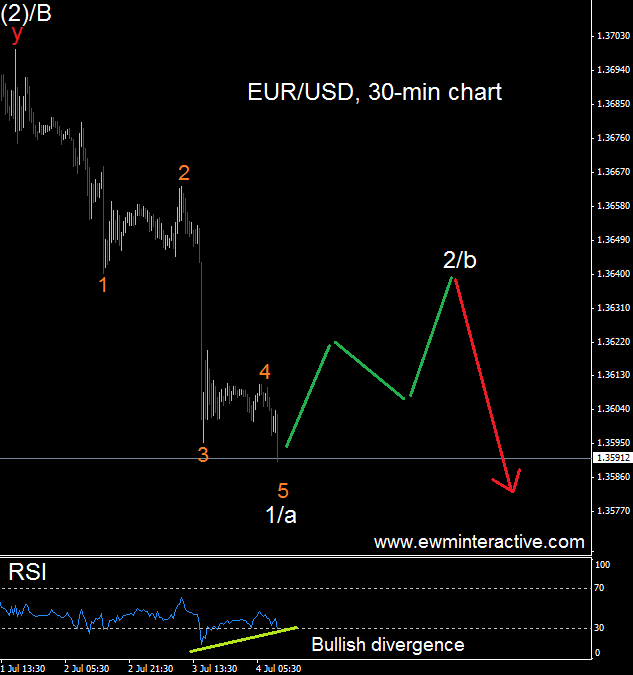

A week ago we published an article in our intraday section called “EURUSD confirms bearish reversal”. With a completed five-wave impulse down, we were expecting a three-wave retracement, saying that “prices could return to the zone around 1.3640 before the downtrend in EURUSD resumes.” Here is how the chart of this pair looked like back then.

Now let’s see what has happened during the seven days after the forecast. Spoiler alert: you will be amazed with the accuracy of the Elliott Wave Principle.

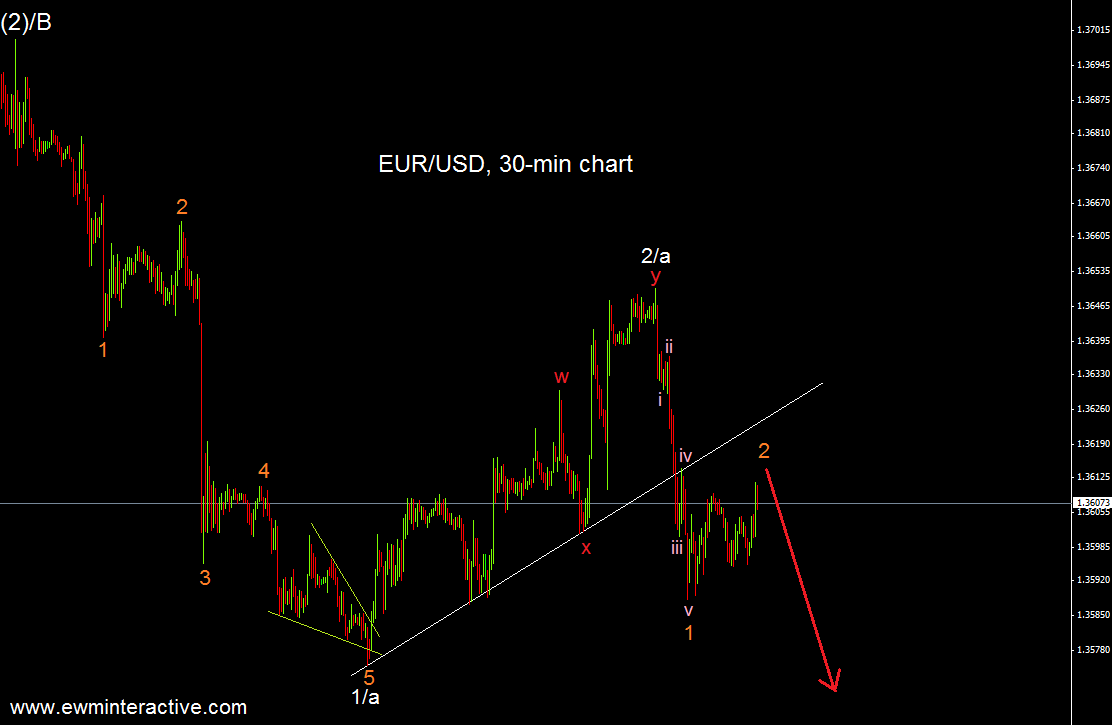

As visible, EURUSD made a double zig-zag correction to the north, reaching 1.3650. What happened after that is more interesting. Prices began declining, dropping-off to 1.3587. What is more important is the wave structure of this new down-move. It looks impulsive as well, labeled i-ii-iii-iv-v, so we can presume this is the resumption of the downtrend we were talking about in the previous analysis.

Recommended reading: EURUSD ready to make a move

Now we expect this broken white trend line to serve as a resistance, from which EURUSD could begin the next sell-off in wave 3 of 3/c. If this is the correct count, target around 1.3520 should not be a problem. The invalidation of this intraday scenario is at 1.3650.

Trading financial instruments entails a great degree of uncertainty and a variety of risks. EMW Interactive’s materials and market analysis are provided for educational purposes only. As such, their main purpose is to illustrate how the Elliott Wave Principle can be applied to predict movements in the financial markets. As a perfectly accurate method for technical analysis does not exist, the Elliott Wave Principle is also not flawless. As a result, the company does not take any responsibility for the potential losses our end-user might incur. Simply, any decision to trade or invest, based on the information from this website, is at your own risk.

Recommended Content

Editors’ Picks

USD/JPY crashes toward 156.00, Japanese intervention in play?

Having briefly recaptured 160.00, USD/JPY came under intense selling and sank toward 156.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD rallies toward 0.6600 on risk flows, hawkish RBA expectations

AUD/USD extends gains toward 0.6600 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.