Good Morning Traders,

As of this writing 4:05 AM EST, here’s what we see:

US Dollar: Up at 84.430, the US Dollar is up 32 ticks and is trading at 84.430.

Energies: October Crude is down at 92.63.

Financials: The Dec 30 year bond is up 12 ticks and trading at 136.16.

Indices: The Sept S&P 500 emini ES contract is down 10 ticks and trading at 1973.50.

Gold: The October gold contract is trading up at 1237.00 and is up 29 ticks from its close.

Initial Conclusion

This is not a correlated market. The dollar is up+ and oil is down- which is normal and the 30 year bond is trading higher. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are down and the US dollar is trading up which is correlated. Gold is trading higher which is not correlated with the US dollar trading up. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

All of Asia traded lower. As of this writing all of Europe is lower.

Possible Challenges To Traders Today

PPI is out at 8:30 AM EST. This is major.

Core PPI is out at 8:30 AM EST. This is major.

TIC Long-Term Purchases is out at 9 AM EST. This is not major.

Currencies

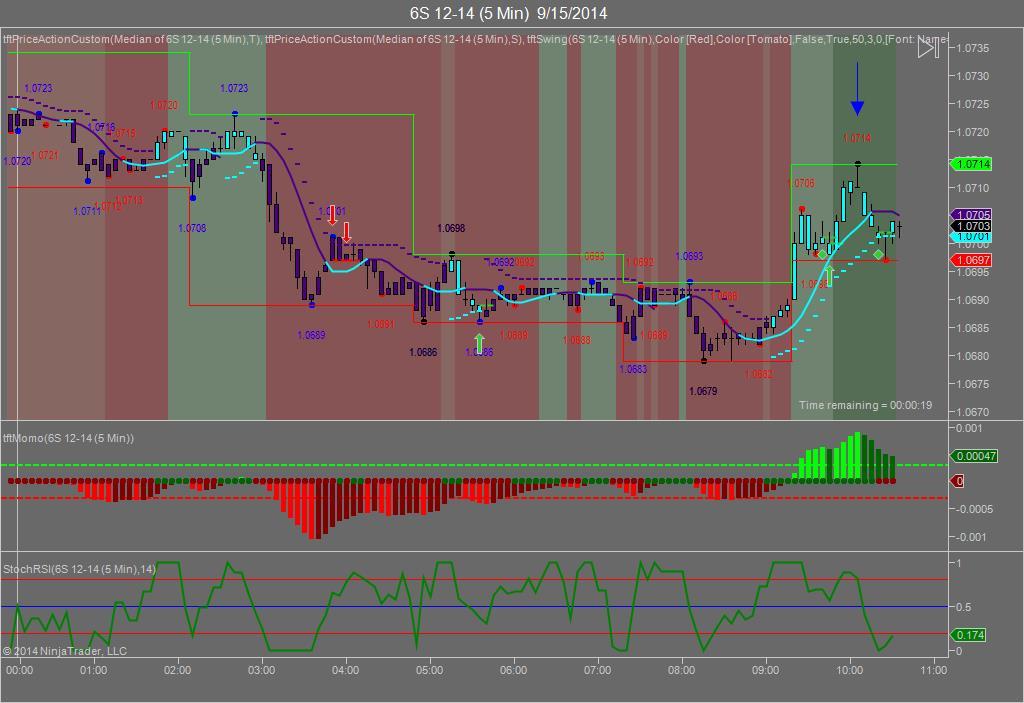

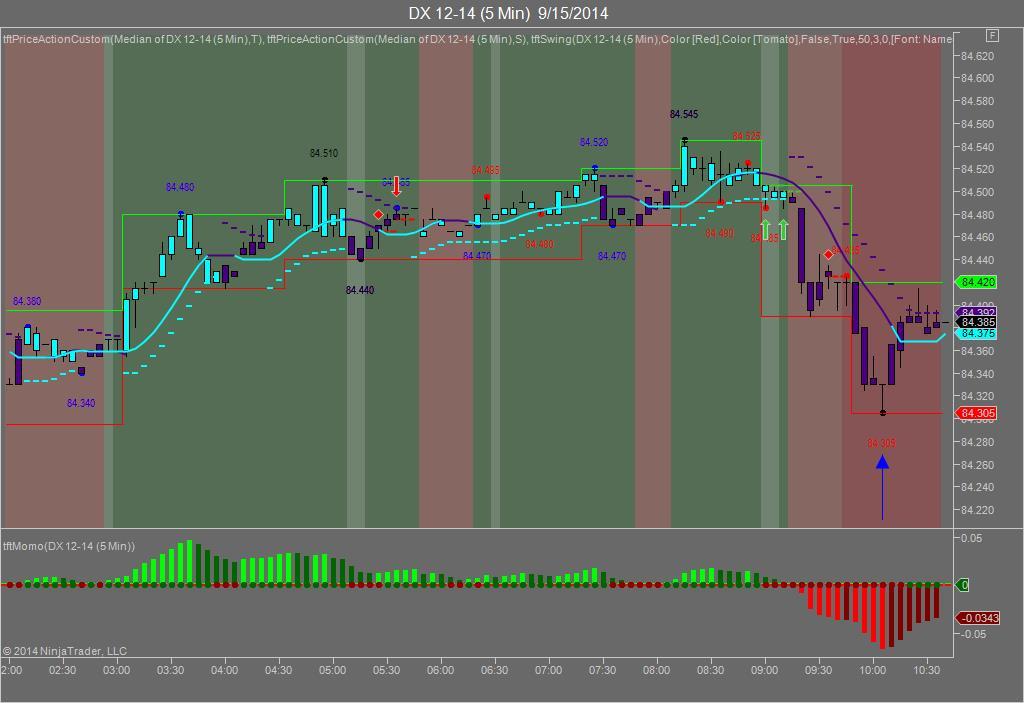

Yesterday the Swiss Franc made it’s move at around 10:05 AM EST after all the economic news came out. The USD hit a low at around that time and the Swiss Franc hit a high. If you look at the charts below the USD gave a signal at around 10:05 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a low at 10:05 AM EST and the Swiss Franc hit a high. I’ve changed the charts to reflect a 5 minute time frame and added a Darvas Box to make it more clear. This represented a shorting opportunity on the Swiss Franc, as a trader you could have netted about 15 plus ticks on this trade. Remember each tick on the Swiss Franc is equal to $12.50 versus $10.00 that we usually see for currencies. Please note that the front month for both instruments is now December.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

Yesterday we said our bias was to the downside as both the USD and Bonds were trading higher. Whereas the Dow gained 43 points, the Nasdaq and S&P did not. The Nasdaq dropped 49 points and the S&P dropped by 2 to close at 1984.00. Today we aren’t dealing with a correlated market and our bias is to the downside.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Yesterday we said our bias was to the downside as both the USD and Bonds were trading higher, crude was trading down and Europe was trading down. Whereas the Empire State Manufacturing Index came in much higher (27.5 versus 16.4 expected); the Dow gained but the Nasdaq and S&P did not. Both closed lower. Capacity Utilization and Industrial Production both came in lower than expected but at this time of the year, it’s only to be expected. Remember that summer is over and during the summer people do take vacations and some facilities have planned shutdowns. Today we have PPI and Core PPI to contend with but my take is everyone is awaiting the FOMC Meeting tomorrow to see what the Fed will say. The key concern is if they take the term “extended period” out of their language. My thought that they probably won’t but time will tell….

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.