Rates: Austria is the newest member to the EUR green bond family

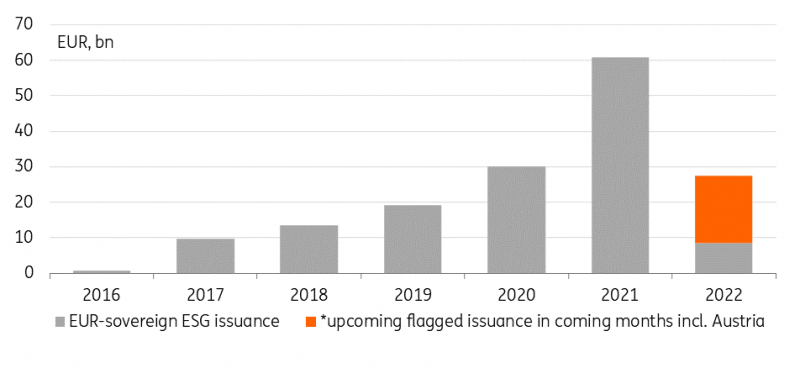

EUR sovereign green bond issuance is lagging behind last year's bumper volume. Issuance is now about to catch up, with Austria soon to enter the market. Nevertheless, it remains a challenging market for duration and a noteworthy greenium is not a given anymore.

Austria's green bond debut should help EUR sovereign ESG issuance volumes to catch up

Euro sovereign green bond issuance is notably lagging behind last year’s volumes. Year-to-date European sovereigns have issued €8.6bn in green and sustainable debt. At the same point last year that amount already stood at more than €27bn. In part, this owed to new entrants to the market which had pushed issuance higher with their inaugural bumper transactions – think of Italy’s €8.5bn 20Y green bond launch.

Austria has indicated €5bn of green expenditures for 2021 and 2022

There should be some catch-up in coming weeks and months. With Austria, another notable new entrant to the sovereign green bond market has been lined up. In its presentation of the green bond framework, the Austrian debt agency indicated around €5bn of eligible expenditures in 2021 and 2022 each. This would back green issuance primarily in the 8Y to 20Y sector, where most of the other European green counterparts are also situated.

EUR sovereign green bond issuance is about to catch up

The novelty is that Austria also wants 20% of its green issuance to be in short-term debt, ie, green treasury bills and commercial paper. Note that Austria has an overall bond issuance target of €40bn for this year and targets outstanding volume of €18bn in short-term debt instruments by year-end. EUR sovereign green bond issuance is about to catch up.

Source: Debt agencies, ING

Market volatility also affects the greenium

Austria arrives in an already mature market for euro sovereign green bonds. We’ve written at length about how we see and calculate the greenium, and what its characteristics are. This deal is an opportunity to refresh our latest data and conclusions, and to make some predictions as to the upcoming Austrian green bond.

First up, we can say that our initial conclusion, and the market’s intuition, that green bonds trade at a lower yield than their grey ‘cousins’ is still justified… in general. The pick-up in rates volatility since the start of the year has, predictably, resulted in greater greenium volatility. This has brought the greenium of the Dutch and Italian green bonds into negative territory for a brief period (ie, green bonds trading with higher yields than their non-green equivalent). Dispersion in greeniums is not a problem per se, but it reinforces our view put forward earlier this year that there are as many greeniums as there are yield curves, rather than one single greenium across many curves. Market volatility has brought about a dispersion of sovereign greeniums.

Source: Refinitiv, ING

We can also conclude that the aim for the new Austrian bond to trade with a positive greenium (in line with intuition) is an uncertain goal. On balance, we suspect this will be achieved thanks to careful marketing, and as this is an inaugural issue from Austria. But primary market conditions are challenging. This will also be a good test of market appetite for sovereign green bonds ahead of the Netherlands reopening its own in mid-June.

Read the original analysis: Rates: Austria is the newest member to the EUR green bond family

Author

ING Global Economics Team

ING Economic and Financial Analysis

From Trump to trade, FX to Brexit, ING’s global economists have it covered. Go to ING.com/THINK to stay a step ahead.