Briefly: In our opinion, no speculative positions are justified.

Our intraday outlook is neutral, and our short-term outlook is neutral:

- Intraday (next 24 hours) outlook: neutral

- Short-term (next 1-2 weeks) outlook: neutral

- Medium-term (next 1-3 months) outlook: neutral

- Long-term outlook (next year): bullish

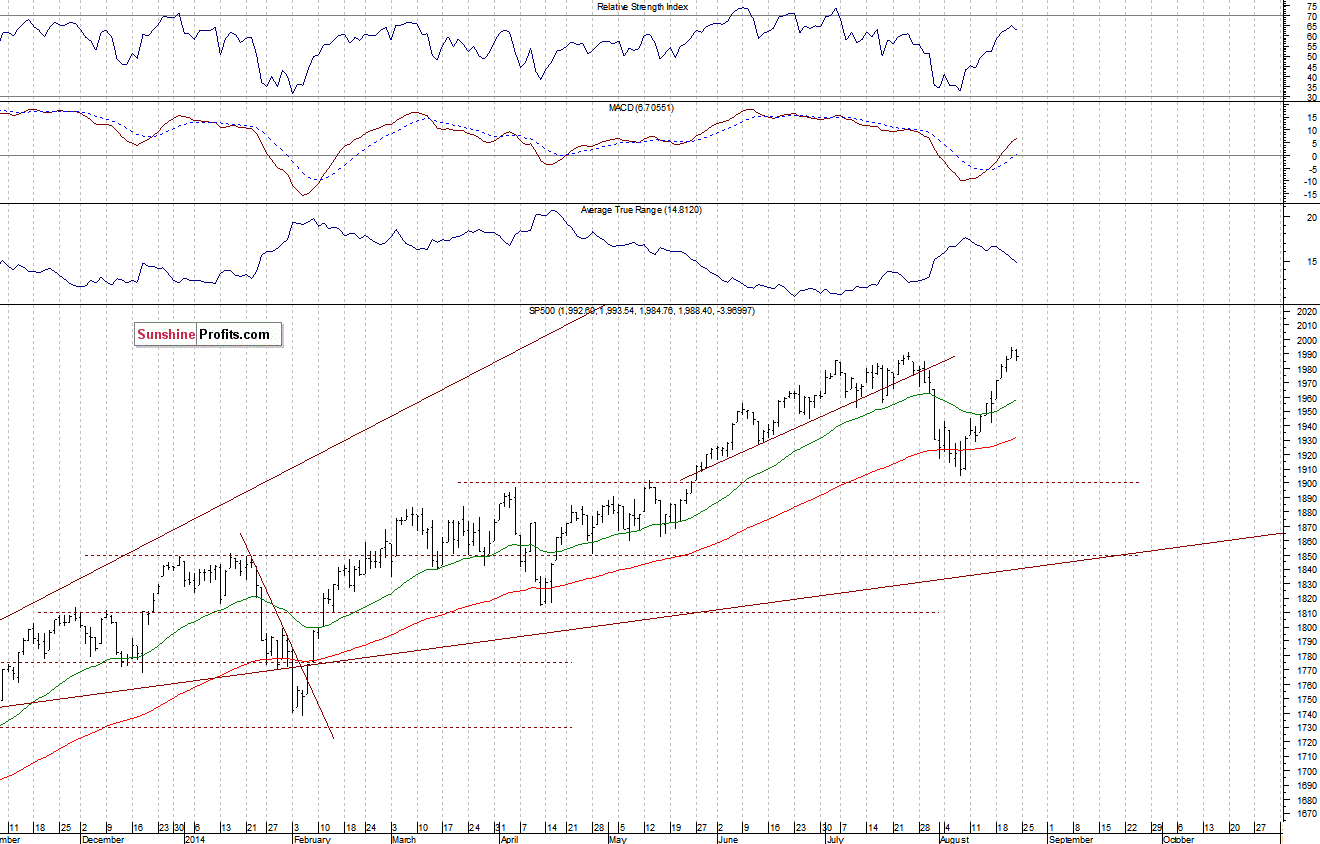

The U.S. stock market indexes were mixed between -0.2% and +0.1% on Friday, as investors hesitated following Janet Yellen’s speech at Fed’s Jackson Hole Conference. Our Friday’s neutral intraday outlook has proved accurate. The S&P 500 index remains close to its Thursday’s all-time of 1,994.76, slightly below the level of 2,000. The nearest important resistance level is at 1,990-2,000, and the level of support is at 1,970, among others. There have been no confirmed negative signals so far, however, we can see some overbought conditions which may lead to a downward correction:

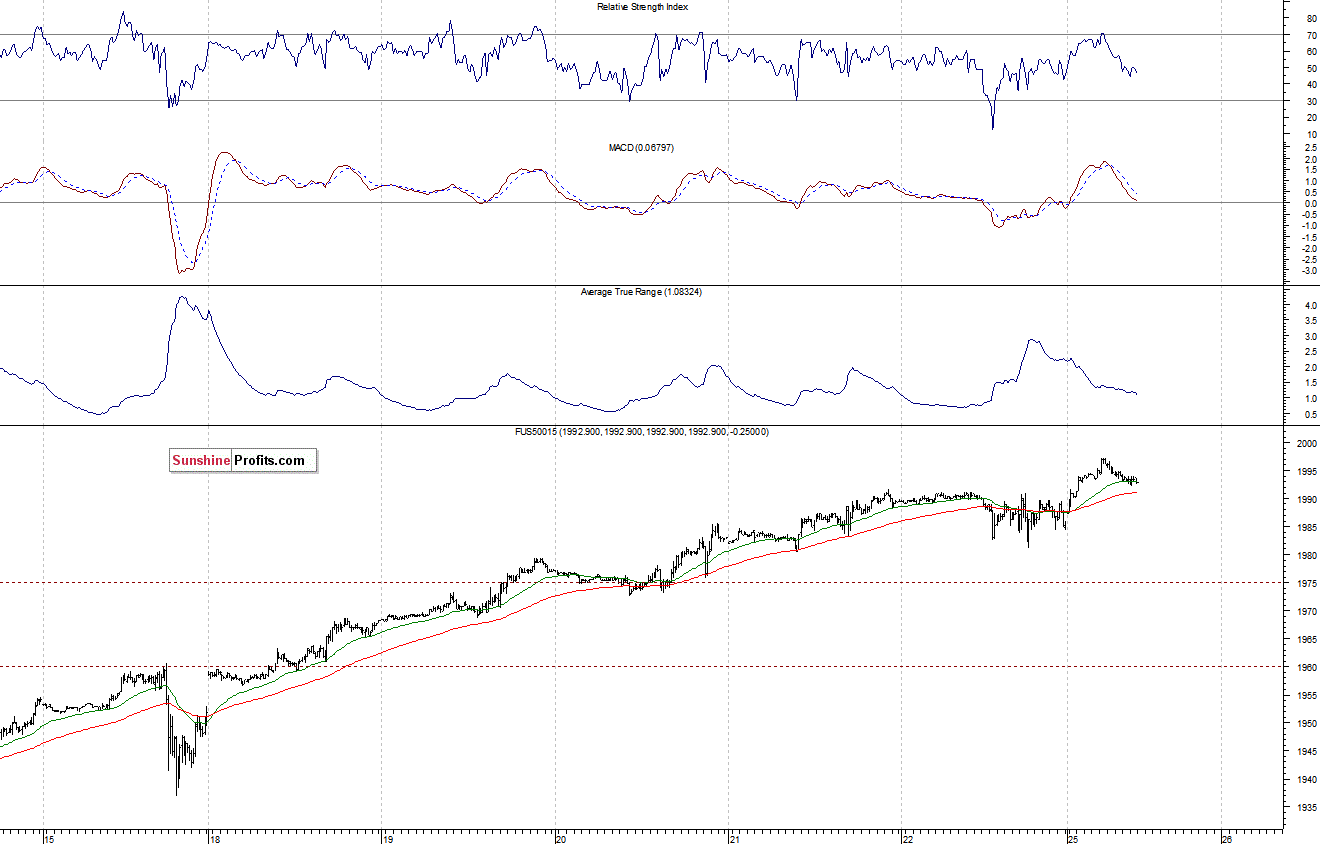

Expectations before the opening of today’s session are slightly positive, with index futures currently up 0.2-0.3%. The main European stock market indexes have gained 0.9-1.0% so far. Investors will now wait for the New Home Sales data release at 10:00 a.m. This report indicates the level of new privately owned one-family houses sold and for sale. However, it is considered to be a lagging indicator of demand in the market. The S&P 500 futures contract (CFD) trades close to its new intraday all-time high, just below the level of 2,000. On the other hand, the level of support is at around 1,980-1,985, marked by recent local lows, as we can see on the 15-minute chart:

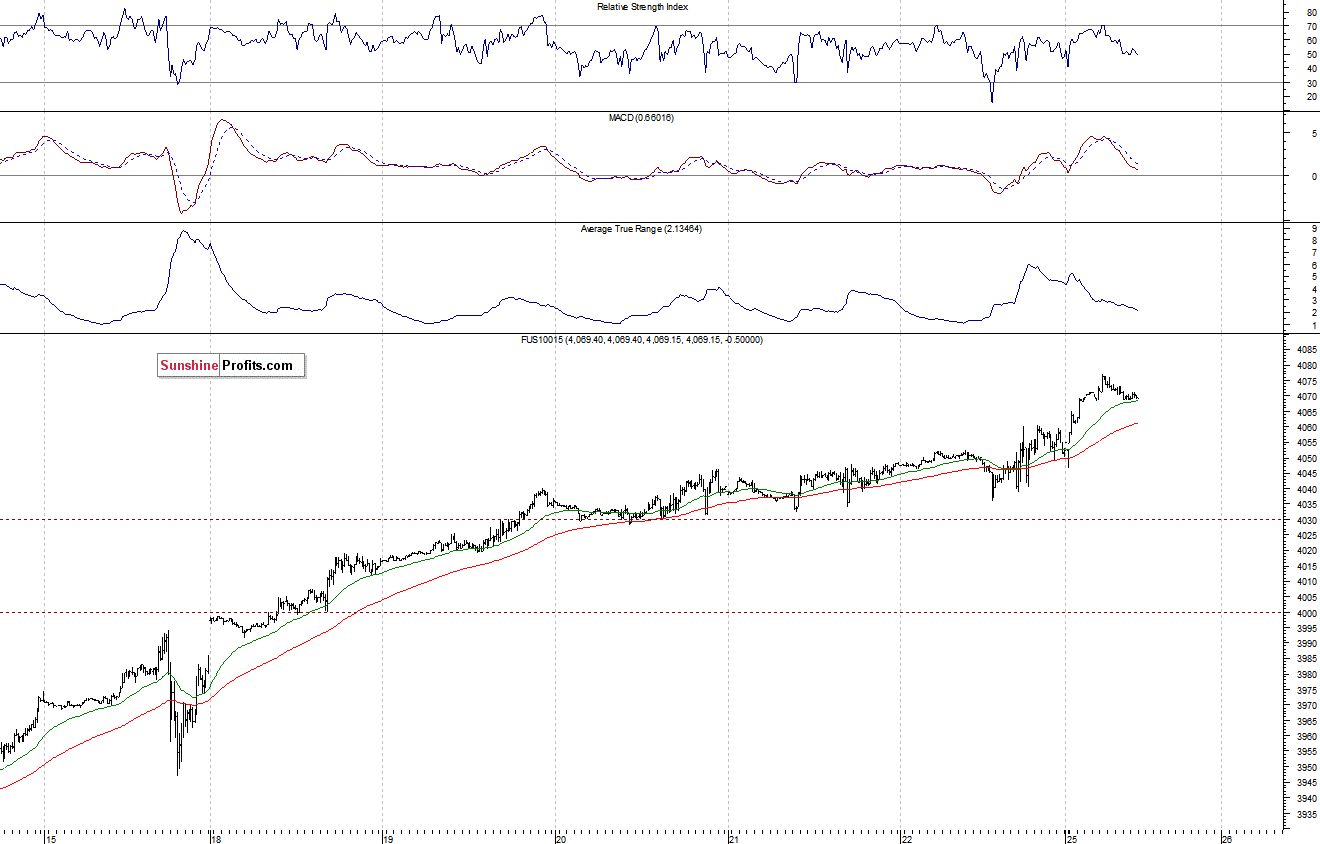

The technology Nasdaq 100 futures contract (CFD) follows a similar path, as it trades just below its long-term high. The nearest important resistance level is at around 4,080-4,100, and the support level is at 4,050-4,060, among others, as the 15-minute chart shows:

Concluding, the broad stock market extends its uptrend, as the S&P 500 index trades close to the level of 2,000. There have been no confirmed negative signals so far. However, there are some negative technical divergences, accompanied by short-term overbought conditions. In our opinion, no speculative positions are justified. We still prefer to be out of the market , just to avoid low risk/reward ratio trades. We will let you know when we think it is safe to get back in the market.

Recommended Content

Editors’ Picks

EUR/USD stays slightly above 1.0700 after mixed US data

EUR/USD lost its traction and turned negative on the day but managed to hold above 1.0700. Although the upbeat Employment Cost Index data boosted the USD earlier in the day, the weak consumer sentiment reading limits the currency's gains.

GBP/USD declines toward 1.2500 on renewed USD strength

GBP/USD turned south and dropped toward 1.2500 in the second half of the day. The US Dollar stays resilient against its rivals following the strong wage inflation data and doesn't allow the pair to gain traction.

Gold extends daily slide toward $2,300 as US yields edge higher

Gold stays under bearish pressure and declines toward $2,300 on Tuesday. The benchmark 10-year US Treasury bond yield stays in positive territory above 4.6% after US Employment Cost Index data, weighing on XAU/USD.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.