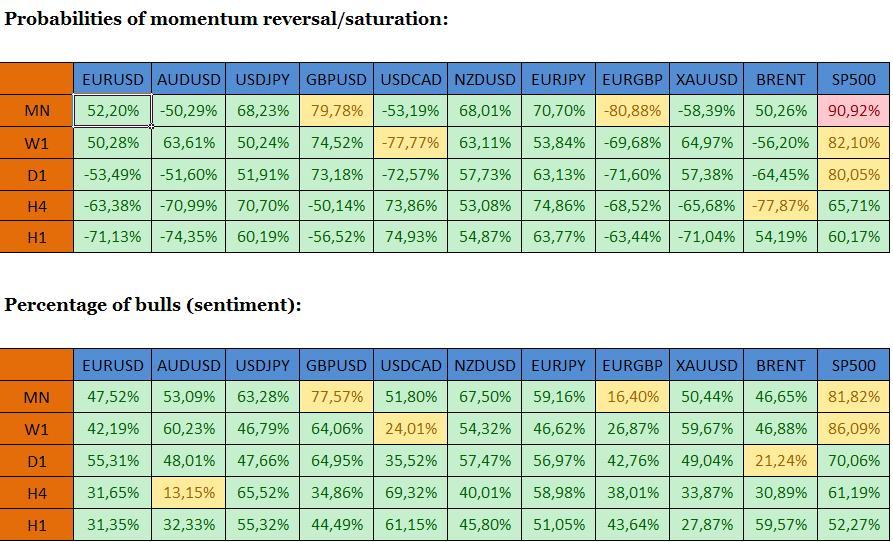

BETA - Propareos levels (areas where probabilities of price action reversal or saturation reach 90%; valid till 09:00 GMT):

EURUSD: 1.3705 -1.3720 on the upside, 1.3585-1.3600 on the downside.

AUDUSD: 0.9455-0.9470 on the upside, 0.9315-0.9330 on the downside.

USDJPY: 102.35-102.50 on the upside, 100.85-101.00 on the downside.

GBPUSD: 1.7180-1.7195 on the upside, 1.7055-1.7070 on the downside.

USDCAD: 1.0705-1.0720 on the upside, 1.0590-1.0605 on the downside.

NZDUSD: 0.8790-0.8805 on the upside, 0.8660 – 0.8675 on the downside.

EURJPY: 139.35-139.50 on the upside, 137.90-138.05 on the downside.

EURGBP: 0.8010-0.8025 on the upside, 0.7890-0.7905 on the downside.

XAUUSD: 1335.00-1345.00 on the upside, 1295.00-1305.00 on the downside.

BRENT: 113.00-114.00 on the upside, 109.00-110.00 on the downside.

SP500: 1985.00-1995.00 on the upside, 1920.00-1930.00 on the downside.

Warning! Propareos levels do not take into account fundamental developments. Their validity is reduced on days when the NFP is released and when Central Banks change their interest rate.

Recommended Content

Editors’ Picks

EUR/USD clings to small gains above 1.0700 ahead of data

EUR/USD trades marginally higher on the day above 1.0700 on Tuesday after EU inflation data for April came in slightly stronger than expected. Market focus shifts to mid-tier US data ahead of the Fed's policy announcements on Wednesday.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. Investors await macroeconomic data releases from the US.

Gold extends daily slide toward $2,310 ahead of US data

Gold stays under bearish pressure and declines toward $2,310 on Tuesday. The benchmark 10-year US Treasury bond yield holds steady at around 4.6% ahead of US data, making it difficult for XAU/USD to stage a rebound.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Eurozone inflation stable as the outlook on prices gets increasingly muddied

Eurozone headline inflation remains stable at 2.4%. With higher energy prices and improving domestic demand, questions about the direction of inflation become louder.