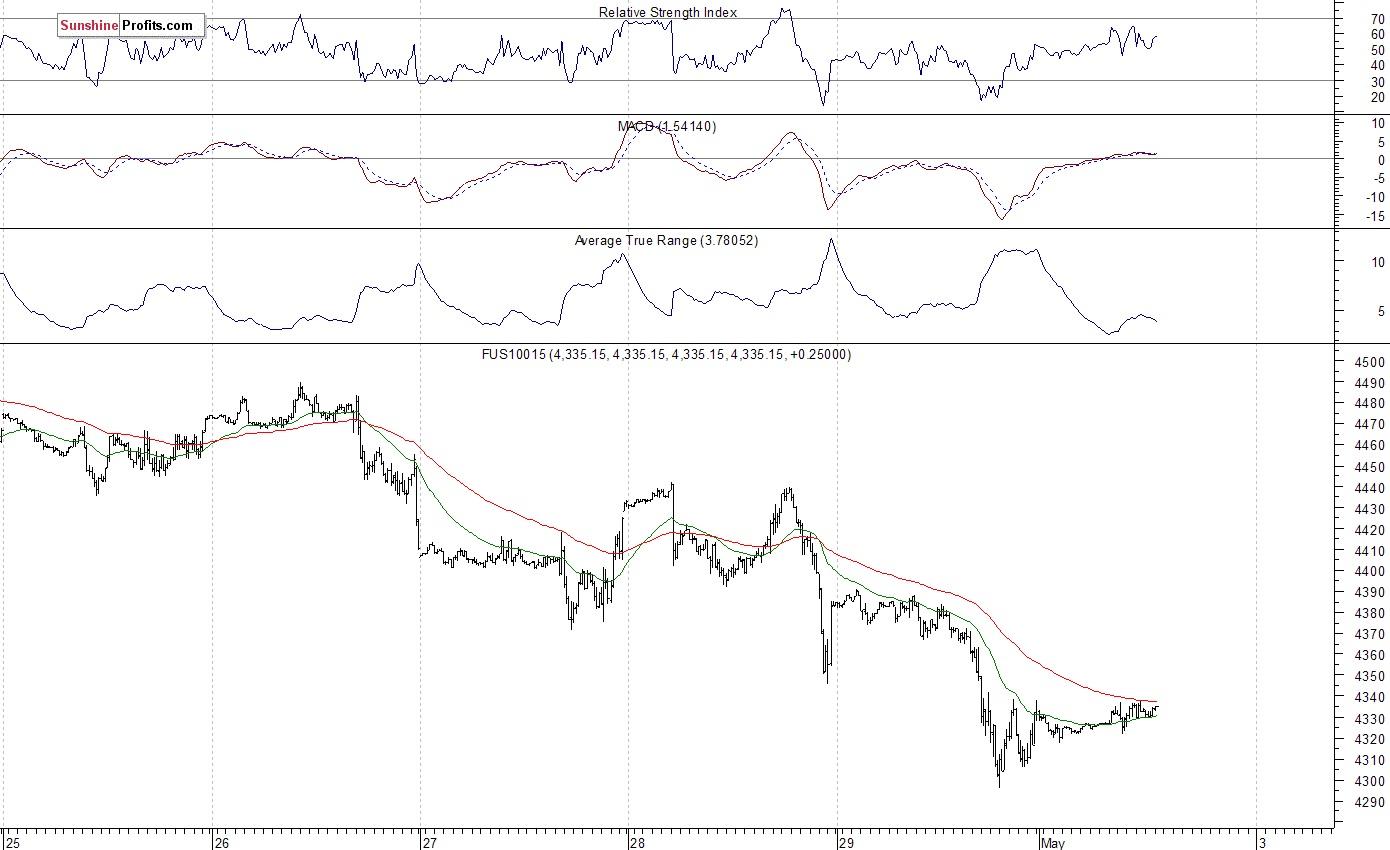

The technology Nasdaq 100 futures contract follows a similar path, as it trades within an intraday consolidation following Friday's move down. The nearest important level of support is at 4,290-4,300., and resistance level is at 4,330-4,350, among others. There have been no confirmed short-term positive signals so far. However, the market may be forming some bottoming pattern, as the 15-minute chart shows:

Concluding, the broad stock market extended its short-term move down on Friday. Is this a new downtrend or just consolidation following February - April rally? We still can see technical overbought conditions that may lead to uptrend's reversal or downward correction. However, there have been no confirmed negative signals so far. For now, it looks like a relatively flat correction within two-month-long medium-term uptrend. We prefer to be out of the market, avoiding low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

EUR/USD retreats to 1.0750, eyes on Fedspeak

EUR/USD stays under modest bearish pressure and trades slightly near 1.0750 on Wednesday. Hawkish comments from Fed officials help the US Dollar stay resilient and don't allow the pair to stage a rebound.

GBP/USD struggles to hold above 1.2500 ahead of Thursday's BoE event

GBP/USD stays on the back foot and trades in negative territory below 1.2500 after losing nearly 0.5% on Tuesday. The renewed US Dollar strength on hawkish Fed comments weighs on the pair as market focus shifts to the BoE's policy announcements on Thursday.

Gold fluctuates in narrow range below $2,320

After retreating to the $2,310 area early Wednesday, Gold regained its traction and rose toward $2,320. Hawkish tone of Fed policymakers help the US Treasury bond yields edge higher and make it difficult for XAU/USD to gather bullish momentum.

SEC vs. Ripple lawsuit sees redacted filing go public, XRP dips to $0.51

Ripple (XRP) dipped to $0.51 low on Wednesday, erasing its gains from earlier this week. The Securities and Exchange Commission (SEC) filing is now public, in its redacted version.

Softer growth, cooler inflation and rate cuts remain on the horizon

Economic growth in the US appears to be in solid shape. Although real GDP growth came in well below consensus expectations, the headline miss was mostly the result of larger-than-anticipated drags from trade and inventories.