Asian markers traded on the front foot overnight and European markets jump higher on the open, whilst safe havens come under pressure as the market mood turns positive.

Both Italy and Spain have reported a substantial slowdown in the number of new coronavirus cases and deaths. France and Germany's curves are also showing signs of flattening. Italy is even considering how to come out of lock down. This is a significant change in situation to where we were just two weeks ago.

The number of cases in Germany has reached 95,391 according to the Robert Koch Institute (RKI) with a total of 1,434 deaths. The number of new cases rose by 3,677 compared with Sunday's 5936.

Whilst there is now light at the end of the coronavirus tunnel, the data showing the economic impact of the restrictive measures taken to protect the public is still only at its initial stages. The full extent of the blow will take some time to seep through the economy.

German Factory Orders Beat Expectations

German factory orders fell by less than forecast also supporting risk sentiment. Factory orders dropped -1.4% month on month in February, versus the -1.9% forecast and the 5.5% print a month earlier. The data will get worse over the coming months before it gets better, but today's reading is a sign of relief for investors, particularly as the coronavirus outbreak shows signs of easing.

Levels to watch

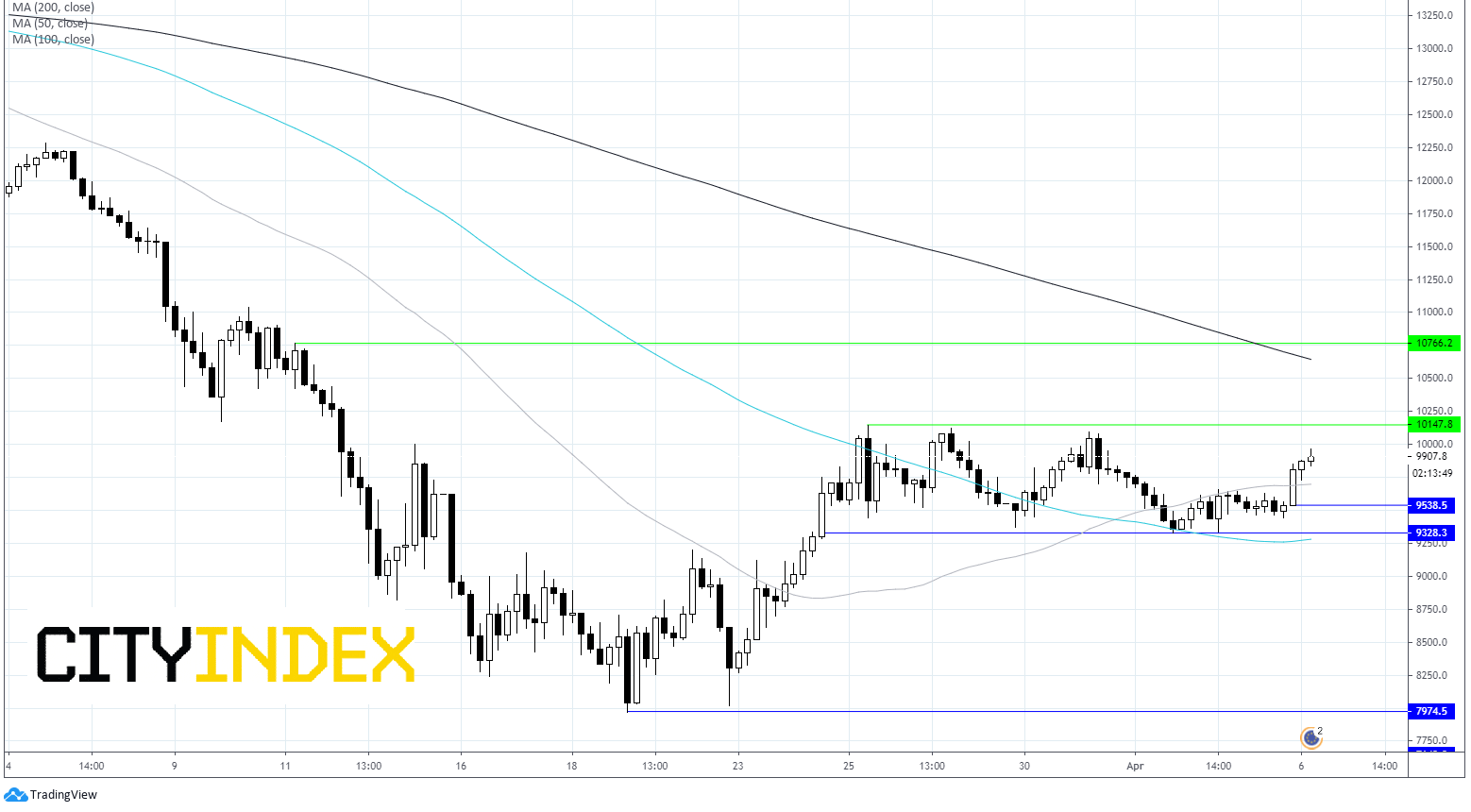

The DAX has jumped 4% on the open, at 9920. It trades above its 50 and 100 sma on the 4 hour chart, a positive sign. Although it remains with the horizontal channel that it has traded within since 25th March. A break above the upper bound of 10144 is needed for more bulls to jump in. Meanwhile a move below the lower bound of 9328 is needed for another step lower.

Immediate resistance can be seen at 10144, prior to 10645 (200 sma) and 10766 (high 11th March).

On the flip side, support can be seen at 9700 (100 sma) prior to 9328 (channel's lower bound).

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.