RBA: What to expect next week

The RBA meets next week and here are the expectations. Short Term Interest Rate Markets see a 75% chance of a 25bps rate hike. The most recent Reuters poll shows 27 out of 28 economists also forecast the RBA to hike by 25bps to 3.60% next week. So, the expected decision is a 25 bps hike.

In the last meeting, the RBA was expected to turn more bullish to tackle inflation as it looked like getting away from the RBA. See the prior RBA decision here. The key takeaway from the last meeting was that the RBA Board pointed out its concerns about a high labour market, high inflation, and some struggling households with higher interest rates.

The data since the last meeting

Since the last RBA meeting, consumer confidence showed a dip on Feb 13 and the labour print from Feb 16 came in below the market’s minimum expectations as -11.5K jobs were removed from the Australian economy vs a forecast for 20K jobs being added. Both of these metrics will give the RBA reason to ease off the pace of hikes. Furthermore, GDP at the start of March came in as expected for the y/y metric of 2.7%, but missed expectations for the q/q reading at 0.5% vs 0.8% expected. Although the prior reading was revised higher to 0.7%.

However, with this being said China’s bounce back from Covid-Zero should also help boost Australia’s economy moving forward. Last week saw some strong PMIs out of China.

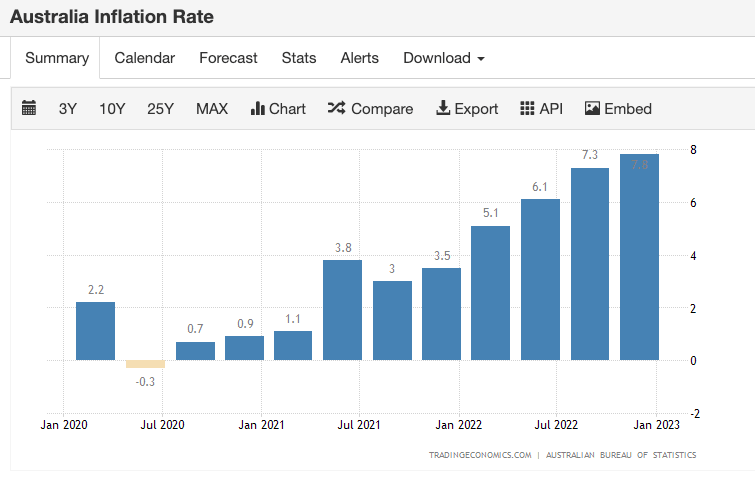

The RBA still has work to do as the inflationary trend has not shown signs of topping unlike it has in the US, UK, and Eurozone. Look at the headline rate and note that the last reading was the highest Q1 print since 1990 at 7.8% which was above market forecasts for 7.5% at the time.

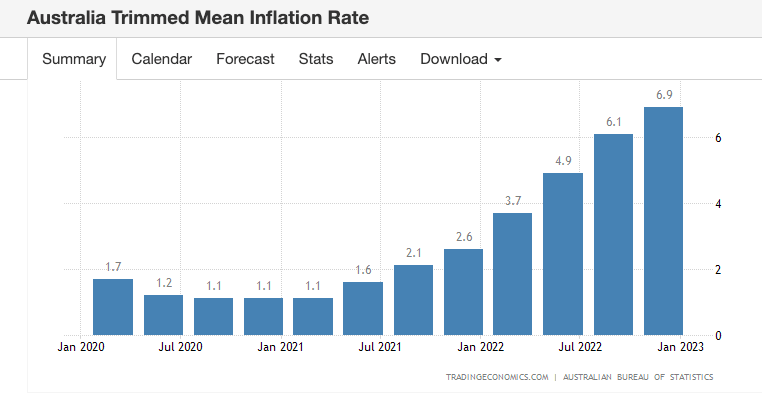

The same is true for the core which, if anything, appears to be accelerating higher. The last print came in at 6.9% above the 6.6% forecast.

So, the inflationary pressure is unlikely to mean the RBA won’t hike rates this week. However, forward guidance will be key. STIR markets currently see a 4.27% peak, but don’t be surprised if the RBA starts to talk about pausing rates at the next meeting. If it does, then watch for some potential AUDNZD falls.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.