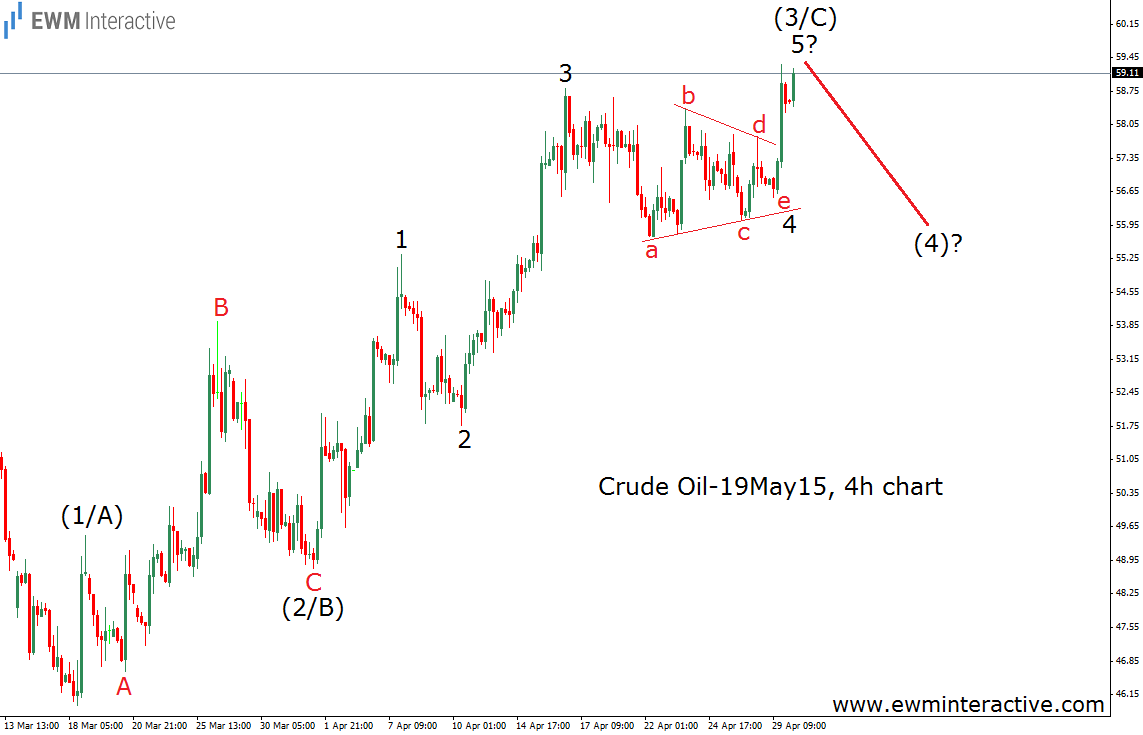

In our previous post about crude oil we thought the “black gold” is in a post-triangle wave 5. That is why we said it was not a good time to go long on crude oil. Once that fifth wave was over, there was likely to be a reversal to the downside. The next chart shows how the forecast looked like less than a month ago, on April 30th.

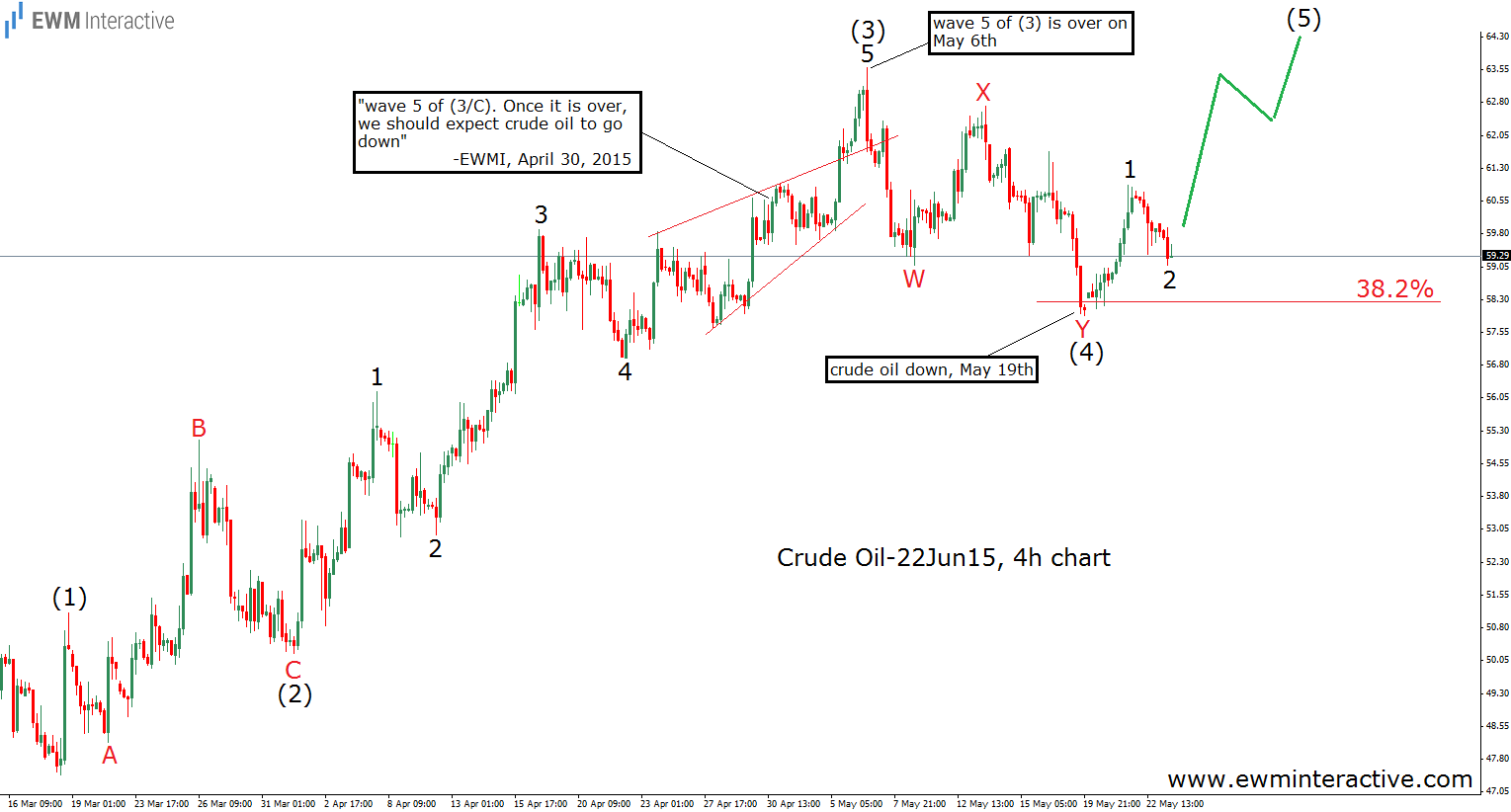

Now we could say that wave 4 was not a triangle. Instead, some of the price swings we thought were part of a triangle, turned out to be part of an ending diagonal in wave 5. Nevertheless, the count did not change much. We were still expecting a bearish reversal. The chart below demonstrates how crude oil has been developing ever since.

The price of crude oil topped on May 6th. Less than two weeks later, it stood more than $5 lower. The three-wave decline we were waiting for developed as a W-X-Y double zig-zag. Fourth waves usually retrace the third wave to the 38.2% Fibonacci level. This is precisely the area, where crude oil prices found support on May 19th. So, if this count is correct, wave (5) to the upside could already be in progress. Unless it becomes truncated, it has the potential to take crude oil prices above $64 per barrel

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.