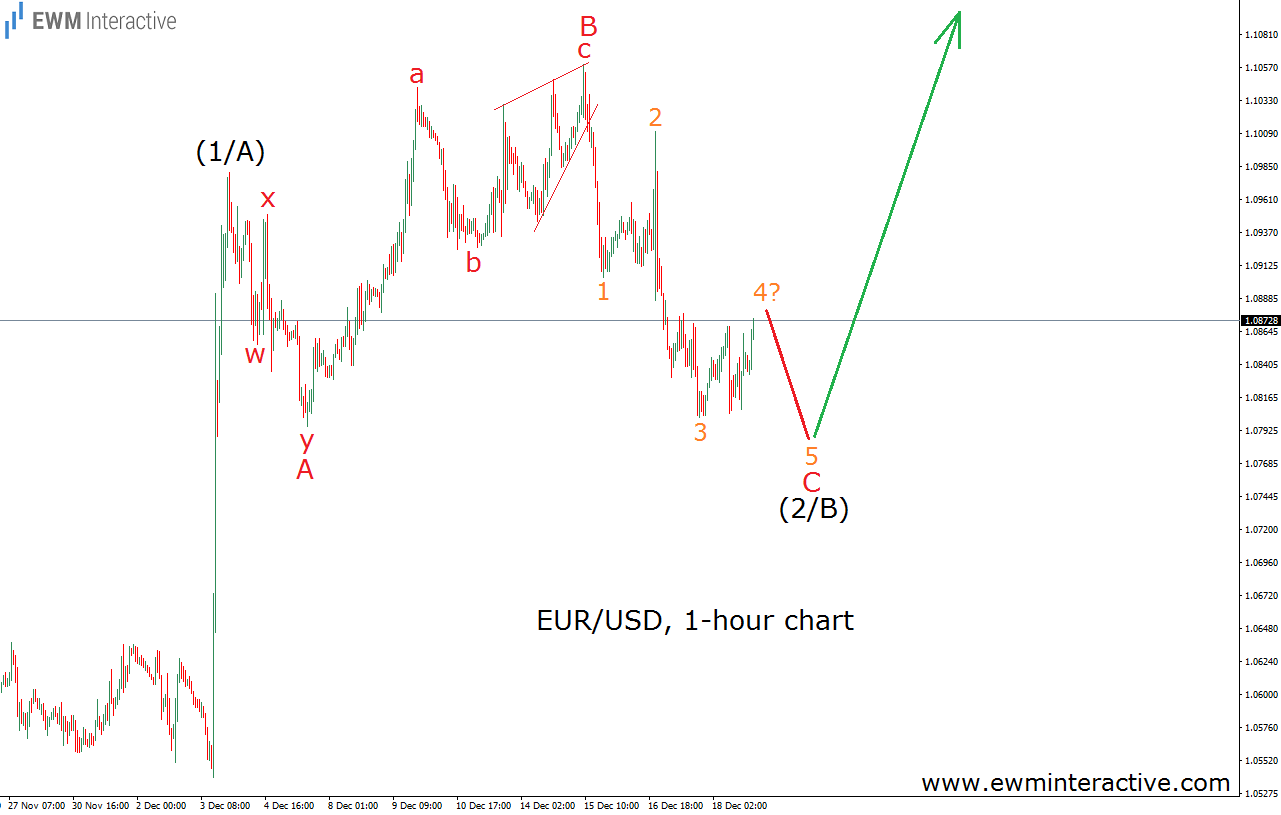

Back in 2015, on December 19th, the majority of market analysts expected EURUSD’s post-ECB gains to be completely erased very soon, especially with the FED having raised interest rates for for the first time since 2006. Instead of going with the flow, we published “Time for EURUSD Bulls to Shine Again?”. The article’s purpose was to warn the bears to calm down, because the Elliott Wave Principle suggested the bulls are likely to have the upper hand, regardless of what Draghi and Yellen were doing or saying. The chart below shows how EURUSD looked like almost two months ago.

That is one of the two bullish wave counts, which made us say that as long as the invalidation level at 1.0540 is safe, “EURUSD could be anticipated to climb to 1.1100 or even higher.” Those of you, who have been watching this pair closely, know how things went, but let’s refresh your memory with the next chart.

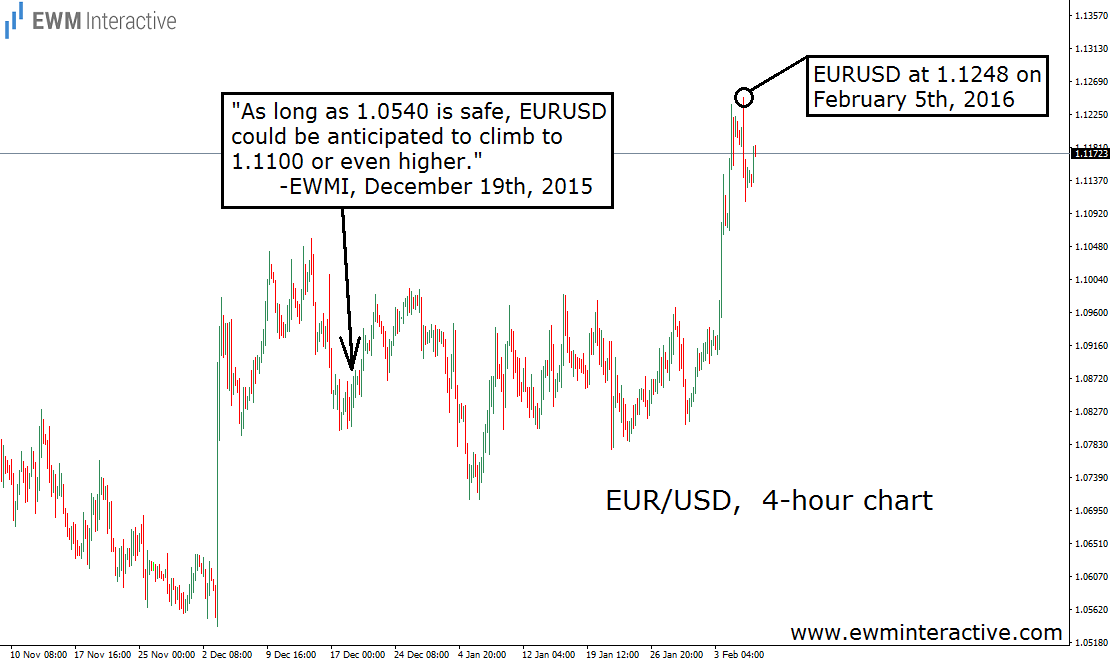

The expected rally did not start immediately. The exchange rate decided to stay in a range between 1.0710 and 1.0990 until the end of January. However, 1.0540 was never in danger, so all we had to do is to keep calm and wait.

Then, in the beginning of February, EURUSD woke up from lethargy. The recovery resumed and EURUSD not only reached, but exceeded the 1.1100 target by a large margin, climbing as high as 1.1248.

This situation is another great example of the Wave Principle’s ability to help disciplined and patient traders achieve their goals in the FOREX market.

What to expect from now on? Is EURUSD going to continue even higher or the resistance at 1.1250 would turn out to be too strong for the bulls to breach? Prepare yourself for whatever is coming. Order your on demand Elliott Wave analysis now or pre-order the one due out on February 29th at our Premium Forecasts section. Stay ahead of the news in any market with the Elliott Wave principle.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Relief wave on altcoins likely as BTC shows a $5,000 range

Bitcoin price has recorded lower highs over the past seven days, with a similar outlook witnessed among altcoins. Meanwhile, while altcoins display a rather disturbing outlook amid a broader market bleed, there could be some relief soon as fundamentals show.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.