Daily Forecast - 20 January 2016

EURGBP Spot

EURGBP clearly in a powerful bull trend as we target 7736/39. Further gains target 7757/60 then 7780/82. If we continue higher look for resistance at 7795.

Support at 7715/13 but below 7695 risks a slide to 7660. The downside is likely to be limited in the negative trend but further losses offer an excellent buying opportunity at 7635/30.

EURUSD Spot

EURUSD first resistance at 1.0940/44 but a break above the 2 day high today could retest last week's high at 1.0984. Further gains target an excellent selling opportunity at 1.1020/25. There is a good chance of a high for the day & even for the week but shorts need stops above 1.1060.

Holding below 1.0920 targets 1.0900/1.0895 then support at 1.0880/76. A good chance of a low for the day and this did just hold yesterday, but longs need stops below 1.0850. Further losses target 1.0835/31 then support at 1.0815. Try longs with stops below 1.0795. Further losses however could target 1.0765/62. If we continue lower look for support at 1.0740/35 to hold the downside.

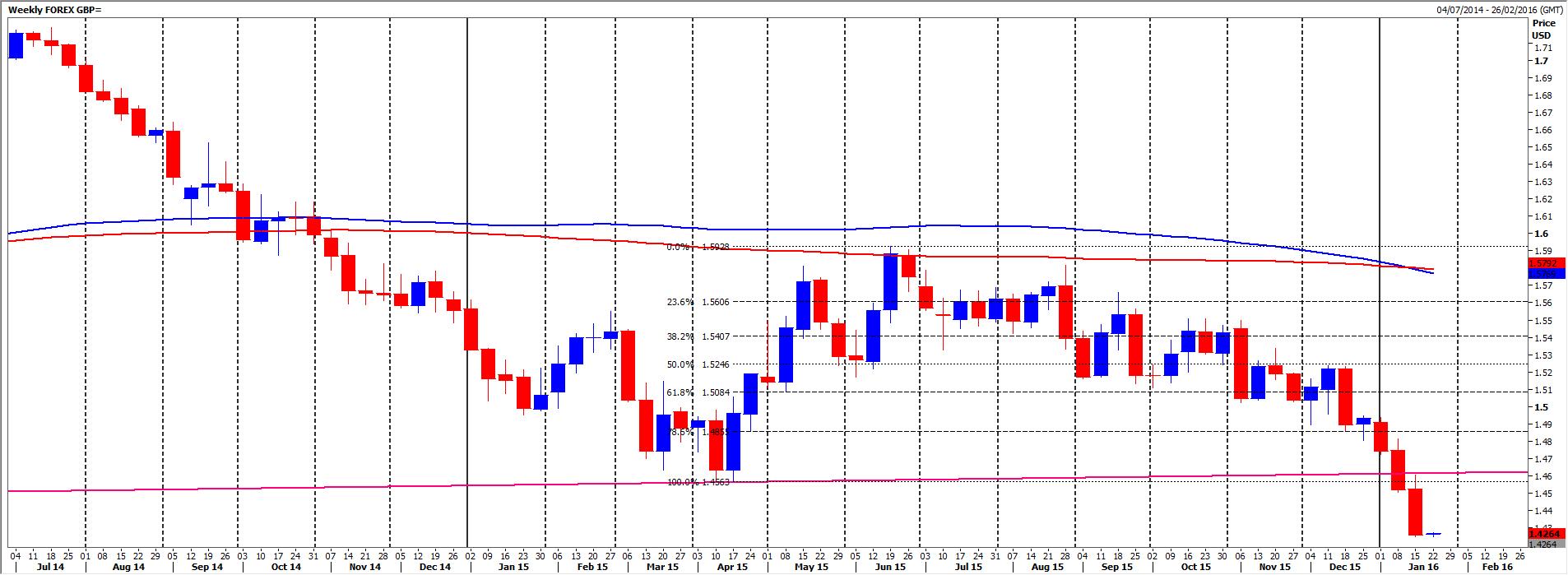

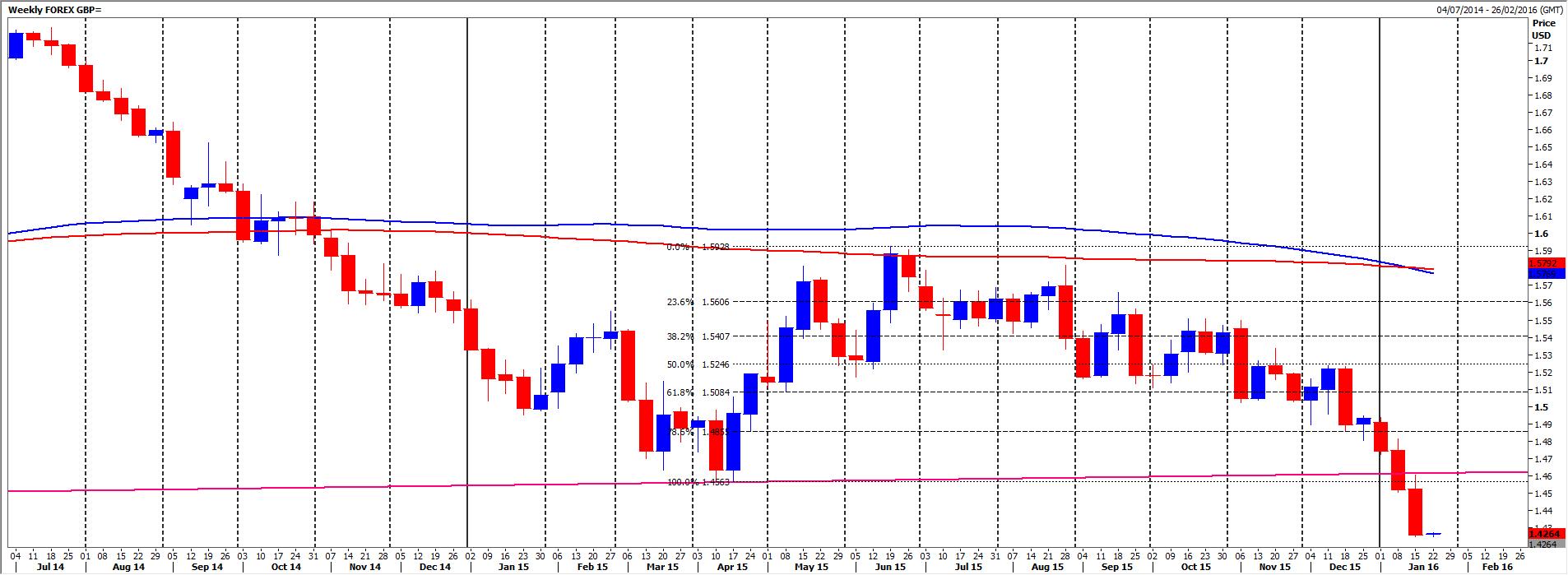

GBPUSD spot

GBPUSD recovery could target 1.4183/80, perhaps as far as 2010 year lows at 1.4230/35. This could hold a rally but further gains meet a selling opportunity at 1.4285/90. Shorts need stops above 1.4320.

Needless to say this is a bear trend so failure to beat 1.4183/80 re-targets 1.4134/30 & perhaps as far as 1.4108. Further losses target 1.4090 & 1.4050/45.

USDJPY Spot

USDJPY has dipped back to 117.21/25 & this held perfectly for a bounce to first resistance at 117.65/70. Again gains are expected to be limited but if we continue higher look for another selling opportunity at 118.10/15. Try shorts with stops above 118.30. An unexpected break higher however targets 118.45/49.

First support at 117.21/25 but below targets 117.00/95 then 116.70/67. August lows at 116.46 are important today of course. A break below here however is obviously negative therefore & could target January 2015 lows at 115.82. This is now the most important support of the week. A break below here however targets 1 year lows at 115.56.

AUDUSD Spot

AUDUSD closing in on 6885/81 but the outlook remains negative so we could continue lower to 6855/50. Further losses retest last week's low at 6829/24. This is not a particularly important support so be ready to sell a break below here to target 6801/00, 6765/60 & 6735/30.

If we hold 6881/85 look for a bounce to resistance at 6915/20. Gains are expected to be limited but look for a selling opportunity again at 6945/50 if we reach this far. Shorts need stops above 6980. An unexpected break higher however targets an excellent selling opportunity at 7015/20.

The contents of our reports are intended to be understood by professional users who are fully aware of the inherent risks in Forex, Futures, Options, Stocks and Bonds trading. INFORMATION PROVIDED WITHIN THIS MATERIAL SHOULD NOT BE CONSTRUED AS ADVICE AND IS PROVIDED FOR INFORMATION AND EDUCATION PURPOSES ONLY.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700 as USD struggles ahead of data

EUR/USD is posting small gains above 1.0700 in the European session on Thursday. The pair remains underpinned by a sustained US Dollar weakness, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.