USD JPY has been in a strong uptrend for the last two months. Is it time for the bulls to take a rest? Traders may want to see what the probabilities show.

Our job as analysts is to try to determine when the trend is most likely to reverse or make a pull-back. In order to do that, we use a method, called the Elliott Wave Principle. It is probably the most advanced price-pattern recognition technique. According to it, trends move in five-wave sequences, called impulses. Every impulse is followed by a correction in the opposite direction. So, in the case with USD JPY, we have to see, if there is a complete five-wave move. If there is one, we should prepare for a pull-back.

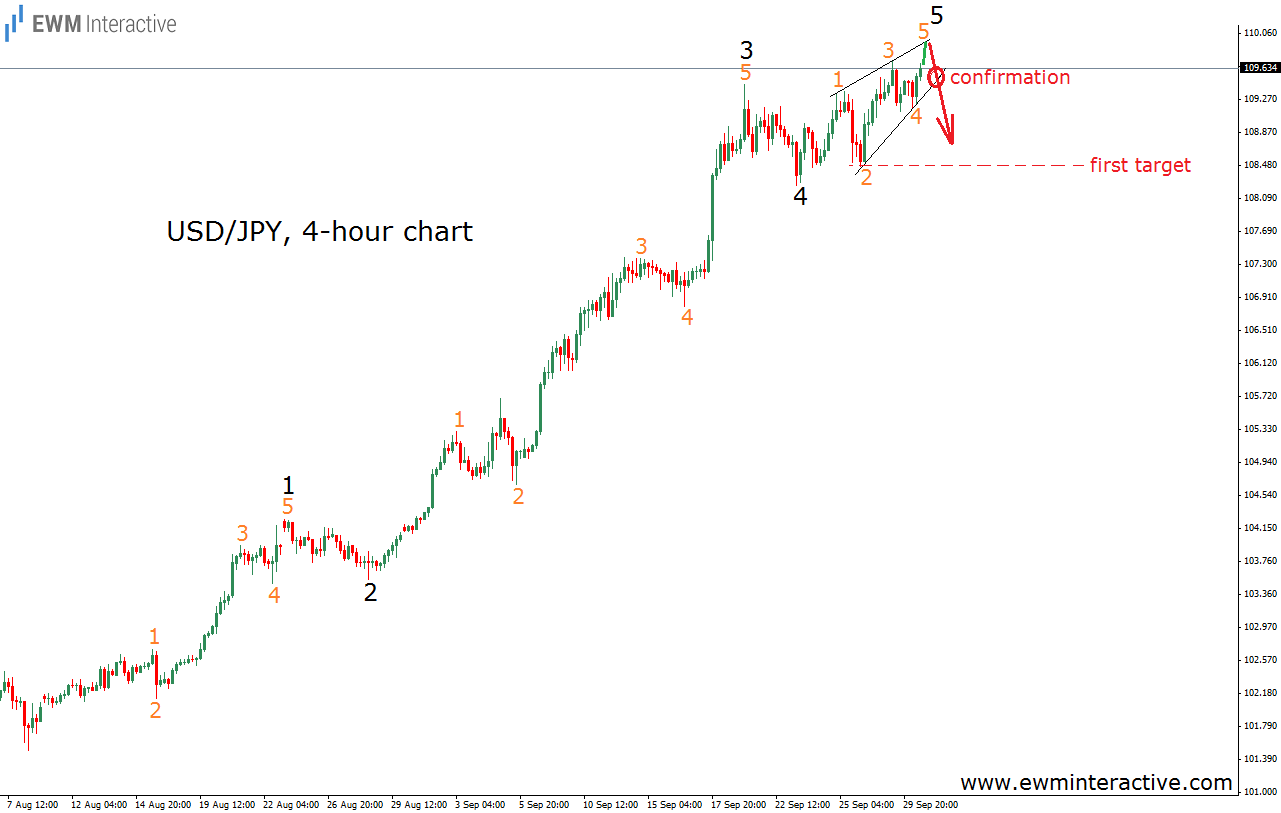

And the 4-hour chart shows a very clear impulsive rally, which seems to be approaching the end of its fifth wave. Fifths waves take the form of either a regular “five” or an ending diagonal. Judging from the wave structure, it looks more like the second possibility. Those of you, who have read our article about ending diagonals, probably know that this is a very tricky pattern. That is why there are three different approaches, when it comes to trading, depending on what type of trader you are. The more aggressive your style is, the earlier you pull the trigger – at the top of wave 5 of the diagonal. Conservative traders prefer to wait for the extreme of wave 4 to give away before initiating a trade. And the third choice is the one we fancy – to wait for the lower line of the diagonal to be broken. There is no right or wrong way to trade this pattern. It all depends on you personal risk tolerance and trading style.

If this is the correct count, USD JPY should make a new high above 109.74, but the 110.00 area may serve as a strong resistance and a reversal zone. The first target to the downside is around 108.50.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.