US stocks rose in the futures market as investors reflected on the strong quarterly results by Alphabet and Microsoft. Microsoft’s revenue jumped to more than $45.3 billion in the third quarter, helped by the strong demand for cloud computing services. Analysts were expecting the company’s revenue to jump to $44.5 billion. Its net income for the quarter was $20.5 billion. Meanwhile, Alphabet’s revenue jumped to $65.11 billion as digital advertising grew. Its net income rose to more than $18.94 billion, which was double where it was in the same quarter last year. These companies joined other firms like JP Morgan, Goldman Sachs, and Morgan Stanley that have reported strong results.

The Australian dollar declined against the US dollar as investors reflected on the latest Australian inflation numbers. The data showed that the headline consumer price index (CPI) declined from 3.8% in the second quarter to 3.0% in Q3. This decline was worse than the median estimate of 3.1%. In the same period, the trimmed-mean CPI rose to 2.1% while the weighted mean inflation rose to 2.2%. Still, analysts expect that consumer prices will keep rising in the fourth quarter as energy prices soar. Elsewhere, in New Zealand, exports jumped to N$4.4 billion while imports rose to N$6.57 billion.

The Canadian dollar declined sharply as investors waited for the latest Bank of Canada (BOC) interest rate decision that will come out later today. Analysts expect that the bank will leave interest rates unchanged at 0.25%. The biggest change is that the bank will likely reduce the size of its asset purchases to about C$1 billion per week. This will be the fourth time that the bank has tapered in the past 12 months. Analysts also expect that the bank will hint about higher interest rates, which will likely happen in the first half of 2022.

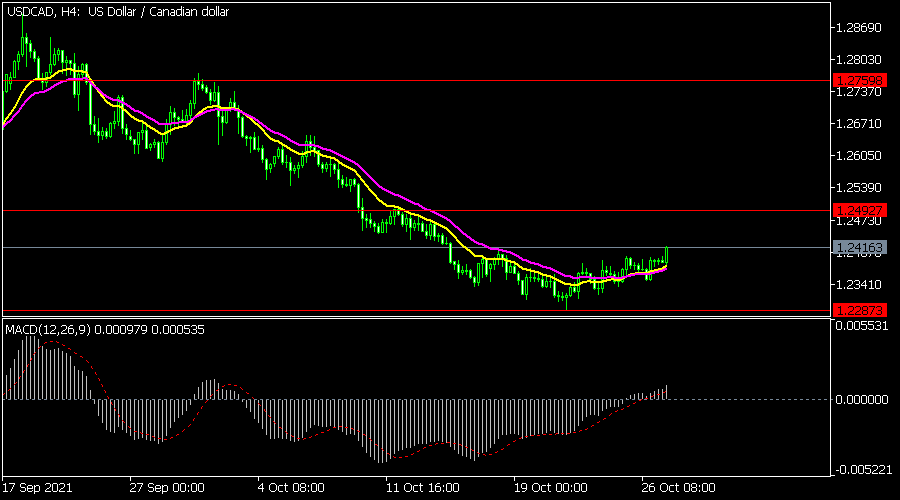

USD/CAD

The USDCAD pair jumped to a high of 1.2415, which was the highest level since October 15. This price was substantially higher than this month’s low of 1.2287. On the four-hour chart, the pair has moved above the 25-day and 50-day moving averages. It also moved slightly above the neckline of the inverted head and shoulders pattern. The MACD has also moved above the neutral level. Therefore, the pair will likely keep rising as bulls target the next key resistance level at 1.2500.

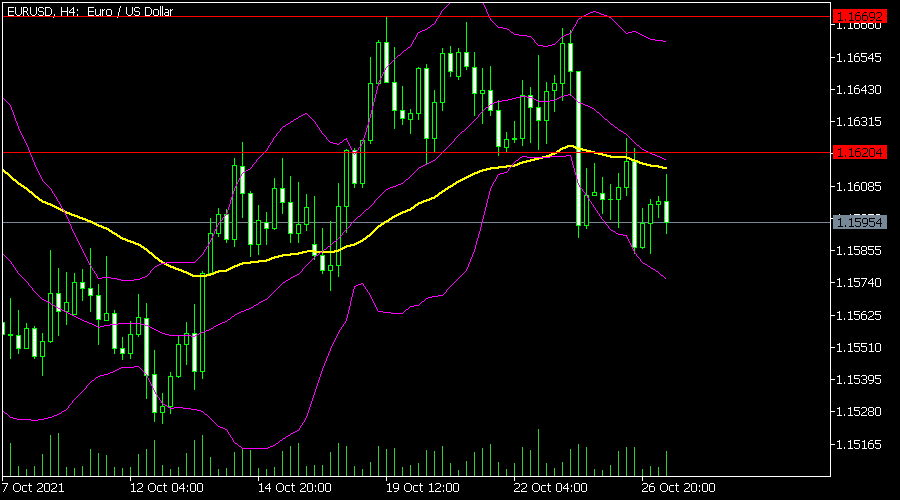

EUR/USD

The EURUSD has little changed ahead of the latest European Central Bank (ECB) interest rate decision. It is trading at 1.1595, which was lower than the neckline of the triple-top pattern at 1.1620. On the four-hour chart, the pair moved between the lower and middle lines of the Bollinger Bands indicator. It also declined below the 25-day moving average. Therefore, the pair may keep falling as bears target the next key support at 1.1550.

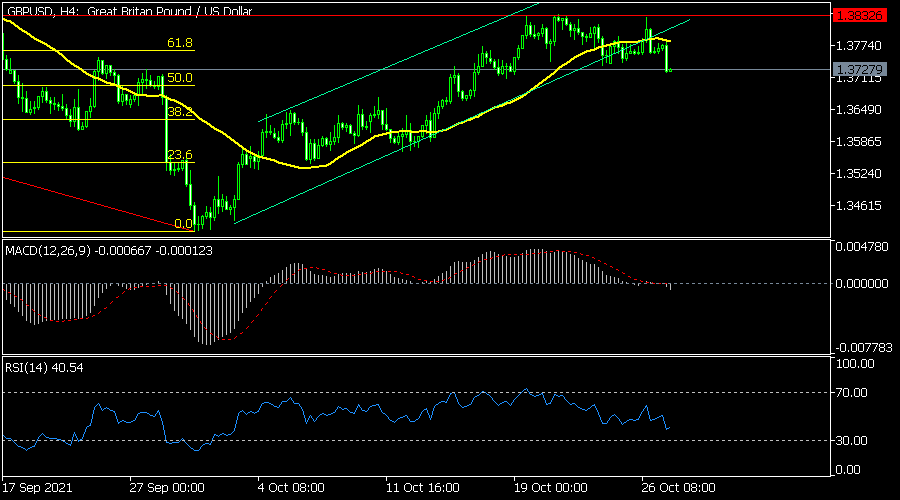

GBP/USD

The GBPUSD made a bearish breakout as traders waited for Rishi Sunak’s budget speech. It declined to a low of 1.3725. On the four-hour chart, the pair moved below the lower side of the ascending channel. It also approached the 50% Fibonacci retracement level. The MACD also declined below the neutral level while the RSI has been in a bearish trend. Therefore, the pair will likely keep falling as bears target the next key support at 1.3650.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.