Precious metals are clear

S&P 500 ran with CS relief that had something for both bail-out and bail-in proponents, disregarding further KRE weakness outdoing XLF, as tech continues attracting fine bid no matter what yields are doing. Together with general bond market underperformance, this is building up non-confirmations and vulnerability to any hawkish Powell statements tomorrow.

Stocks in their daily risk-on turn are willing to run with the current moves as being enough to maintain and restore confidence. Even if the banks don‘t need to compete for deposits, and didn‘t hedge the rising rates totally, stocks are disregarding that for now.

The picture is though still of the dust not really settled, and S&P 500 continuing trading in a relatively wide range above Oct lows. The daily outlook thus far confirms uneasy session ahead for the bears (continued pain), with bond yields and the dollar being the key determinants of risk sentiment ahead as much as copper with silver (if I had to pick only two).

Keep enjoying the lively Twitter feed via keeping my tab open at all times – on top of getting the key daily analytics right into your mailbox. Combine with Telegram that never misses sending you notification whenever I tweet anything substantial, but the analyses (whether short or long format, depending on market action) over email are the bedrock.

So, make sure you‘re signed up for the free newsletter and that you have my Twitter profile open in a separate tab with notifications on so as to benefit from extra intraday calls.

Let‘s move right into the charts.

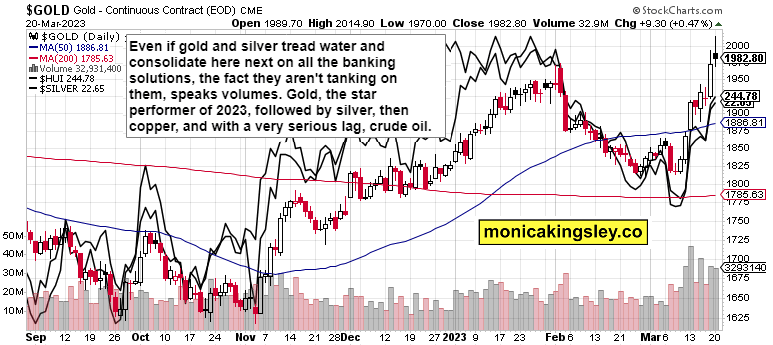

Gold, Silver and Miners

Precious metals do remain in vogue, and I‘m not looking for any kind of a powerful feedback. If we see 25bp tomorrow with some hawkish language on readiness, and not too much banking / deposits fights, gold followed by silver would keep thei own. Consider pullback below $1,950 a gift (may come before FOMC as almost usual) - this is the main star of 2023.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.