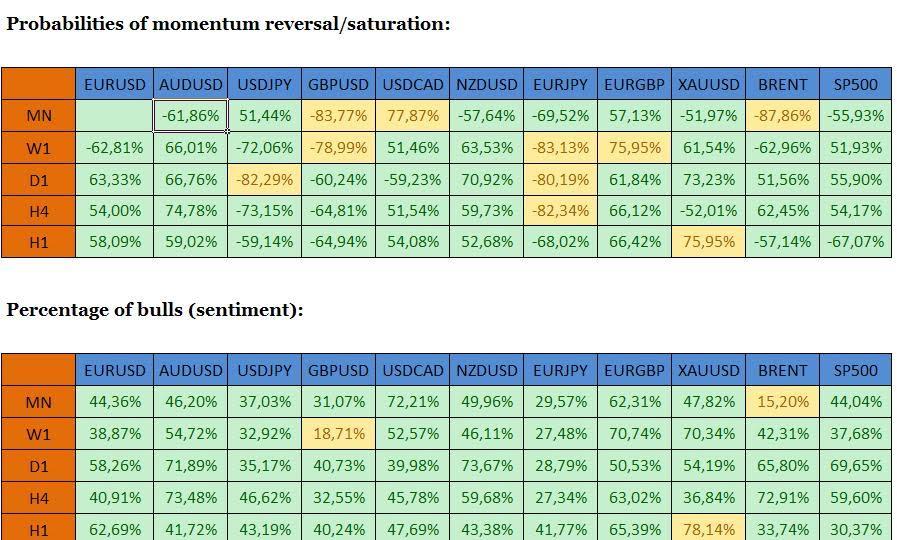

BETA - Propareos levels (areas where probabilities of price action reversal or saturation reach 90%; valid till 09:00 GMT):

EURUSD: 1.1205-1.1220 on the upside, 1.0960-1.0975 on the downside.

AUDUSD: 0.7330 -0.7345 on the upside, 0.7005-0.7020 on the downside.

USDJPY: 113.70-113.85 on the upside, 111.10 -111.25 on the downside.

GBPUSD: 1.4500 -1.4515 on the upside, 1.3910-1.3925 on the downside.

USDCAD: 1.3960-1.3975 on the upside, 1.3615-1.3630 on the downside.

NZDUSD: 0.6780-0.6795 on the upside, 0.6440 – 0.6455 on the downside.

EURJPY: 126.50 -126.65 on the upside, 122.75-122.90 on the downside.

EURGBP: 0.7880-0.7895 on the upside, 0.7700-0.7715 on the downside.

XAUUSD: 1250.00-1260.00 on the upside,1175.00-1185.00 on the downside.

BRENT: 35.50- 36.50 on the upside, 30.50 - 31.50 on the downside.

SP500: 1980.00-1990.00 on the upside, 1855.00-1865.00 on the downside.

Warning! Propareos levels do not take into account fundamental developments. Their validity is reduced on days when the NFP is released and when Central Banks change their interest rate.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 after the data from the US showed that private sector employment rose more than expected in April. The Federal Reserve will announce monetary policy decisions later in the day.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar holds its ground after upbeat ADP Employment Change data and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold consolidates losses below $2,300, eyes on Fed policy decision

Gold price hovers below $2,300 as uncertainty ahead of the Fed’s policy announcements improves the appeal of the US Dollar and bond yields. The Fed is expected to hold the policy rate unchanged amid stubborn inflation.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.