Stabilization attempt

S&P 500 paused the decline as per yesterday‘s premium analysis, and weak ASML (guidance) helped it back towards the low 5,120s that form the upper border of the range marked on the downside by my 5,080 target talked intraday (ultimately hit). Powell didn‘t add to bullish sentiment either, and little wonder with market yields solidly trending higher (10y practically 4.70%), doing the Fed‘s tightening when CPI yoy is 3.5%.

On top of Mideast escalation (timing) unpredictabilities, we have also BoJ monitoring USDJPY at 104.70 yesterday and today, which is sure to do wonders for inflation in Japan. Add in manufacturing PMIs and overall LEIs turning, and you have even more impetus for yields rising, and given my calls for earnings to start disappointing in Q2 (it all starts with guidance now, and we know how financials were treated Friday), that‘s a perfect constellation for pushing stock prices down – some faster than others, and that‘s what our intraday calls are good for unless you play indices swing.

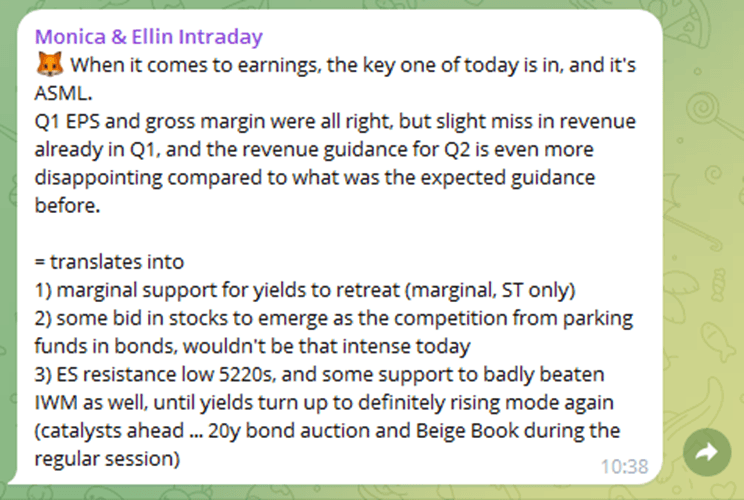

This is how I summed it up this European morning in our channel.

Let‘s move right into the charts – today‘s full scale article contains 3 more of them, with commentaries.

Tired of seeing those red boxes instead of way more valuable information? Try the premium services based on what and how you trade.

Credit markets

This is the chart least likely to be broken – yields rising, doing Fed‘s job and reflecting still humming economy, manufacturing recovery and sticky inflation to name a few, all called for you in prior weeks and months.

The rush into gold on safe haven demand was much weaker than Saturday‘s PAXG spike would suggest, and that hints at most easiest gold gains on the long side being already in, and a period of relative consolidation starting – and that would involve occassional selloffs. Unless gold goes below $2,320, the momentum on the downside wouldn‘t though develop. Silver is to be more resilient, just as copper.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.