S&P 500 avoids bear market as volatility eases

The S&P 500 index avoided moving to a bear market as investors reacted to a relatively positive statement by Joe Biden on tariffs. It rose by more than points on Monday. Similarly, the Dow Jones and the Nasdaq 100 indices rose by over 700 points and 145 points, respectively. At the same time, the US dollar index retreated while bond yields rose. In a statement, Biden said that his administration was considering doing away with Trump’s tariffs. Many officials in Washington believe that these tariffs amounted to an unnecessary tax, and they hope that removing them will lead to lower inflation.

The euro rallied against other currencies as investors reacted to a highly hawkish blog post by Christine Lagarde of the ECB. In it, she explained the reasoning behind the bank’s most recent decisions. She also signaled that the bank would embrace a more hawkish tone in the coming months as it continues to battle the soaring inflation. She said that the bank will start hiking interest rates in July and then exit negative rates in September. The currency will today react to her statement in which she will likely explain her case. Markit will also publish the flash manufacturing and services PMI data from the bloc.

There will be several economic data releases today. The most important will be the latest flash manufacturing and services PMI numbers from Europe and the US. In the UK, economists expect the data to reveal that the manufacturing and services PMIs increased slightly to 56 and 59, respectively. In the euro area, analysts expect the data to show that the two declined to 54.9 and 57.5. The other important number will be the latest new home sales from the US. These numbers are expected to show that the housing sector is slowing down. Finally, Jerome Powell and Christine Lagarde will talk.

EUR/USD

The EURUSD pair rose to a high of 1.0675 after the hawkish statement by Christine Lagarde. It was the highest level since late April. On the four-hour chart, the pair is along the upper side of the Bollinger Bands. The pair has also formed what looks like an inverted head and shoulders pattern. The Stochastic Oscillator and the Relative Strength Index have moved above the overbought level. Therefore, the pair will likely keep rising.

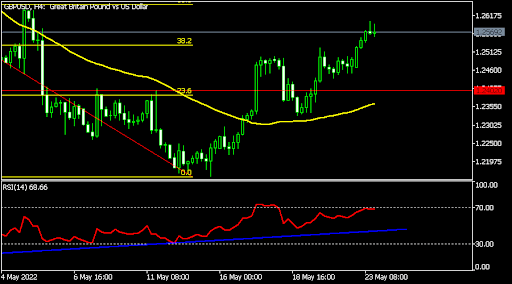

GBP/USD

The GBPUSD pair has been in a strong bullish trend in the past few days. On Monday, the pair moved above the important resistance level at 1.2500. It has moved above the 38.2% Fibonacci retracement level. It has also risen above the 25-day and 50-day moving averages while the Relative Strength Index (RSI) is approaching the overbought level. The bullish momentum will likely continue.

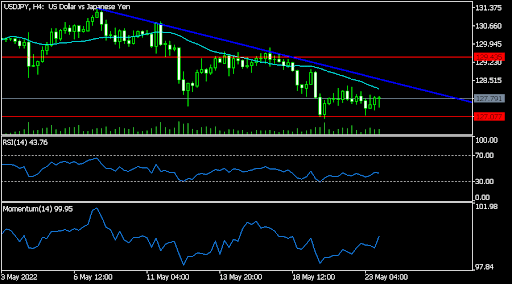

USD/JPY

The USDJPY pair has moved sideways in the past few days. The pair is trading at 127.8, which is slightly above the key support at 127.0. It has formed a descending triangle pattern. Also, it has declined below the 25-day and 50-day moving averages. The RSI and the momentum have moved slightly upwards. Therefore, the pair will likely have a bearish breakout in the near term.

Author

OctaFx Analyst Team

OctaFX

OctaFX is a market-leading forex broker, providing personalised forex brokerage services to customers in over 100 countries worldwide.