Daily Forecast - 20 January 2016

Emini Dow Jones March contract

Emini Dow Jones tested quite good support at 15550/530 & bottomed exactly here. THERE IS A GOOD CHANCE WE HAVE JUST SEEN A LOW FOR THE DAY & FOR THE CORRECTION AT THIS STAGE. As I write we have bounce to 15638. If we continue higher look for resistance at 15730/735. We should struggle here & a high for the day not out of the question, but if we continue higher look for the next target & resistance at 15855/865. No further gains expected today. Try shorts with stops above 15895. A break higher then targets 15960.

Good support at 15550/530 is holding. Failure here however could target 15460/450. If we continue lower look for 15385 before very, very important August mini crash lows at 15285/275.

S&P March contract

Emini S&P has now tested the August & 2015 lows at 1831. *Obviously this is the most important support of the week & there is a chance of a low for the correction here once again.* A break below here however is a strong sell signal but we do need a close below to confirm. This is likely to trigger sell orders targeting 1818/17 & 1808/07, perhaps as far as April 2014 lows at 1804/03.

As I write we have bottomed almost exactly at the August & 2015 lows at 1831. The expected recovery has reached 1839 but above here look for 1849. From here up to resistance at 1852 looks like a potential high for the day. Shorts need stops above 1858. A break higher sees 1853/52 act as support to target 1866/67. Shorts need stops above 1871.

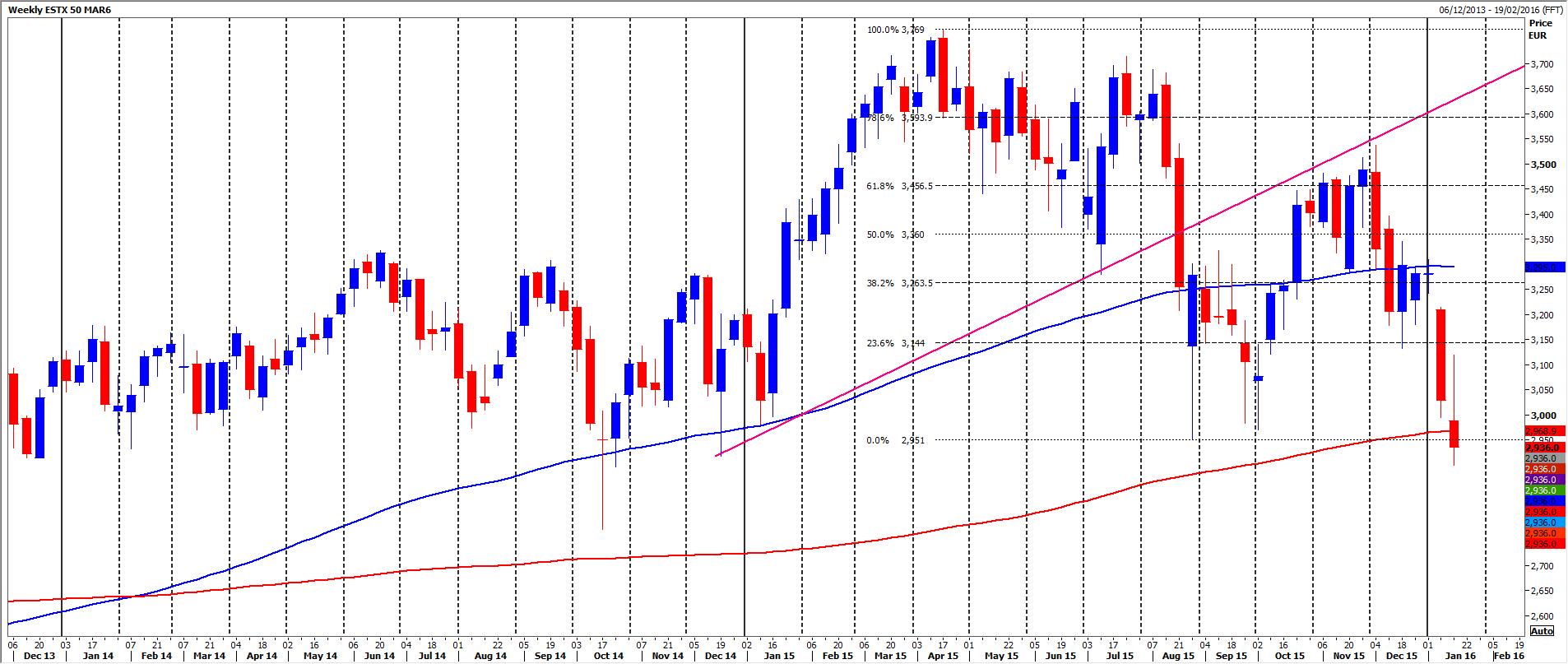

Eurostoxx March contract

EuroStoxx has broken lower as far as targets 2880 & 2863. We bottomed exactly here at 2861. Be aware that although this is not an important support the Dax & Emini S&P have tested August mini crash lows & held. Therefore a recovery is now possible & initially targets 2900. If we continue higher look for resistance at 2922/23. We should struggle here with a good chance of a high for the day. However A break above 2930 keeps bulls in control to target a selling opportunity at 2960/65.

Failure to hold above 2830 however risks a slide to quite good support at 2848/44. However further losses could target 2825/23.

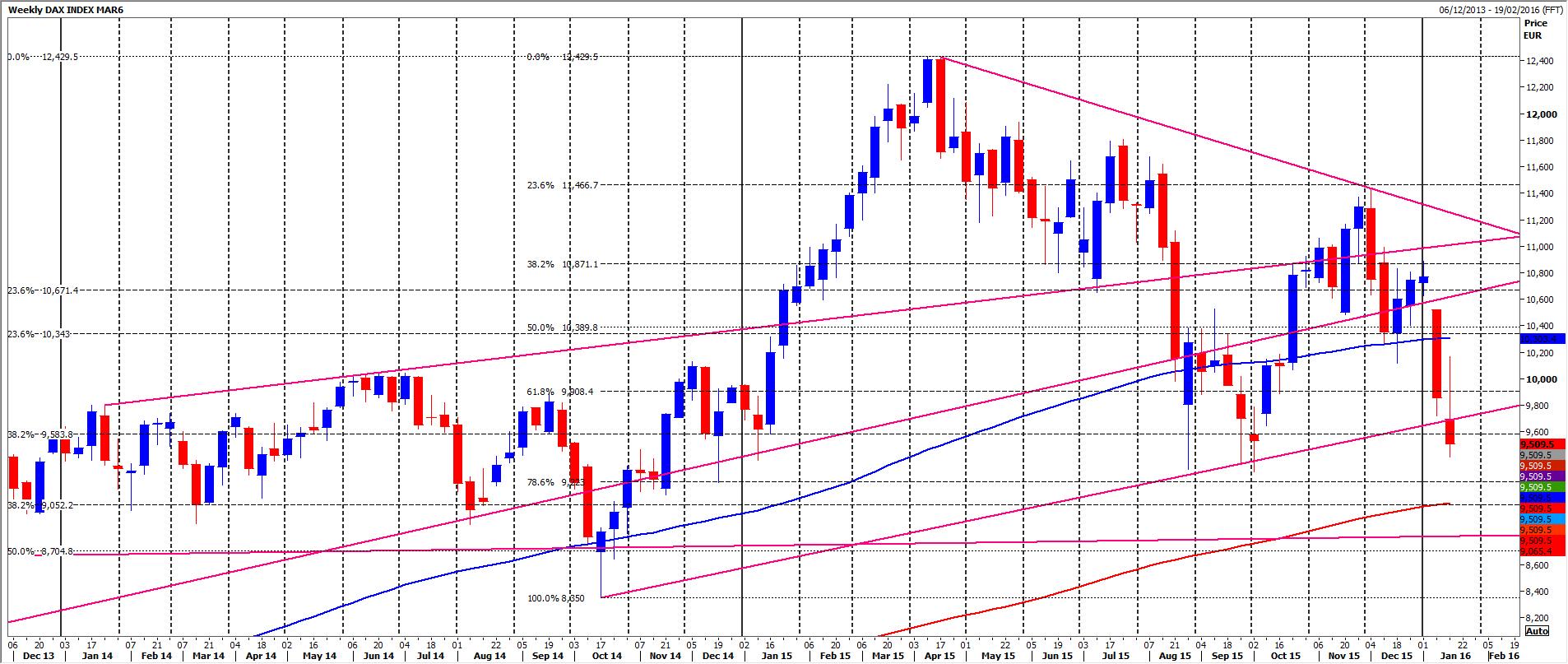

Dax March contract

Dax has tested the most important support of the week at 9317/9301. This is the September/August double bottom low & the last line of defense for bulls now. As I write, we have bottomed exactly here. THERE IS A GOOD CHANCE THAT THIS IS THE LOW FOR THE MOVE LOWER AT THIS STAGE. First resistance at 9410 but above here targets strong resistance at 9510/15. A break above 9530 however keeps bulls in control & targets resistance at 9640. Just be aware that further gains could then target an excellent selling opportunity at 9740.

A close below 9300 starts a new leg lower in the 9 month bear trend & targets 9230/20. If we continue lower look for 9130/20. JUST BE AWARE THAT WE THEN MEET VERY STRONG SUPPORT AT 9060/9050. More on this if we approach it during the week.

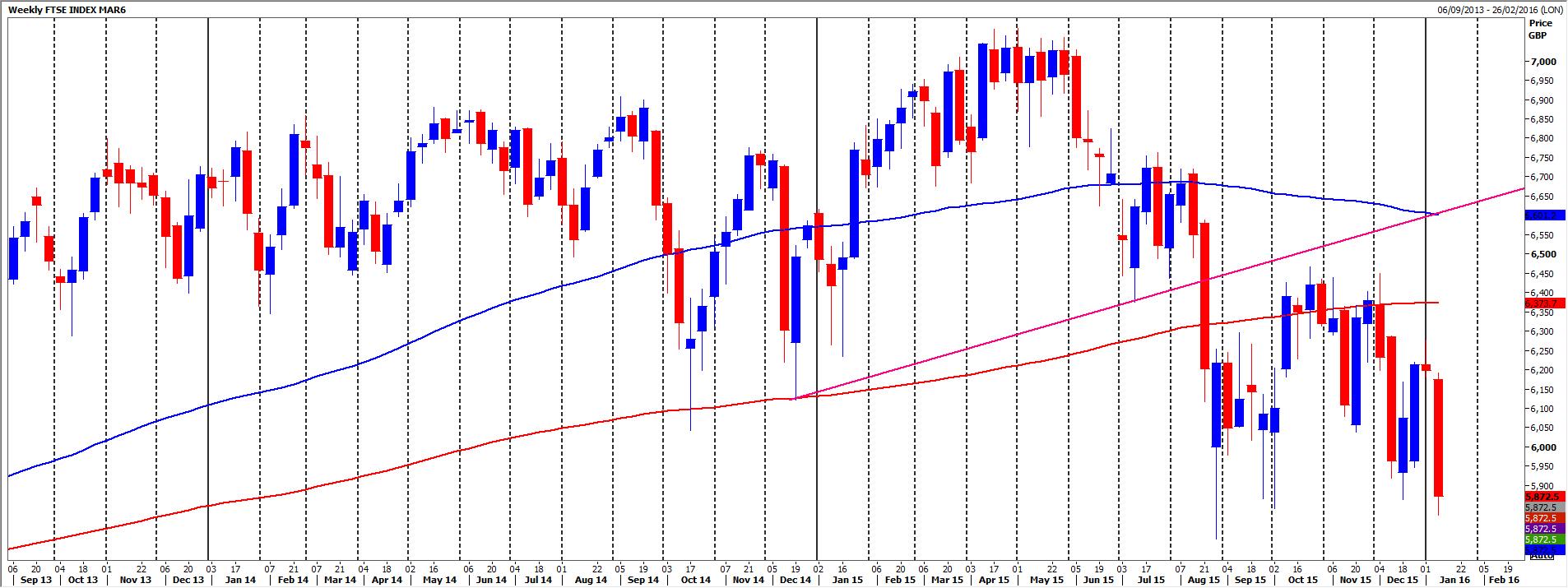

Ftse March contract

FTSE broke important support at 5690/80 to hit 5641. We may just see a recovery now as other indices hold August lows. First target is 5980/85 but above here look for resistance at 5711/15. This could hold a rally but further gains target a selling opportunity at 5750/55. Shorts need stops above 5775. A break higher targets 5795 then strong resistance at 5825/30.

Failure to hold above 5640 targets strong support at 5615/10. There is a very good chance of a bounce from here but longs need stops below 5590. A break lower could target 5575, 5545, 5530.

E Mini Nasdaq March contract

Emini Nasdaq has collapsed again hitting the target of September lows at 4041. There are signals that we may have now seen a low for the day...perhaps even for the correction at this stage. First target is 4077 then resistance at 4096/99. We should struggle here but if we continue higher look for 4125 then strong resistance at 4135/38. Try shorts with stops above 4145. Just be aware that a break higher from here then targets 4166/69 & perhaps as far as a selling opportunity at 4190/95.

A break below 4035 targets 4000/3999. A break below 3990 risks a slide to 3982 then 3960/56.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.