Good Morning Traders,

As of this writing 6:15 AM EST, here’s what we see:

US Dollar: Up at 81.015, the US Dollar is up 53 ticks and is trading at 81.015.

Energies: September Crude is up at 102.11.

Financials: The Sept 30 year bond is up 5 ticks and trading at 138.01.

Indices: The Sept S&P 500 emini ES contract is down 11 ticks and trading at 1978.00.

Gold: The August gold contract is trading up at 1294.30 and is up 36 ticks from its close.

Initial Conclusion

This is not correlated market. The dollar is up+ and oil is up+ which is not normal and the 30 year bond is trading higher. The Financials should always correlate with the US dollar such that if the dollar is lower then bonds should follow and vice-versa. The indices are down and the US dollar is trading up which is correlated. Gold is trading higher which is not correlated with the US dollar trading up. I tend to believe that Gold has an inverse relationship with the US Dollar as when the US Dollar is down, Gold tends to rise in value and vice-versa. Think of it as a seesaw, when one is up the other should be down. I point this out to you to make you aware that when we don’t have a correlated market, it means something is wrong. As traders you need to be aware of this and proceed with your eyes wide open.

Asia traded mainly to the upside with the exception of the Indian Sensex and Singapore exchanges which traded lower. As of this writing Europe is trading mainly lower with the exception of the London exchange which is fractionally higher.

Possible Challenges To Traders Today

Core Durable Goods is out at 8:30 AM EST. This is major.

Durable Goods Orders are out at 8:30 AM EST. This is major.

Currencies

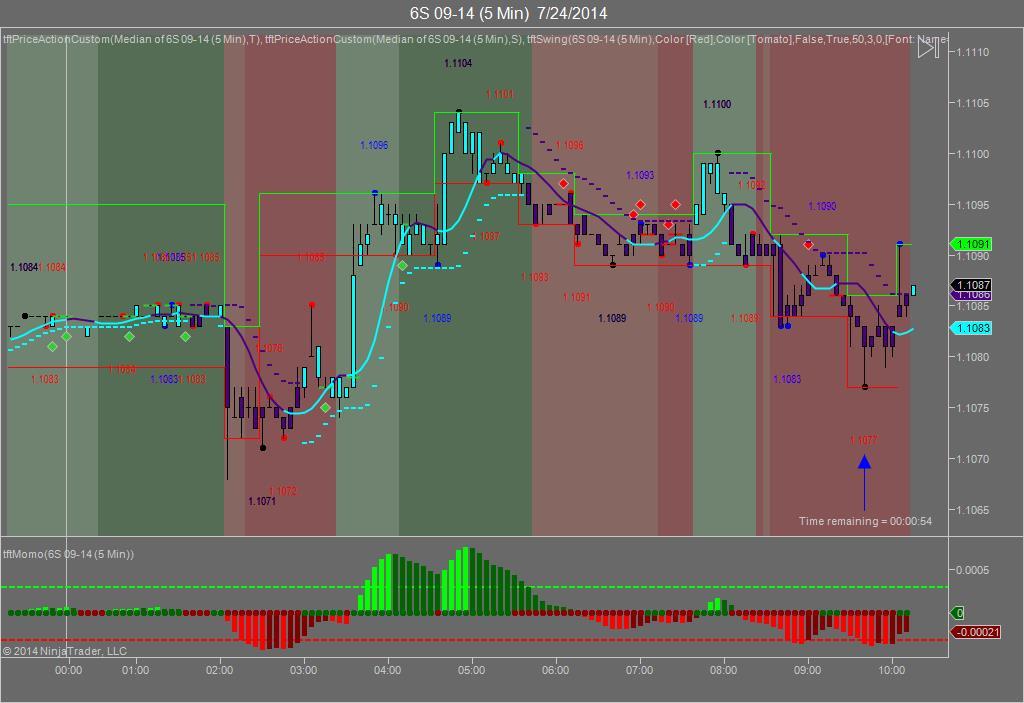

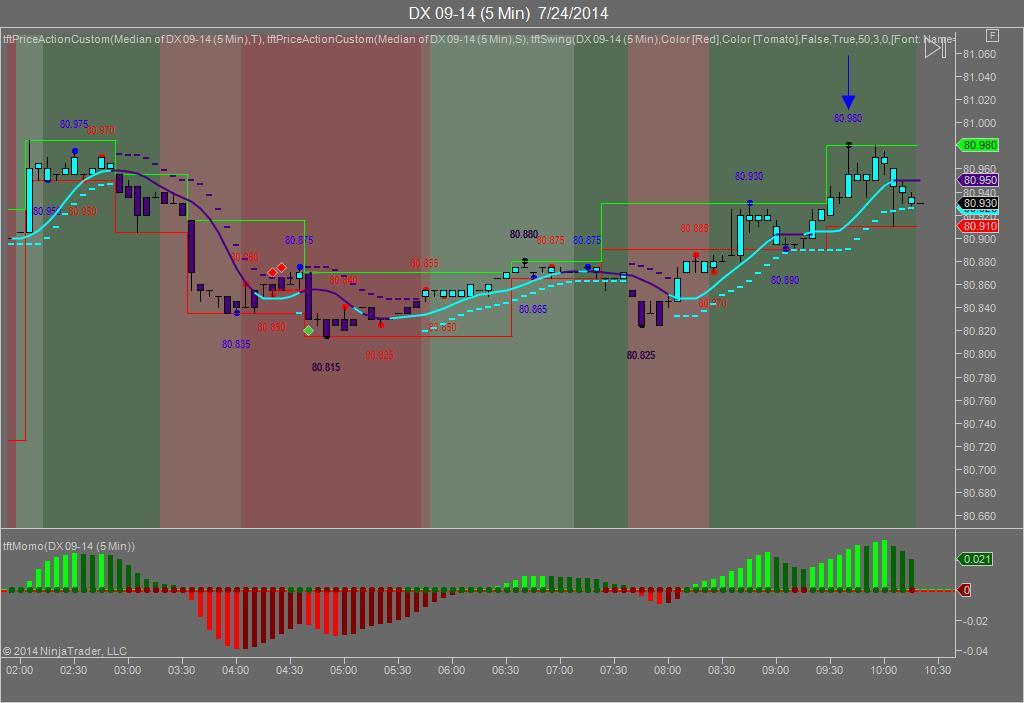

Yesterday the Swiss Franc made it’s move at 9:40 AM EST before New Home sales numbers came out. The USD hit a high at around that time and the Swiss Franc hit a low. If you look at the charts below the USD gave a signal at 9:40 AM EST, while the Swiss Franc also gave a signal at just about the same time. Look at the charts below and you’ll see a pattern for both assets. The USD hit a high at 9:40 AM EST and the Swiss Franc hit a low. I’ve changed the charts to reflect a 5 minute time frame and added a Darvas Box to make it more clear. This represented a long opportunity on the Swiss Franc, as a trader you could have netted 12-15 ticks on this trade. Remember each tick on the Swiss Franc is equal to $12.50 versus $10.00 that we usually see for currencies.

Charts Courtesy of Trend Following Trades built on a NinjaTrader platform

Bias

Yesterday we said our bias was to the upside as Europe was trading higher and the Financials (both the USD and Bonds) were correlated to the upside. The Dow and Nasdaq dropped fractionally but the S&P advanced by 1 point. Today we aren’t dealing with a correlated market however our bias is to the downside.

Could this change? Of Course. Remember anything can happen in a volatile market.

Commentary

Yesterday we said our bias was to the upside as both the USD and the Bonds were correlated to the upside. The markets opened higher until 10 AM when New Home Sales was released. That report came in at 406,000 versus 485,000 expected. The markets then proceeded to drop and flip flopped between positive and negative territory. All in all it wasn’t as bad as it could have been. The Dow dropped 3 points and the Nasdaq dropped 2. The S&P gained 1 point. You have to wonder why in the middle of summer which is traditionally selling season in the home industry did the numbers come in so low. I have a theory that I’ll share with you. Home Builders seem to have this idea that the economy is doing great and that the so-called “recovery” is in full bloom. As such their prices are completely insane and quite frankly unaffordable. This plus the looming specter of interest rate hikes are keeping many potential home buyers from buying. I live in the Garden State and I’ve seen this firsthand. A major builder who a year ago was charging $450,000 for a new home is charging $675,000 for the same home in the same development. No change, no additional options. Who’s buying these homes? Well they aren’t Americans, they’re foreigners whose respective economies are doing far better than the US. Interesting to say the least.

On another note, Mr. Greenspan decide to come out the woodwork yesterday and conducted an interview with Marketwatch. Basically what he said was it would be hard for the Fed to unravel the low interest rate bubble. Really? So when you were the Fed chief and decided to raise interest rates in 1999-2000 with no inflation to speak of and an economy that was running on 8 cylinders, what were you thinking of? You were looking at an outdated model called the Phillips Curve and decided that the economy was overheating and you wanted to slow it down. When you did that you cut off capital to new firms that wanted to expand their infrastructure but couldn’t because you cut off capital to them. Guess what? Many of those firms went out of business except of course Amazon and eBay. You encouraged deregulating banks and guess what? You helped to create the financial bubble that burst in 2008. Do us a favor, stay retired and don’t give interviews.

Trading performance displayed herein is hypothetical. The following Commodity Futures Trading Commission (CFTC) disclaimer should be noted.

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown.

In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance trading results is that they are generally prepared with the benefit of hindsight.

In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results.

There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results.

Trading in the commodities markets involves substantial risk and YOU CAN LOSE A LOT OF MONEY, and thus is not appropriate for everyone. You should carefully consider your financial condition before trading in these markets, and only risk capital should be used.

In addition, these markets are often liquid, making it difficult to execute orders at desired prices. Also, during periods of extreme volatility, trading in these markets may be halted due to so-called “circuit breakers” put in place by the CME to alleviate such volatility. In the event of a trading halt, it may be difficult or impossible to exit a losing position.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.