Briefly: In our opinion, speculative short positions are favored (with stop-loss at 2,140, and profit target at 1,980, S&P 500 index)

Our intraday outlook is bearish, and our short-term outlook is bearish:

Intraday outlook (next 24 hours): bearish

Short-term outlook (next 1-2 weeks): bearish

Medium-term outlook (next 1-3 months): neutral

Long-term outlook (next year): bullish

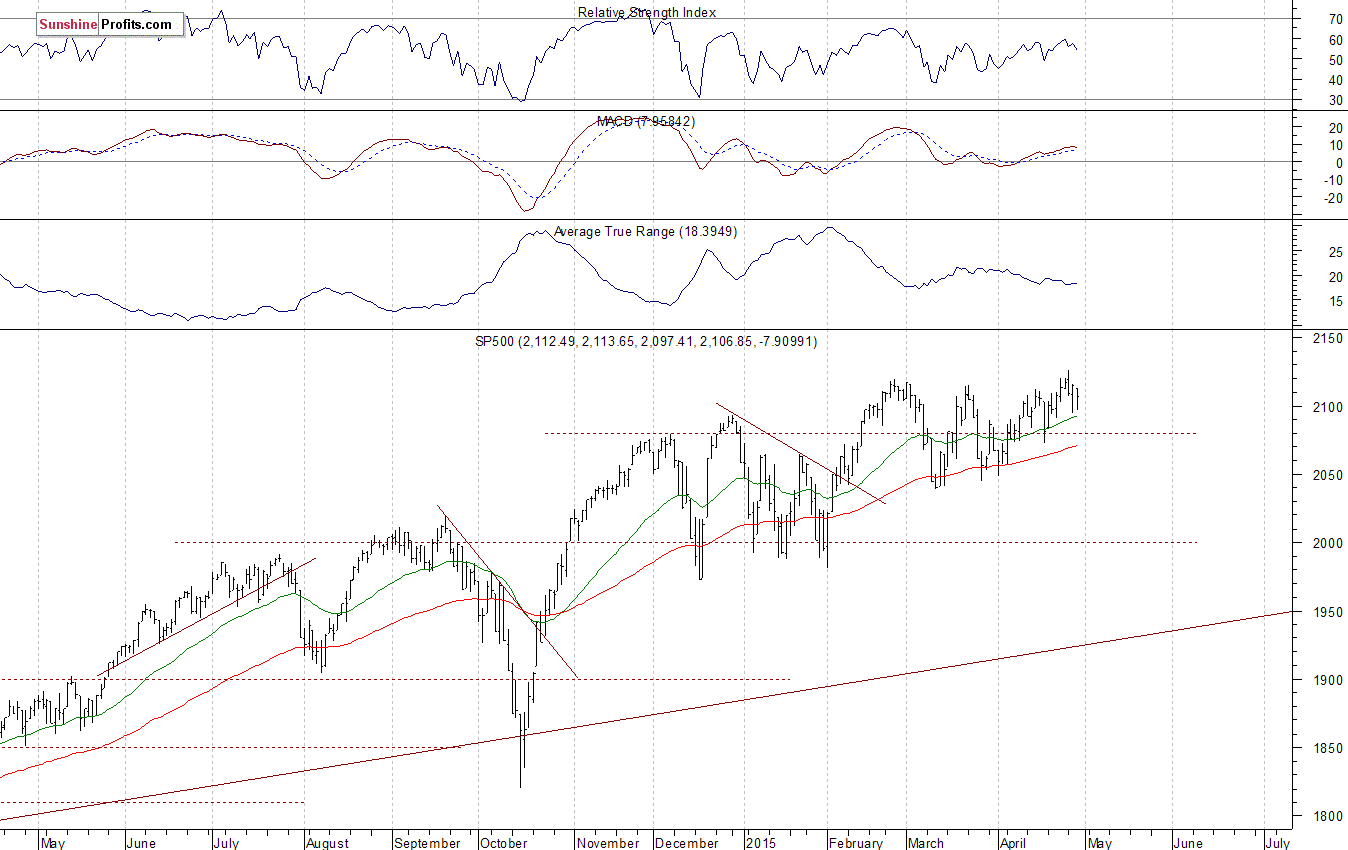

The U.S. stock market indexes lost 0.4-0.6% on Wednesday, extending their short-term fluctuations, as investors reacted to FOMC Rate Decision announcement, among others. Our yesterday's bearish intraday outlook has proved accurate. The S&P 500 index continues to fluctuate along the level of 2,100, as it remains relatively close to its April 27 all-time high of 2,125.92. The nearest important level of resistance is at around 2,120-2,125. On the other hand, support level is at 2,095-2,100. There have been no confirmed negative signals so far. However, we can see negative technical divergences:

Expectations before the opening of today's trading session are negative, with index futures currently down 0.4%. The main European stock market indexes have lost 0.1-0.3% so far. Investors will now wait for some economic data announcements: Initial Claims, Personal Income, Personal Spending at 8:30 a.m., Chicago PMI at 9:45 a.m. The S&P 500 futures contract (CFD) trades within an intraday downtrend, as it fluctuates close to yesterday's low. The nearest important resistance level is at around 2,100-2,150, as the 15-minute chart shows:

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it trades lower. The nearest important support level is at around 4,450. On the other hand, level of resistance is at 4,500, among others, as we can see on the 15-minute chart:

Concluding, the S&P 500 index continued to fluctuate on Wednesday, as investors reacted to FOMC Rate Decision release. There have been no confirmed negative signals so far. However, we maintain our speculative short position (2,098.27, S&P 500 index), as we expect a downward correction or an uptrend reversal. Stop-loss is at 2,140, and potential profit target is at 1,980. You can trade S&P 500 index using futures contracts (S&P 500 futures contract - SP, E-mini S&P 500 futures contract - ES) or an ETF like the SPDR S&P 500 ETF - SPY. It is always important to set some exit price level in case some events cause the price to move in the unlikely direction. Having safety measures in place helps limit potential losses while letting the gains grow.

All essays, research and information found above represent analyses and opinions of Przemyslaw Radomski, CFA and Sunshine Profits' employees and associates only. As such, it may prove wrong and be a subject to change without notice. Opinions and analyses were based on data available to authors of respective essays at the time of writing. Although the information provided above is based on careful research and sources that are believed to be accurate, Przemyslaw Radomski, CFA and his associates do not guarantee the accuracy or thoroughness of the data or information reported. The opinions published above are neither an offer nor a recommendation to purchase or sell any securities. Mr. Radomski is not a Registered Securities Advisor. By reading Przemyslaw Radomski's, CFA reports you fully agree that he will not be held responsible or liable for any decisions you make regarding any information provided in these reports. Investing, trading and speculation in any financial markets may involve high risk of loss. Przemyslaw Radomski, CFA, Sunshine Profits' employees and affiliates as well as members of their families may have a short or long position in any securities, including those mentioned in any of the reports or essays, and may make additional purchases and/or sales of those securities without notice.

Recommended Content

Editors’ Picks

AUD/USD drops to 0.6550 on dismal Aussie Retail Sales and mixed China's PMIs

AUD/USD is seeing a fresh selling wave, dropping to 0.6550 after Australian Retail Sales dropped by 0.4% in March while China's NBS April PMI data came in mixed. Focus shifts to China's Caixin Manufacturing PMI data.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Relief wave on altcoins likely as BTC shows a $5,000 range

Bitcoin price has recorded lower highs over the past seven days, with a similar outlook witnessed among altcoins. Meanwhile, while altcoins display a rather disturbing outlook amid a broader market bleed, there could be some relief soon as fundamentals show.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.