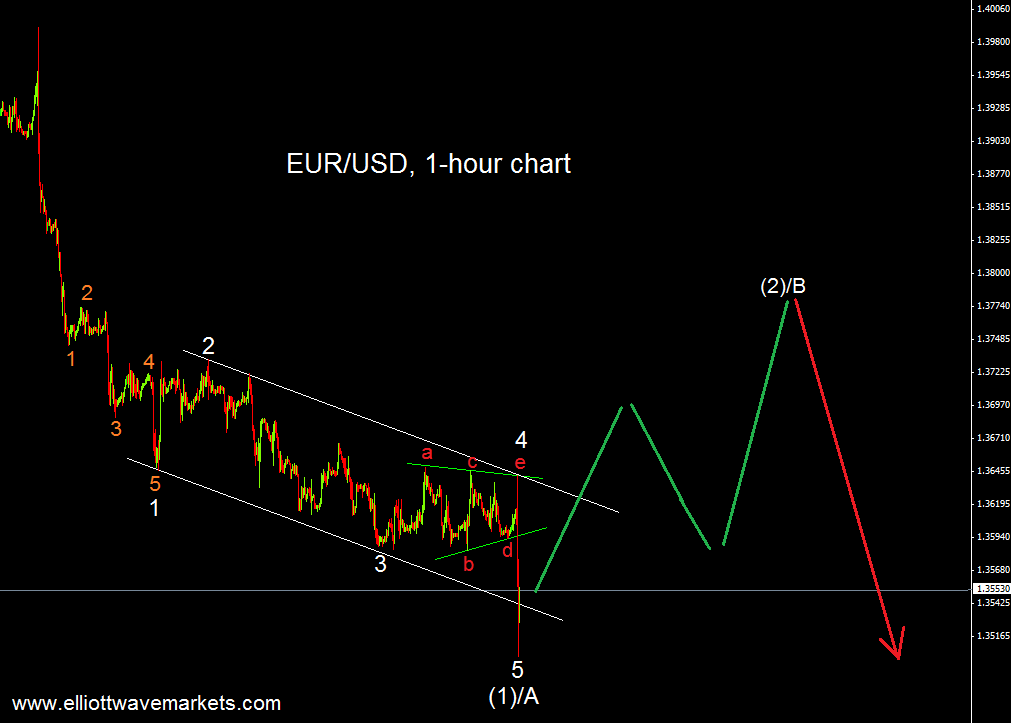

On June 5th we showed you an analysis of EURUSD suggesting that we have a complete impulse to the south and therefore we should prepare for a three-wave correction in the upward direction. On the chart below you can see how EURUSD looked like when that forecast was made.

The previous analysis was published right after the European Central Bank lowered the interest rates. However, we as Elliotticians, cannot afford to let the news distract us. That is why the sell-off after the ECB announcement was just a normal fifth wave down for us. And the last thing you should do during fifth waves is going with the crowd. Almost a month later we can see how the situation has been developing so far.

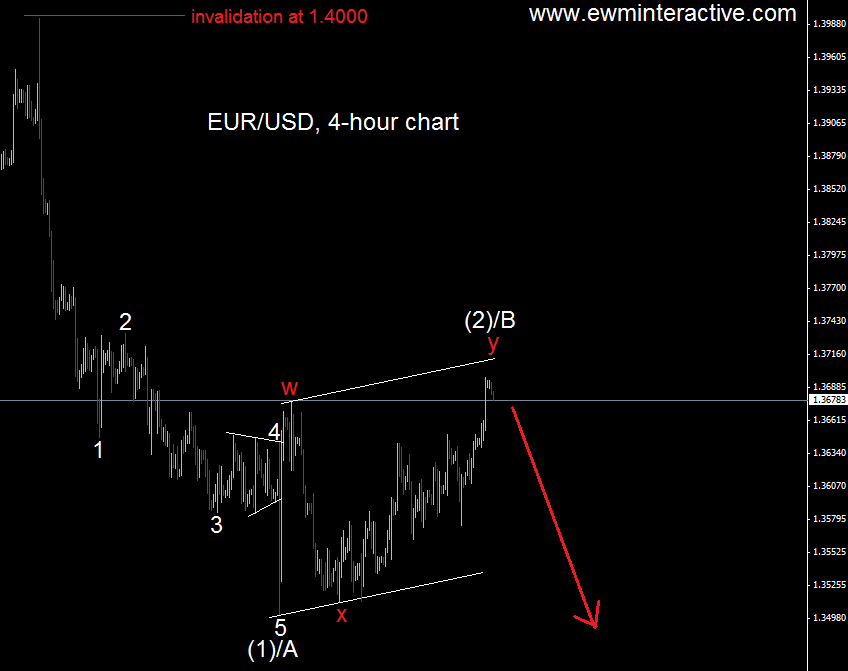

The three-wave retracement to the north is a fact already. Five waves down from 1.40 to 1.35, followed by three waves up to 1.37 means that EURUSD has made the familiar Elliott Wave 5-3 cycle. Now we can expect the trend to resume with another five-wave decline. Keep in mind that this count would be invalidated at 1.4000. In other words, prices could extend their rally some more, but as long as 1.40 holds, we will look at EURUSD from the short side.

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.